New Referral Partnership Between Coldwell Banker Canada and Guiding Star Mortgage Group Celebrates First Closed Transactions

July 26, 2023

The little get together between teammates at Coldwell Banker Canada and Guiding Star Mortgage Group on a patio in June in Exeter, Ont., was, in the history of business partnership lunches, modest.

What the two companies were quietly celebrating was remarkable: Coldwell Banker Canada and Guiding Star Mortgage Group had closed their first transactions in their new referral partnership.

Shaun Westlake, Vice-President, Sales, at Guiding Star Mortgage Group called it “nothing short of a phenomenal success story.”

Westlake added: “Guiding Star is a team that, effectively, had its first agents onboarded in January and, by May, we are already closing deals through that new partnership. It made sense to celebrate together.”

Strong, independent leadership

The referral partnership is an example of two independent lines of Canadian-based business able to intersect when the conditions are right, allowing a unique service to be offered to the consumer.

Karim Kennedy, CEO of Coldwell Banker Canada and Guiding Star Mortgage Group, at Gen Blue in Vancouver, May 2023.

“We continue to attract real estate and mortgage professionals in Canada who see the rich promise of a partnership that gives customers easy and helpful access to the expertise of both,” said Kennedy, CEO of Coldwell Banker Canada and Guiding Star Mortgage Group.

“Each company remains unique, and each company has strong, independent leadership,” Kennedy said. “What a referral partnership does is make possible a deal-by-deal collaboration of creative people backed by great tools and technology.”

Coldwell Banker Dawnflight Realty

Greg Dodds, the Broker/Owner of Coldwell Banker Dawnflight Realty in Exeter, Ont., was at the celebration lunch. It was his deal that made history.

For us, it was a no-brainer to get involved in the partnership, says Greg Dodds, Broker/Owner, Dawnflight Realty

“It definitely was a happy group,” said Dodds. “For us it was a no-brainer to get involved when the Guiding Star partnership was announced.”

After that announcement, Dodds’s go-to mortgage agent, Jeff Ruston, switched to Guiding Star, which is backed by Dominion Lending Centres National Ltd.

“That helped us out and it gave him access to more lending options,” said Dodds. “We’ve already put together some creative deals that we wouldn’t have been able to do before.”

Dodds said his working relationship with Ruston has been “supercharged” by the Coldwell Banker Canada-Guiding Star Mortgage Group partnership.

“It has worked smoothly because we already had that existing relationship with him and with [Guiding Star mortgage agent] Matt Doughty,” Dodds said. “The products he now has access to means he can do anything from finances, refinances, assignment deals, commercial deals, literally, anything.”

Coldwell Banker First Ottawa Realty

“I’m all in,” says Ross Webley, Broker/Owner, First Ottawa Realty

Ross Webley, the Broker/Owner of Coldwell Banker First Ottawa Realty, is also an early adopter of the partnership. Guiding Star mortgage agent Moe Baalbaki now works out of First Ottawa’s office in Stittsville, Ont.

“We closed our first transaction a week or two ago and there are more to come,” Webley said. “Things are looking good. The agents are trying him out. Moe is quick to respond. He’s knowledgeable. They like what they hear from him.”

Baalbaki attends the brokerage’s monthly business meetings and has hosted lunch-and-learn sessions for First Ottawa real estate agents. Webley said that when the corporate partnership was announced, “I jumped all over it. I’m all in on this. If it’s done properly, it will work.”

Webley said the working relationship with Guiding Star enhances the corporate tools that Coldwell Banker agents use to grow their business.

“I look at the agents as my clients and I want them to have all the tools and systems to do just that—to grow their business,” he said.

Ross Webley, right, with Moe Baalbaki, Guiding Star Mortgage Group agent, in the office in Stittsville, Ont.

“There are a lot more tools and technology now that assist Coldwell Banker agents, and this relationship with Guiding Star is just one more way that the agents can grow their business and satisfy their customers in what is a very competitive field.”

Coldwell Banker All-Points Festival City Realty

The partnership provides a distinct competitive advantage, says Donny Rivers, Broker/Owner, Coldwell Banker All-Points Festival City Realty

Donny Rivers, Broker/Owner at Coldwell Banker All-Points Festival City Realty in Goderich, Ont., is another of the partnership’s early adopters whose brokerages have closed transactions.

He said being able to offer another service to brokerage clients—a unique service, at that—convinced him to embrace and market the relationship.

