Coldwell Banker Around the World: Nelson, BC

This article was reposted from Blue Matter by Sam Shalom, Article Here

Picturesque Nelson, BC, is set roughly halfway between Vancouver on Canada’s west coast and Calgary in the Canadian Rockies. Nestled in the Selkirk Mountains and set on the west arm of Kootenay Lake, the city of 11,000 residents is home (and vacation home) to people who love life outdoors in all four seasons. Nelson’s stunning natural architecture is bejewelled by the town itself—its waterfront, some 350 heritage buildings, a restored streetcar, a thriving arts and artisan scene and a rich offering of restaurants and live music.

“It’s a small town, but it’s got a big town feel,” says Kevin Arcuri, co-owner of Coldwell Banker Rosling Real Estate in Nelson. “People are continually amazed with what Nelson, for its size, offers.”

We caught up to Kevin after a showing and got him to talk a little more about Nelson, British Columbia, and what makes it so attractive to the anglers, hikers, single-track bike riders, photographers, skiers, snowshoers, paddle boarders, kayakers, beachcombers, gardeners, wildlife lovers, mountain climbers, artists, artisans, foodies and mountain types who either call it home, or who are counting the days until they can get back.

What’s the feel of the place?

There is a definite lifestyle here. Everybody has to work and has to make a living, but there’s something here called Kootenay Time. If we get 15 centimetres [half a foot, or so] of snow, you’ll experience Kootenay Time. Some businesses will put a sign in their window saying Back at Noon, and they’re away to enjoy the skiing while it’s there to be enjoyed. Everyone understands it. It’s a little quieter here in Nelson. It’s a little more challenging to get to because we’re not on the Trans-Canada Highway, but that’s also what keeps it quaint and feeling the way it does.

What’s a perfect weekend day for you?

Well, of course, I am a realtor, so…. but a perfect day these days would be getting up early and going cross country skiing with my wife or taking a drive along the lake. In the summer, I love to fish, as well. There’s a popular trail out of Nelson called Pulpit Rock that is good in spring, summer, winter and fall. There’s a good growing season here, too, so a perfect day would include some time in my garden. I start my garden in early April and we’re still getting food out of it in October. The garlic will be up in the spring. Tomatoes, onions, peppers, potatoes, carrots, artichokes. You name it, we can pretty much grow it here.

So, sitting at home and watching TV, not so big in Nelson?

Not ideally, not unless there’s a reason for that!

What are the main industries?

Originally, Nelson was a mining town. It has evolved. It has had to re-invent itself from being just an industrial-type town. What they ended up doing was undertaking a heritage revitalization program. They stripped the facades from the original buildings and now Nelson is full of original heritage buildings. We’re not designated as a resort community, but tourism has become a main draw. I hear it from clients from out of town all the time. They’re just amazed at how a small town can have so many high-quality restaurants. I was with some people from California, and they could not say enough about the restaurants and the quality of the food. They were blown away.

What are the major modes of transportation?

Car, definitely. We have great city transit. We have a streetcar that runs along the waterfront. But it’s an active town, too. E-bikes have become huge in Nelson.

What’s a little known but cool fact about Nelson?

I’m not sure if you remember it but there was a movie back in the 1980s called Roxanne, starring Steve Martin and…

Daryl Hannah, yes!

…it was a re-creation of the story of Cyrano de Bergerac, and it was filmed in Nelson around the time of the whole heritage building transition. It’s great to be able to pick out the sites from the movie here at home.

Is Nelson affordable?

When I started in the business 16 years ago, the average sale price was, probably, you could find a house for $250,000 (CAD). That’s your average three- or four-bedroom, 2,000 to 3,000-square foot house on a 6,000 square-foot lot. Now, we’re taking $600,000-plus. So, things have changed. But we still are more affordable than many of the mountain towns that Nelson gets compared to, including Fernie, Revelstoke, Squamish or Whistler. Nelson has very little vacancy as far as rentals go. We’re always below one percent there and it’s been that way for years.

What do you want people to know about Nelson?

It is worth checking out, for sure. I can’t tell you how many times I’ve heard from real estate clients that there is just something about this place. Everybody is friendly. The food is great. It’s got a low-pressure vibe. I’ll go back to what I’ve said before: it’s the lifestyle.

