This article is a Guest Post by Chris Perkins, Broker/Owner, Coldwell Banker Maritime Realty in Halifax, NS.

Our office had the senior economic analyst from the Canadian Real Estate Association speak to us this week, and his message was clear: “Buckle up.” In a captivating and somewhat terrifying 45-minute presentation on the Canadian real estate market, he predicted a surge in activity as people, previously held back by high interest rates, get ready to jump on opportunities when Spring listings hit the market. While we haven’t seen the expected influx of listings yet, things are delicately poised, with homeowners gearing up for the busiest time of the year.

HRM Snapshot: Over the past 24 months, Spring has consistently seen home sale prices that were 10-15% higher than in Winter.

Where are prices going?

For those hoping for a drop in real estate prices, the outlook is not promising. Rising interest rates created intense pressure in the rental market. With a vacancy rate of less than 1%, the expensive rental rates are prompting people to consider buying again. Those entering the real estate market are likely to encounter far more competition than in recent times.

Why is there a housing supply shortage?

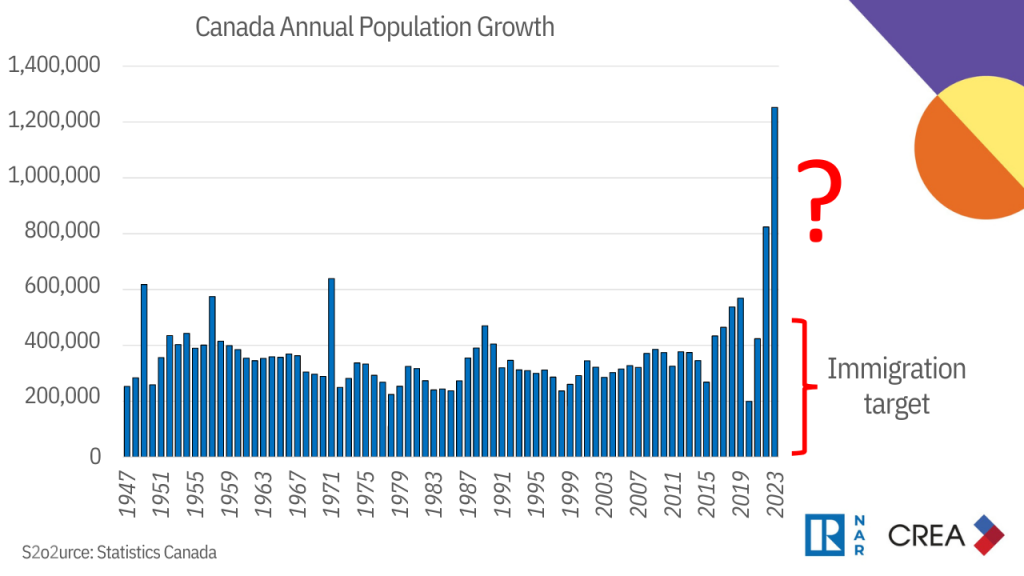

In 2023, Canada’s population grew by a staggering 1.2 million, surpassing the government’s target by 800,000. The pressing question: Where will these people live?

To meet rising demand, the government sees the need to construct 3.5 million homes, equivalent to 830,000 annually by 2030. Currently, we are only building 250,000 units so it seems completely impossible to meet that goal. On top of that, construction cranes dominating our skylines are not addressing the right housing needs – apartments vs single family. I own a wiener dog who I love dearly, but he barks at everything. The last place I want to be is in an elevator with him.

What about locally?

Looking at the local market in HRM (Halifax Regional Municipality), there’s a similar story to the rest of Canada. The influx of individuals from other countries and inter-provincial migration is creating significant pressure on housing in Halifax. As of now, the average price of a home is $575,000, marking an 8% increase from the last year. With just two months of housing supply (A Seller’s Market), there are only 750 homes on the market in an area with a population approaching half a million.

So, how do I navigate this?

For those thinking about their next steps, selling a home in this competitive environment allows you to leverage the demand to maximize property value. If upgrading is in your plans, the greater competition in lower price brackets allows you to sell at a premium while retaining negotiating power in higher brackets. However, first-time homebuyers have a tough task. I would recommend getting on the ladder, even if that means making concessions on your needs/wants list. What seems expensive now is likely to be even more so in the years to come. Once you own, you’ll benefit from rising prices by way of building value in your home, rather than chasing a market that could soon be out of reach.

Considering a move?

Contact Chris Perkins for expert guidance in navigating the complexities of the current real estate landscape. He will be with you every step of the way, ensuring you successfully achieve your real estate goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link