“In my area, which is more of a rural setting, this seems to be something that gives us a distinct advantage over our competition,” Rivers said. “Nobody else is advertising this service at all, not one other group, not Royal LePage, not RE/MAX.”

Rivers said the work his brokerage has put into the trust it enjoys in the community is leveraged into more goodwill by the partnership.

“We’ve worked really hard to develop a good reputation and trust within our community and within our client base,” he said. “When we say, here’s someone you should at least have a phone call or a talk with who’s part of our larger group, I think the confidence is automatically there for the client.”

Shaun Westlake, Guiding Star Mortgage Group, VP, Sales, speaks at Coldwell Banker Canada’s Gen Blue conference in Vancouver, May 2023.

Interfaced or face-to-face

Guiding Star’s Westlake pointed to the different ways the partnership can take shape in real life. In Exeter and Goderich, it’s primarily a virtual arrangement. In Ottawa, it’s an in-person set up.

Interfaced or face-to-face, the partnership is working, he said.

“Those are two very different approaches to the partnership and the exposure of the partnership, and both are working very well,” said Westlake.

“There are other offices where people work in more of a hybrid arrangement. But whatever the arrangements need to be for the Broker/Owner, that is what we are doing. That flexibility will prove to be our success.”

“A better place to be” for mortgage agents

Westlake will judge the success of the partnership by its bottom line, of course, but also by a few other factors, including the continued growth of the share of his agents’ book of business that is referred by Coldwell Banker Canada.

“I would say that now, somewhere between 15% and 25% of the business that is coming in is from Coldwell Banker,” he said. “That tells me that we are actually building that Coldwell Banker referral relationship.”

Success will also mean more mortgage agents signing up with Guiding Star.

“We want to bring on mortgage agents that have depth and breadth of experience,” said Westlake. “Those are the people who are looking for a better place to be, looking for a team that provides more dedicated support to them, a team that actually does embrace the idea of being part of a team.”

Partnership in action: Guiding Star Mortgage Group Agent Dom Vetro explains the new My Mortgage app to colleagues at Coldwell Banker Fieldstone Realty in Halton Hills, Ont.

Success will mean the continued growth of awareness of the partnership.

“When we can walk in off the street to any Coldwell Banker office and say, Hello, I’m from Guiding Star Mortgage Group and people say, Oh, come on in, that, to me, will be the true testament of success,” he said.

And success will mean a few more celebration lunches, Westlake said.

“Next, I’m going to go to Ottawa and Goderich for a little celebration with Ross and Donny. I really couldn’t ask for more welcoming Broker/Owners than Greg and Ross and Donny and

Ron. What a great start.”

L-R, Westlake, Ron Hunter, Broker-Owner, Coldwell Banker Community Professionals and Dom Vetro, Guiding Star Mortgage agent, celebrate another first closed transaction over breakfast at Sunset Grill, Hamilton, July 2023.

Editor’s note: the pic of the celebration lunch at the top of the post shows, left to right, Greg Dodds and Kate Wuytenburg from Coldwell Banker Dawnflight Realty, and Shaun Westlake and Jeff Ruston from Guiding Star Mortgage Group, at Eddington’s of Exeter.

-30-

Why Women Are Natural Realtors

Women everywhere are influencing the real estate industry! In fact, in most countries throughout the world, more than 50% of Realtors are women and here in Canada, that number climbs to nearly 60%.

Real estate careers for women have been growing in popularity as women are searching for more meaning in their careers and seeking opportunities that promote a work-life balance. Workplace culture has become a top priority, especially among younger women. Some are leaving jobs where they feel undervalued or are experiencing a lack of culture, and are choosing careers in real estate or becoming entrepreneurs to have more flexibility or even work part time.

What It Takes to Be a Successful Realtor

Realtors benefit from having certain soft skills including communication, active listening, negotiation, high attention to detail, and patience. Every client is different, therefore the skills you need to work with each client need to be different.

What skills do successful Realtor’s have?

- Communication skills

- Understanding of real estate

- Knowledge of your local market

- Time management skills

- Negotiation skills

- Marketing skills

Why Do Women Make Great Realtors?

By nature, women tend to possess the skills that are required to be a successful agent. They are often good communicators, active listeners, and masters at managing their time. Women tend to have a passion for architecture and design, along with creating a space that feels warm and inviting. They also have the ability to empathize and listen intently, which are highly valuable skills when it comes to buying and selling homes. These skills allow for a relationship of trust which helps buyers to feel they are in good hands and that their needs are taken care of.