Territory summary

Nelson is in the Selkirk Mountains on the west arm of Kootenay Lake in the Southern Interior of British Columbia. Along with Castlegar and Trail, Nelson forms the population and commercial core of the West Kootenay region.

Key Facts

- Population (2016): 10,664 (area 25,000)

- Population change 2011-2016: + 3.1%

- Total private dwellings: 5,106

- Age cohort percentage: 0-14 (15.1%), 25-54 (41.2%), 65+ (18.7%)

- Major language spoken: English

- Currency: CAD

Industry Facts

- Median list price of homes in Nelson, January 2024 ($604,308). Source: Houseful

Follow Coldwell Banker Rosling Real Estate on social media!

Coldwell Banker Brand Announces Q1 Achievements

Coldwell Banker Real Estate Continues to Expand Horizons Globally and Maintains Strong Partnerships Domestically

This article was reposted from Blue Matter by Sam Shalom, Article Here

In the dynamic world of real estate, the Coldwell Banker® brand has been making waves across borders. The first quarter of 2024 witnessed remarkable achievements, both internationally and domestically. Let’s dive into the details:

Domestic Triumphs

$61 Million in GCI Retained: At home, the Coldwell Banker brand retained an impressive $61 million USD in Gross Commission Income (GCI) across 16 companies. This achievement underscores the brand’s commitment to excellence and strong partnerships in key markets.

Global Markets Flourish

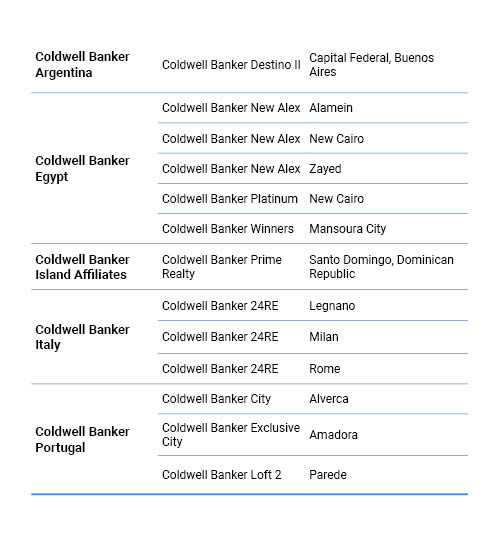

35 New Offices Worldwide: the Coldwell Banker brand’s global footprint expanded significantly with the opening of 35 new offices across 10 countries. From bustling city centers to serene coastal towns, our brand is making its mark in diverse locations. Some of the highlights include:

- Coldwell Banker Egypt leading expansion efforts by adding eight new locations, across New Cairo, Mansoura City, and Zayed among other locations.

- Coldwell Banker Turkey affiliated seven new companies to maintain their number one position as the largest network outside of the United States.

- Coldwell Banker France & Monaco opened its first office in Marseille, the oldest city in France with second largest population, after Paris.

- Coldwell Banker Spain & Andorra opened an office on the prestigious Golden Mile in Marbella, a luxury enclave for Europe’s elite. Additionally, Coldwell Banker Unique opened in the Barrio Salamanca neighborhood in Madrid, the capital of Spain and key real estate market.

- Coldwell Banker Italy and Coldwell Banker Mexico opened four new locations each, while Coldwell Banker Portugal and Coldwell Banker Argentina added three apiece.

COLDWELL BANKER INTERNATIONAL WELCOMED THE FOLLOWING NEW COMPANIES IN Q1 2024:

Additionally, the brand welcomed the following 14 offices to existing international companies:

COLDWELL BANKER INTERNATIONAL

About Coldwell Banker Canada: Founded in 1906, the Coldwell Banker brand is the most established residential real estate franchise system in North America. Fast forward over 100 years and the Coldwell Banker network is one of the most trusted in the world, with a global presence across over 40 countries and territories worldwide. The Coldwell Banker brand made its way to Canada in 1989 and has since gained a legacy of serving the real estate needs of Canadians from coast to coast for over 30 years. Since being acquired in 2021 by Canadian entrepreneurs Steve Houle and Karim Kennedy, the company strives to grow the brand’s presence on a national level. Coldwell Banker Canada is ready to make their mark in the Canadian Real Estate Market and transform the industry along the way.

