August 11, 2023

Christina Steplock remembered being confused about her own mortgage. It was a confusing time. Think 2003. TD Bank Financial Group had just acquired the Laurentian Bank branches in Ontario. Steplock’s own mortgage was caught up in the coming together of the financial giants. She remembered listening to the radio. A pair of mortgage brokers on a call-in show were answering common questions about mortgages. She called in with hers.

Before she hung up, they had offered her a job.

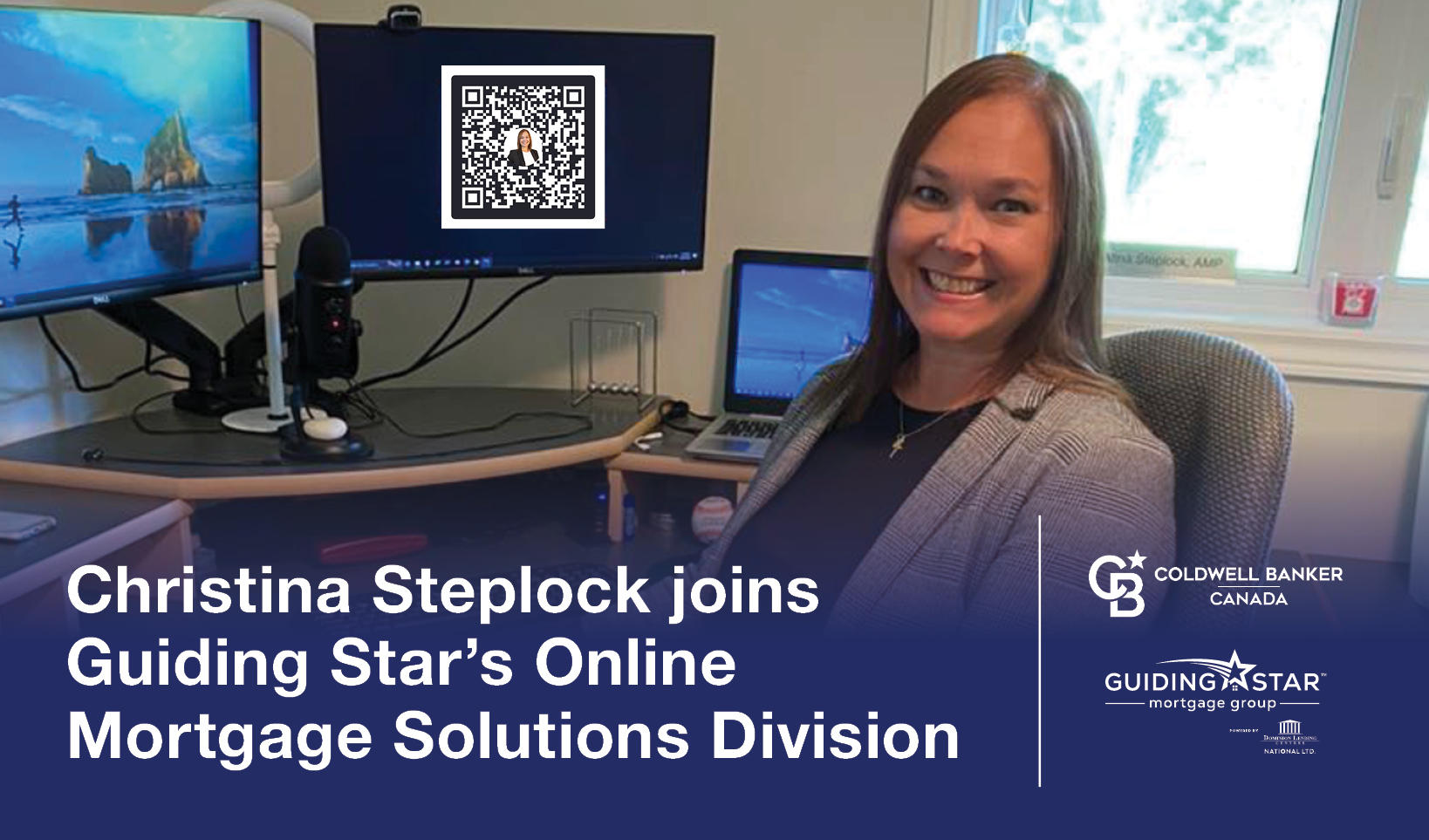

“True story. It was CKNX 920 in Wingham, Ontario, more than 20 years ago now,” said Steplock, the new Vice-President, Online Mortgage Solutions, with Guiding Star Mortgage Group.

“I get on the radio and I’m speaking to these brokers and I said what about this and what about that and they say why don’t we take this conversation off air because we don’t know the answers. We got talking and they couldn’t help me with the mortgage, but they said, you know what, how about we hire you?”

A strong desire to help mortgage clients

Steplock remembered her thought process:

“I was a law clerk/paralegal with a real estate law background. I liked a challenge. I had a strong desire to help people. I didn’t really know what mortgage agents did, but, I thought, I’ll do it. I took the offer.”

Steplock got her credentials and then turned that job with the mom-and-pop company after a year into a 20-year career with a national mortgage brokerage where she worked as a mortgage agent and a director of underwriters.

Christina Steplock, AMP, has now joined Guiding Star Mortgage Group, leading the Online Mortgage Solutions Division.

“It is a confusing time again for people and families who are trying to build their futures and who need mortgages,” said Shaun Westlake, Vice-President, Sales, at Guiding Star Mortgage Group.

“The Christina Steplock of today is exactly the person who could have helped the Christina Steplock back then solve her confusing mortgage questions, and who can help online clients today.”