Why Do Women Choose Real Estate Careers?

We asked some of the women of Coldwell Banker Canada what motivated them to choose a career in real estate. The majority of responses were focused on the freedom and flexibility of business, income potential, and the ability to help people buy the home of their dreams.

A career in real estate allows women the freedom to work around their commitments and obligations, while building a career they are passionate about. With virtual showings, virtual tour features and everchanging technologies, being a Realtor brings a much more flexible work schedule than it has in the past.

Advice from other women in the industry?

- Build your own personal brand as a Realtor.

- Decide on the type of Realtor that you want to be and build it into your identity.

- Find mentors and allies.

- Utilize technology and adapt.

- Be authentic and be yourself.

Areas for Improvement

Even though women in real estate have come a long way, there are still areas that need improvement. While approximately 60% of Realtors in Canada are women, there is still a lack of women in leadership roles. Especially in the Commercial space, as Commercial real estate has a much lower ratio of women in the industry. Unfortunately, gender pay gaps still exist for women in the industry, so it is important to negotiate commission percentages or salaries.

What else can you do?

- Determine how your brokerage promotes inclusivity

- Are there equal opportunities for training and mentoring?

- Are reward and recognition given fairly and equally?

- Talk to other females at the brokerage

- Read reviews!

To all woman in real estate, we celebrate you and support you! Let’s all do our best to close the gender gap and promote diversity and inclusivity in the industry.

Information referenced from:

https://www.realtrends.com/articles/opinion-she-sells-more-real-estate-than-he-sells/

https://www.repmag.ca/news/what-is-the-average-age-of-a-realtor-334931.aspx

https://ottawamommyclub.ca/women-in-real-estate-dominating-canada/

https://www.theceshop.com/agent-essentials/real-estate-agent-encyclopedia/women-in-real-estate

https://storeys.com/real-estate-careers-women-work-life-balance/

https://www.theceshop.com/agent-essentials/real-estate-agent-encyclopedia/real-estate-skills

Safe at Home: The Story of Friendship Between Coldwell Banker Canada and the Homes for Dogs Project

July 19, 2023

Donna Pyette surveyed the joyful scene at Fox & Hound Canine Retreat near Sarnia, Ont.—the dogs, the sunshine, the people, the laughter, the barking, the splashing, the community spirit—and she didn’t waste her words.

“This is unbelievable,” she said. “It’s really incredible.”

Pyette is the executive director of the Sarnia Humane Society. She was one of 2,000 or so people and the hundreds of dogs who turned out on a lovely day in June for the 5th Annual Dog Festival presented by the Coldwell Banker Homes for Dogs Project. The festival raises money and awareness to meet the plight of shelter dogs looking to be rescued.

The issue isn’t going away.

“Typically, for the Sarnia Humane Society, we see about 3,000 animals a year,” Pyette said. “That has increased substantially since Covid has ended. We’re seeing intakes of dogs, especially, that we haven’t seen in 30 years.”

The Covid exit has not been especially kind to dogs, who were adopted at elevated rates as so-called “pandemic pets.” In a routine year, the humane society’s 32 kennels would be half to three-quarters full, and the dogs would come in and get adopted out quickly, said Pyette.

“Now, the stay time is longer and there are more of them,” she said. “We’re full.”

Dock diving is a big attraction at the dog festival in Sarnia.

To the rescue

A little less full now. This year, the Sarnia festival adopted out 39 dogs (and counting) and helped raise $48,000 (and counting) for the humane society.

“It’s just the whole community coming together to support us and to support the vendors, to support Fox & Hound,” she said. “What’s really nice about it is that the dogs in our care that we brought along all have appointments for meet and greets with prospective owners”.

Creature comforts

Summer Scott attended the festival, too. Scott, an animal rescue veteran herself, is Vice-President, Marketing & Communications, at Coldwell Banker Canada. She was struck by the vital role that pets continue to play in the lives of their owners.

Scott said that inescapable fact has been underlined during a summer of forest fire evacuations in her home province, Alberta.

“When emergency evacuations are announced, evacuees are reminded to take three categories of things with them,” she said. “They’re told to take important documents and to take their medications—and they’re also told to take their pets.”

