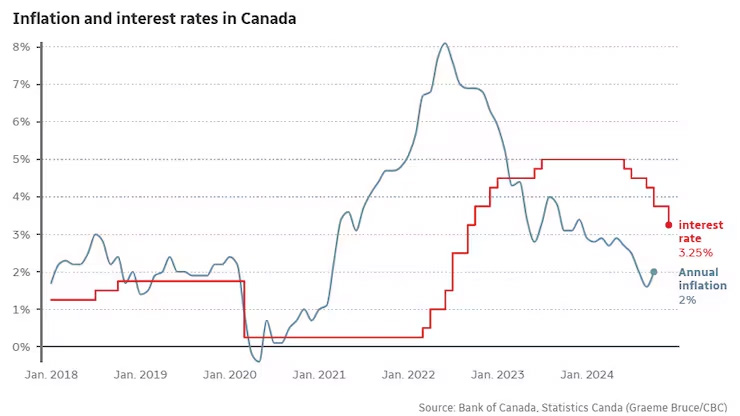

On Wednesday, the Bank of Canada announced a second consecutive interest rate cut of 50 basis points, bringing the central bank’s policy rate down to 3.25 per cent. While the move was widely anticipated by economists and markets, it signals a shift towards a more cautious pace of easing amid growing economic uncertainty. Let’s explore what this decision means for Canada’s housing market and what experts predict for the months ahead.

Rate Cuts and Their Impact on Borrowing

The Bank of Canada’s recent cuts—five in total since June—have taken the policy rate from restrictive territory to a more neutral range. This shift is designed to balance the economy, stimulating growth without significantly driving inflation. According to Bank of Canada Governor Tiff Macklem, past rate reductions are already beginning to lift household spending.

For Canadian borrowers, this is welcome news. Fixed mortgage rates, currently above four per cent, are expected to stabilise, while variable rates are likely to fall below five per cent. As Penelope Graham from Ratehub.ca notes, this will provide relief for mortgage borrowers, especially those with variable-rate loans, as their payments decrease or more of their payment goes toward principal rather than interest.

Real Estate Market Activity

Real estate experts anticipate that the lower rates will lead to heightened housing market activity, even during the traditionally slower winter months. Buyers are becoming increasingly active, with a noticeable uptick in demand following the initial rate cuts earlier in the year.

Experts predict an early start to the spring housing market, possibly as soon as late January or February. “Buyers have woken up to the reality that property prices are rising again, and more will feel an urgency to act before affordability erodes,” say market analysts.

Victor Tran from RATESDOTCA advises prospective buyers to secure pre-approvals now in preparation for an expected market shift in early 2025, where conditions may start to favour sellers once again.

Mortgage Trends and Opportunities

Lower borrowing costs are not only a boon for homebuyers but also for investors. As Alana Riley of IG Wealth Management explains, reduced rates create favourable conditions for real estate investments, potentially boosting property values in major urban markets. Meanwhile, homeowners with upcoming mortgage renewals or unsecured loans can look forward to some relief in their monthly cash flow.

What’s Next for the Bank of Canada?

Governor Macklem has signalled that while further rate reductions are being considered, the pace of cuts is likely to slow. With inflation back at two per cent and the economy showing signs of strain, the central bank’s focus will shift to a more gradual approach to monetary policy.

For Canadians planning to enter the housing market, the next few months present a unique window of opportunity. Whether you’re looking to buy your first home, upgrade to a larger property, or invest in real estate, this period of lower rates could be the right time to act.

Take the Next Step with Coldwell Banker Canada

Your dream home is within reach. Contact a Coldwell Banker Canada agent today to learn how we can guide you through the process of buying, selling, or investing in real estate. With the best experts in the market, we ensure a smooth and stress-free experience every step of the way. Visit coldwellbanker.ca/directory to get started. Let’s make your real estate dreams a reality!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link