Online mortgage solutions

Christina Steplock, AMP, Vice-President, Online Mortgage Solutions, Guiding Star Mortgage Group

Steplock oversees the building of a national online mortgage solutions division for the Canadian-owned Guiding Star Mortgage Group, which has a referral partnership with real estate company Coldwell Banker Canada

Guiding Star Mortgage Group is backed by Dominion Lending Centres National Ltd.

Steplock brings her expertise in residential mortgages (purchase, refinance, switch/transfer, spousal buyout, 55+, CHIP etc.), along with experience in small commercial and rental property purchases/refinances.

“I love private lending and alternative lending, whether it’s a construction build, an equity takeout, bankruptcy, poor credit or deals that don’t fit the box,” she said. “It’s a complete common-sense approach to a deal that lets me be creative with lenders/investors and the borrowers.”

Concentrating at first on the Ontario market, Steplock will develop a feeder and training system for mortgage agents who get referrals from Coldwell Banker real estate agents.

“We will make sure the mortgage agents we introduce to the Coldwell Banker channel have the depth and breadth of experience to deliver the solution a client is looking for,” said Westlake. “They will understand all the aspects of all the lending programs available to them via Dominion Lending Centres.”

The alliance attracted Steplock.

“I really like what Dominion Lending brings to the table,” she said.

“Their systems and processes are phenomenal. The training, the accessibility of people. It’s a culture of people genuinely wanting to help people be their best. That resonates with me.”

Steplock will be the central point of contact for online mortgage referrals from interested Coldwell Banker Canada real estate agents or members of the mortgage-shopping public, whether through:

- the mortgage calculator on the Coldwell Banker Canada website,

- the Guiding Star mortgage application link,

- the Guiding Star information number (1-866-684-2947, 1-866-MTG-BY-GS),

- her version of the Dominion Lending Centres My Mortgage Toolbox app, or other online channels.

“There’s a lot of room out there for education about mortgages, and for trust, too” says Steplock.

Efficiency for online clients

In her new position, Steplock again finds herself using technology to connect with folks. Her ability to communicate over the radio back then has evolved into the skill of communicating via online video now.

It’s not remote communication for Steplock. It’s just plain communication. Success comes from the ability to listen deeply and to get one’s personality and expertise across clearly.

“I don’t know that it’s the platform that makes it,” Steplock said.

“It’s about human beings. My office just happens to be virtual. That doesn’t mean it’s less successful than the workplace of somebody who’s driving two hours in Toronto when, technically, they live only a half hour away.”

In some ways, virtual communication is more real than in-person communication.

“If people run through the background of your screen, or their children or dogs or animals do, or if there’s an Amazon delivery, I think people are okay with that now,” Steplock said.

“It’s more forgivable and it’s more human. If businesses, especially in our world, do not have a virtual, internal division like this, they’re missing the boat. This isn’t going to go away.”

Quick online mortgage solutions

Westlake said many mortgage customers don’t require a bricks-and-mortar setting in which to meet with an expert as much as they need access to an expert.

“Not everyone has the time or the patience to drive to a meeting or to wait to have someone come to their office or their home,” he said. “For those clients, Christina will be able to quickly facilitate that transaction, quickly deal with that client and quickly deliver the mortgage solution to them.”

Mortgage education

The drive to find a solution for mortgage customers is the thread that runs through Christina Steplock’s career.

“That’s why I got into the business, because of my own personal experience,” she said. “The banks weren’t able to help, and I couldn’t get answers to my questions. The questions that mattered were the questions that mattered to me—not frequently asked questions that apply to everyone.”

Steplock said she has tried above all to treat clients as she wanted and wants to be treated—with kindness and respect.

“Those are more than just words to me,” she said.

There is a lot of room in the market for education about mortgages and what is possible with mortgages.

“There’s a lot of room out there for more trust, too,” Steplock said. “People need a trusted professional, someone who is there for them, offline or online, especially for those who might not fit in the usual box when it comes to getting a mortgage. That’s what it means to make a difference in someone else’s life.”

***

Safe at home: Steplock coaches daughter Leah and friends on the Brussels Tigers U13 Girls’ team in Brussels, Ont.

Christina Steplock by the numbers

Thousands: number of mortgages researched and delivered to Canadian customers so far over her career

56: in minutes, the average public transit commute time in Toronto. (Source: moovit, 2022)

30: in seconds, the commute to Steplock’s workplace office

21: in years, the time Steplock has been in the mortgage and real estate business

10: number of years coaching minor girls’ baseball

9.5: in times out of 10 Steplock says she can come up with a mortgage solution (“I am the type of person who will turn over every single stone until I can come up with a solution. Chances are if I can’t, nobody else can, either!)

5: number of years she hosted the Mortgage Talk Show with Christina Steplock on CKNX Radio (2006-2011)

4: age at which she started playing her first musical instrument—the organ

3: musical instruments played in high school jazz, concert and stage bands (clarinet, saxophone, trumpet)

2: professional accreditations earned (Accredited Mortgage Professional, residential mortgage specialist)

1: number of rules Steplock lives by. “Treat others the way I want to be treated.”

Editor’s note: the photo used in the illustration at the top of the post is courtesy of Christina Steplock’s daughter Breelle. (The QR code takes you to the super helpful Dominion Lending Centres My Mortgage Toolbox app.) The best way to reach Christina is christina.steplock@dominionlending.ca or 519-357-2558. Please note that this currently excludes provinces Saskatchewan, Manitoba, Quebec & Nova Scotia.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link