Scott said that those emergency evacuation orders answer the old hypothetical question, what would you take with you if your house was on fire?

“We are told to take proof of our existence and the medicine we need to stay healthy and to not forget the sense of home that pets provide,” said Scott. “Pets bring with them the precious feeling of home.”

Rob Longo, Broker/Owner, Coldwell Banker Southwest Realty, Sarnia, Ont.

“We love supporting Homes for Dogs”

Rob Longo was also at the festival in Sarnia. Longo is sold on the role that dogs and pets play in helping to make a house a home. Longo is the Broker/Owner of Coldwell Banker Southwest Realty. His brokerage sponsors and helps organize the Annual Dog Festival presented by the Coldwell Banker Homes for Dogs Project.

“We love supporting the Homes for Dogs event,” Longo said.

“The biggest thing that we find is when we’re selling homes, we’re not just selling houses. We’re selling a place for your family to live—yourself, the kids, the grandkids, all your pets and animals. And we know how important that is for homebuyers.”

Coldwell Banker Canada’s Homes for Dogs project in action.

Putting heart into Homes for Dogs

Karley Chamberlain worked for months to ensure the dog festival ran smoothly. Chamberlain is the Marketing Director at Coldwell Banker Southwest Realty in Sarnia. She said dogs deserve the same feelings of safety, companionship and love that humans rely on them to provide.

Karley Chamberlain at the 5th Annual Dog Festival presented by the Coldwell Banker Homes for Dogs Project, June 2023.

“You want to find a home for a rescue dog as much as you want to find a home for a person, just on a different level,” said Chamberlain. “It’s so easy to put your heart into something like that.”

That virtuous circle is why Coldwell Banker Canada representatives have dug into the Homes for Dogs Project. Homes for Dogs started as an initiative of Coldwell Banker in the United States. It’s been adopted by Coldwell Banker Canada, where affiliates across the country have volunteered time, organized supply drives, raised and donated money, taken to social media and hosted and helped at local adoption events.

“Home is where the dog runs to meet you!”

Globally, the Coldwell Banker network has helped to find forever (also pronounced “furever) homes for more than 100,000 dogs. The Homes for Dogs Project has reached more than 1.8 billion people on social media.

“At a corporate level, we love to get our hands dirty at our local shelter partner, the Alberta Animal Rescue Crew Society, where we help by cleaning enclosures, sorting supplies and socializing animals,” said Coldwell Banker Canada’s Scott. “Between raising awareness and monetary supports, Coldwell Banker Canada believes in trying to make a difference.”

Making a difference for the people whose lives are enriched by pets. And making a difference for the likes of Ziggy in Kelowna.

Crunch in Vancouver.

Bubba from Winnipeg.

And Kipper in St. John’s.

Safe at home

Coldwell Banker Canada’s Homes for Dogs Project is built on the priceless feeling known to homeowning dog lovers everywhere: home is where the dog runs to meet you.

That warmth deserves to be gifted back to the warmth-making dogs themselves.

“It’s a mutual thing,” said Scott.

Summer Scott, VP, Marketing & Communications at Coldwell Banker Canada, has more than a decade of animal rescue experience herself.

Coldwell Banker Canada, Guiding Star Mortgage Experts Share Helpful Insights Into Latest Bank of Canada Interest Rate Hike

July 12, 2022

The Bank of Canada has increased its key policy interest rate to 5.00%—a jump of 25 basis points from June and the latest of 10 rate hikes in the last 16 months.

If real estate is about location, location, location, the central bank’s rationale is about inflation, inflation, inflation.

“While CPI inflation has come down largely as expected so far this year, the downward momentum has come more from lower energy prices, and less from easing underlying inflation,” the Bank of Canada said in a statement.

“With three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated. This is reinforced by the Bank’s business surveys, which find businesses are still increasing their prices more frequently than normal.”

Inflation in Canada has fallen from a peak of 8.1% last summer to 3.4% in May.

The Bank of Canada expects inflation to remain at about 3% for the next year before declining gradually to its 2% target by the middle of 2025, six months later than expected.

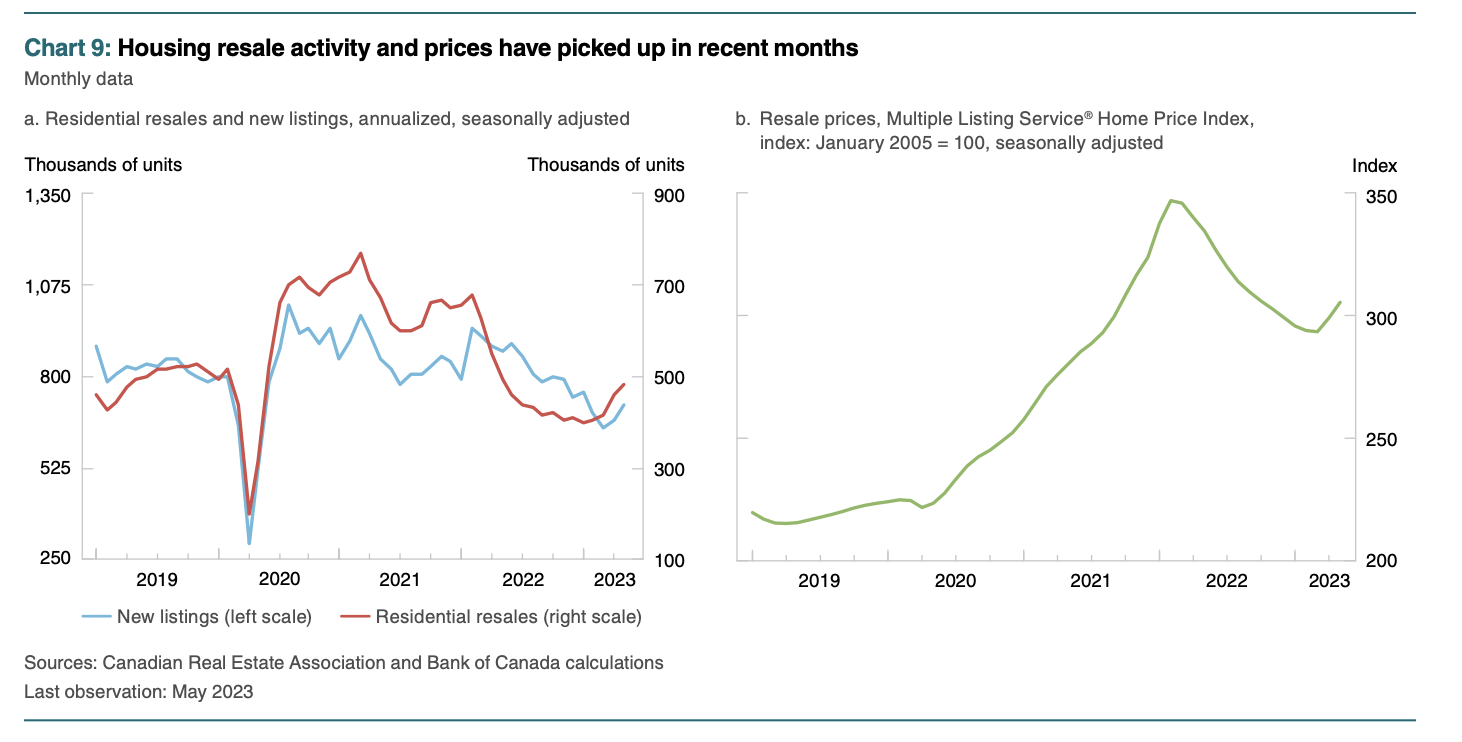

Housing prices received some of the closest attention from the Bank as it explained its decision.

Photo courtesy of Bank of Canada.

Housing prices and inflation

“The previously unforeseen strength in house prices is likely to persist and boost inflation by as much as 0.3 percentage points by the end of 2023, compared with the January outlook,” the Bank said its newly published Monetary Policy Report.

The upward revision to the inflation outlook is due in part to those higher-than-expected house prices, the Bank said. House prices increased in May for the second straight month. Increases in both prices and resales have been widespread across the country and stronger than predicted in January.

Courtesy of Bank of Canada.

A better seller-buyer relationship in Ontario

The Bank’s announcement came as little surprise to experts across the Coldwell Banker Canada-Guiding Star Mortgage Group network. Here, from the front lines, are some takeaway insights from the Bank of Canada’s interest rate announcement.

Marc Ronan, Broker/Owner of Coldwell Banker Ronan Realty, said the Ontario real estate market remains strong from a price point of view.

“The challenge is that our jobs sector is sadly lacking in employees right now,” Ronan said. “We’re short in the labour market in Ontario, drastically, and it’s creating an inflationary situation with builders and developers in the housing market.”

Ronan, whose market centers on the lucrative Golden Horseshoe area of southern Ontario, said he does not expect to see interest rates to drop for some time.

Marc Ronan, Coldwell Banker Ronan Realty, says interest rate hike is more of a global economy adjustment

“This is not a Canadian thing, we’ve still got a solid economy in the U.S. and Canada,” he said. “This is more of a global economy adjustment. Interest rates were too low for too long. It created massive inflation. And now we have to deal with it.”

That dealing-with-it has begun, he said, explaining that there is the beginning of an acknowledgement of the current reality between house buyers and sellers.

“In the last few weeks, since the June rate increase, we are seeing some product consistency that is giving the buyers a little more leverage to acknowledge the interest rate cost in purchasing a home,” Ronan said.

“The sellers are now starting to acknowledge that the market is not what it has been in the last five years and we’re seeing a better seller-buyer relationship where there’s more collaboration to get real estate transactions together now. I do see that being a consistent item necessary for the market to remain reasonable in the next six months to a year.”

No decline in prices in Surrey, B.C.

Bianca Myddleton, Broker/Owner of Coldwell Banker Marquise Realty in Surrey, B.C., agreed that record low rates over the past few years are gone.

“Today’s announcement has put the prime rate [the interest rate that banks and lenders use to determine the interest rates for many types of loans and lines of credit] at the highest it has been in 22 years,” said Myddleton.

“This rate is burdensome on those with variable-rate mortgages, HELOCs, and lines of credit,” she said. “Meanwhile, sales and home prices in Canada’s housing market have accelerated over 2023, which suggests that financial conditions have not been restrictive enough.”

Get the advice of a mortgage broker, says Bianca Myddleton, Coldwell Banker Marquise Realty

Myddleton said home sales have “slowed a little” in her are, but “the fall market will be a better indicator.”

She reports no decline in prices in the White Rock-Surrey area, and some price drops in Vancouver, but nothing significant. What she has started to notice is in the rental space.

“I do find people that have rental properties are starting to sell them because the payments have increased, and, in B.C., one can only raise rent 2% per year. This is going to add to the shortage of rental properties.”

Myddleton has also noticed that some buyers in her market sights are re-setting their sights on how much mortgage and how much house are within reach.

“I do find that people are having to qualify at two points over prime rate, so the person who was looking at a $1-milion home now has to set their sights a little lower in order to purchase,” she said.

Her advice for clients looking for a mortgage in the wake of the Bank of Canada’s decision to hike its rate?

“I encourage clients to make sure that they speak with a mortgage broker about all of the options,” she said. We won’t see low rates as we did in the past, and there are several options.”

Time to reconsider short-term rate approach

Shaun Westlake, Vice-President, Sales, for Guiding Star Mortgage Group joined the chorus of experts not expecting rates to come down anytime soon.

The Bank of Canada’s extended timeline to 2025 for inflation reaching its target of 2% caught his attention.

“This is a slight change to earlier commentary and expectations which leads me to think we are going to see rates well above 5% for a much longer period than we had previously expected,” he said. “Many were previously banking on rates starting to come down in early 2024. I no longer see that happening.”

Guiding Star Mortgage Group’s Shaun Westlake suggests reconsidering short-term mortgage rate strategy

Consumption levels and demand for housing will continue to rise and a growing population will mean more supply but also more demand for goods, all of which contributes to pressure on inflation rates, Westlake said.

“I expect that the interest rates we see today are going to be here for quite some time to come, so anyone who has been thinking short-term rates are the way to go should perhaps reconsider that approach,” he said.

A wallet wallop is around the corner for some Canadians, he said.

“We are getting into prime summer vacation time, people are still travelling, and spending,” Westlake said. “With inflation continuing to run above 3%, with interest rates not coming down any time soon, housing continuing to be in high demand, I do expect that this latest rate increase will start to really impact Canadians’ wallets.”

The final word from Ottawa

Ross Webley, Broker/Owner of Coldwell Banker First Ottawa Realty, said the Bank of Canada’s interest rate decision was tough news, especially for people with lower income.

“Obviously, most people need a mortgage, so it’s going to affect them,” Webley said. “Some people are not going to be able to enter the market because of it.”

Higher rates may present opportunities for buyers, says Ross Webley, Coldwell Banker First Ottawa Realty

Webley said he sympathizes with people in the market overwhelmed by all the information coming at them.

“Inventory is still low, but, in some cases, people are holding off to buy because they don’t quite know what to do—and I’m one of them. We’re looking to downsize but we’re a little afraid of the market. First, we have to find something. The rental market is tough. To buy is tough. A lot of people sit on the fence.”

Webley suggested that buyers keep in mind that, generally speaking, when rates are up, there’s pressure on prices to come down.

“If you need to buy, buy,” he said. “You can’t always just wait. I think there are opportunities to maybe get a better price on the house than you normally would a couple of years ago. Sellers have to realize that this is what’s happening.”

Welcome, Sarah Brophy-Platts! Coldwell Banker Escarpment Realty Gears Up to Help Serve Halton Hills in the Greater Toronto Area

July 5, 2023

Sarah Brophy-Platts, the Broker/Owner at the new Coldwell Banker Escarpment Realty office in Acton, Ont., politely paused the interview over Zoom to take a call from her local automobile mechanic.

“$78.50 for a light bulb?!!!” she asked, slightly exasperated.

It was mostly labour, she was told. The light bulb in question was in a difficult place to get to, she was told. “Okay, okay, approved, go ahead, I get it,” she said. “Aaargghh.”

Brophy-Platts knows her way around real estate brokerages—and automobiles, too. She knew she wasn’t being sold on unnecessary work. Systems are complex these days.

“The light bulb is in a tricky spot, he’s right,” she said. “So is the oil filter. It’s right up against a coolant pipe. You’ve got to know what you’re doing working in there.”

Coldwell Banker Escarpment Realty, Acton, Ont.

Escarpment Realty Broker/Owner runs on knowledge

Sarah Brophy-Platts admitted that she has “a need for knowledge and a need for understanding how things work, no matter what it is.”

Some credit for that trait goes to her father, John. A young Sarah Brophy was allowed to drive the 1991 Buick Regal when she knew the basics of how the car worked and how to keep it running.

“I grew up changing my own oil and changing the tires,” she said. “I did ball joints. I did tie rod ends. I did brakes. I did the windshield washer pump.”

On one occasion, suspecting the car had a faulty water pump, John took the device apart.

“And it was completely apart,” she said. “There was nothing I could do except figure out how to put it all back together. That was a difficult one, but I got it done.”

Coldwell Banker Escarpment Realty’s Sarah Brophy-Platts was voted Hometown Hero in Halton Hills.

Brokerage converts to Coldwell Banker

Sarah Brophy-Platts has carried that desire for knowledge and that skill for keeping things running into her business and into her community.

In 2010, after college, she got her real estate license and started on a team with RE/MAX, having left behind a previous gig as a video game marketer on big projects that included the launch of Playstation’s PS3.

“We helped sell the actual games in the cases, the actual disks,” she said, “but then everybody started downloading them. The industry had changed, so, I did, too.”

A few years later, she moved to Royal LePage as an agent, became a Broker of Record, then Partner, and then she bought the business outright in 2021.

Brophy-Platts now brings her agents and her knowledge of the business to Coldwell Banker Canada.

“Coldwell Banker Canada has made me feel comfortable from the beginning,” she said. “They’ve provided support and encouragement. I like the way that they do business. We’re a small town in Acton and we’re a small-town brokerage. We’re not massive. They support that. I like that idea.”

Paul Abbott is a Vice-President of Franchise Development at Coldwell Banker Canada.

Paul Abbott, VP of Franchise Development

Abbott said the arrival of Coldwell Banker Escarpment Realty means clients in Halton Hills have another experienced team led by a knowledgeable and innovative Broker/Owner.

“That brokerage exemplifies what it means to be a Coldwell Banker franchise,” said Abbott.

“They know their community, they know their business, they have strong technology and training,” he said. “They and the clients they serve are now part of the national and international Coldwell Banker network.”

Escarpment Realty joins Suzanne Clark, Broker/Owner of Coldwell Banker Fieldstone Realty in Georgetown, Ont., in serving customers in the area.

Community commitment

Brophy-Platts also brings to Coldwell Banker her commitment to the community of Acton (pop. 9,377) where she grew up. The affection for home goes both ways. In 2022, the Halton Hills Chamber of Commerce voted her Hometown Hero.

“I was so surprised,” she said. “It’s so nice to be recognized for things you don’t expect recognition for.”

Pumpkin Promenade in Acton, Ont. After the event, the jack-o’-lanterns are donated for feed to area farms.

In 2015, Brophy-Platts founded the Pumpkin Giveaway and, in 2020, in the throes of COVID isolation, co-founded and co-organized the Pumpkin Promenade.

Imagine more than 500 pumpkins carved into jack-o’-lanterns lit from the inside by little electric lights (the dollar-store variety, not the Volkswagen engine variety J ) and placed a-glow along the Town Hall Centre streets. That’s the Pumpkin Promenade.

“It’s just beautiful,” said Brophy-Platts.

“And it’s outdoors,” she added. “At the beginning, in Covid, it brought people out who were reluctant to be with each other inside, and it kept us all together. It has just kept growing.”

Brophy-Platts does these things to help keep community life humming.

“I do these things in the community because I enjoy them and my kid enjoys them, and I want to see my kid grow up in a town where we have sports and programs and fall fairs and all the rest that are worth going to—and staying for.”

Sarah Brophy-Platts is a Coldwell Banker Broker/Owner—and a character—in Acton, Ont.

Brokerage expertise

Keeping a close eye on all the moving parts of a real estate brokerage is second nature for Brophy-Platts.

There’s the law and the regulations and a code of ethics that the Brokers/Owner must know inside-out. The offer must be constructed on a solid understanding of rights and obligations. There’s the need for a deep knowledge of what buyers and sellers want and need. Market trends must be mastered. IT acumen is required. Emergencies call for calm navigation through, and opportunities need a creative eye to take advantage of. Agents require the latest in Coldwell Banker training and mentoring.

“I do love my job,” Brophy-Platts said.

“In real estate, I want to know how things work so that I can help guide the agents and help deliver the best experience possible for our clients who trust Coldwell Banker with the most important investment in their lives,” she said. “That’s important work.”

Sarah Brophy-Platts, Broker/Owner, Coldwell Banker Escarpment Realty.

Putting a deal back together

It can be painstaking work, too.

Brophy-Platts remembered being the selling agent for a property in what became an ordeal for everyone involved. In the mix were a tenant, a couple looking to buy their first property and the law.

“I felt bad for the buyers,” Brophy-Platts said. “It was eight straight months of trying to get the house closed. It wasn’t about me, it wasn’t about them, it was about the law and how things had to be written. They had no way out other than walking away from their deposit.”

Name-calling ensued. “They called me names. It was not pleasant.” The deal was in pieces. Like she did in the water pump episode, Brophy-Platts faced it and helped put it back together. “I accepted their anger and put it aside.” The deal closed. Foes became friends.

“We celebrated,” Brophy-Platts said. “Those buyers are wonderful people. We’re friends now. We stay in touch. We play baseball together.”

The takeaway for Brophy-Platts was that stress alters people temporarily.

“When people are under extreme stress, they are not the people who they actually are,” she said. “That is a good lesson for all of us to remember for life.”

What’s that sound?

Handling, diverting or defusing stress is the job of the Broker/Owner in modern real estate.

“Knowing preventative measures, knowing what to do when things don’t quite go as planned, that’s part of the job, too,” Brophy-Platts said.

Having those skills in a friend is invaluable. Recently, Brophy-Platts took a phone call from one such friend.

“She’s driving along and she’s like, Sarah, my car is going guh-guh-guh-guh-gug-guh-guh-guh. I was, like, your lug nuts are loose. Pull over.”

The friend thought she could make it the 20 minutes home. The realtor said pull over. The friend kept driving. They negotiated. The realtor convinced the friend. She pulled over. Good thing.

“I walked her through it, she tightened up the lug nuts, they were finger loose,” said Brophy-Platts.

Grand re-opening

Coldwell Banker Escarpment Realty’s grand re-opening happens July 14 from 2 p.m. to 7 p.m. at 2 Mill Street East in Acton. It’s an opportunity for Brophy-Platts to say thank you to the people who have meant the most to her along the road—her parents John and Min, husband Kris, son Gray, along with the professionals she works with and those who work for her.

Friends, colleagues, clients past and present, Pumpkin Promenaders, everyone from Acton, Georgetown, Limehouse, Rockwood, Guelph and beyond are welcome.

“Bring your questions about real estate or the market or just come by to say hello,” said Brophy-Platts. “We want people to see the knowledge at Coldwell Banker Escarpment Realty that is ready to be put to use to serve them.”

– 30 –

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link