Real Estate Spring 2024 – Buckle Up

This article is a Guest Post by Chris Perkins, Broker/Owner, Coldwell Banker Maritime Realty in Halifax, NS.

Our office had the senior economic analyst from the Canadian Real Estate Association speak to us this week, and his message was clear: “Buckle up.” In a captivating and somewhat terrifying 45-minute presentation on the Canadian real estate market, he predicted a surge in activity as people, previously held back by high interest rates, get ready to jump on opportunities when Spring listings hit the market. While we haven’t seen the expected influx of listings yet, things are delicately poised, with homeowners gearing up for the busiest time of the year.

HRM Snapshot: Over the past 24 months, Spring has consistently seen home sale prices that were 10-15% higher than in Winter.

Where are prices going?

For those hoping for a drop in real estate prices, the outlook is not promising. Rising interest rates created intense pressure in the rental market. With a vacancy rate of less than 1%, the expensive rental rates are prompting people to consider buying again. Those entering the real estate market are likely to encounter far more competition than in recent times.

Why is there a housing supply shortage?

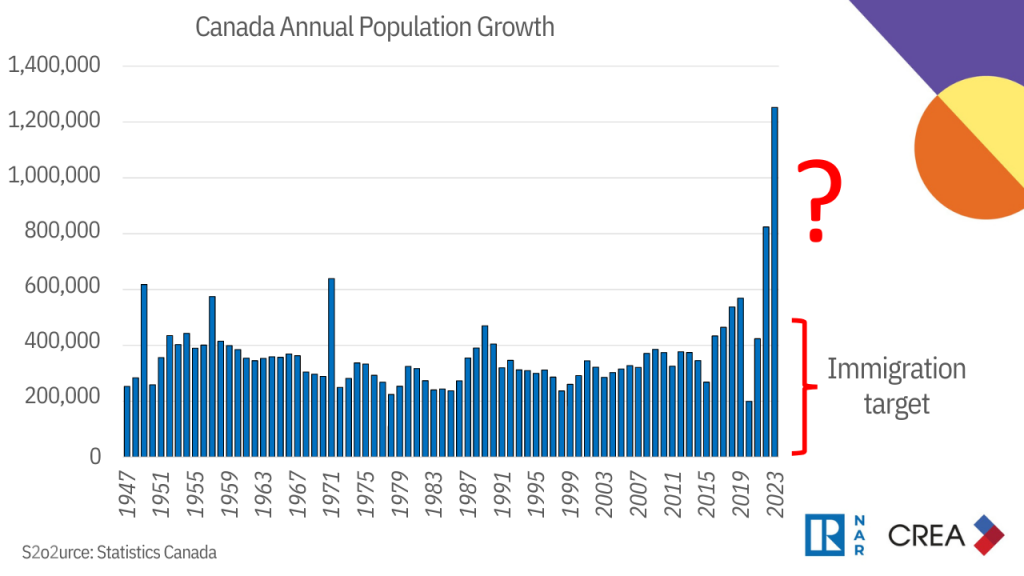

In 2023, Canada’s population grew by a staggering 1.2 million, surpassing the government’s target by 800,000. The pressing question: Where will these people live?

To meet rising demand, the government sees the need to construct 3.5 million homes, equivalent to 830,000 annually by 2030. Currently, we are only building 250,000 units so it seems completely impossible to meet that goal. On top of that, construction cranes dominating our skylines are not addressing the right housing needs – apartments vs single family. I own a wiener dog who I love dearly, but he barks at everything. The last place I want to be is in an elevator with him.

What about locally?

Looking at the local market in HRM (Halifax Regional Municipality), there’s a similar story to the rest of Canada. The influx of individuals from other countries and inter-provincial migration is creating significant pressure on housing in Halifax. As of now, the average price of a home is $575,000, marking an 8% increase from the last year. With just two months of housing supply (A Seller’s Market), there are only 750 homes on the market in an area with a population approaching half a million.

So, how do I navigate this?

For those thinking about their next steps, selling a home in this competitive environment allows you to leverage the demand to maximize property value. If upgrading is in your plans, the greater competition in lower price brackets allows you to sell at a premium while retaining negotiating power in higher brackets. However, first-time homebuyers have a tough task. I would recommend getting on the ladder, even if that means making concessions on your needs/wants list. What seems expensive now is likely to be even more so in the years to come. Once you own, you’ll benefit from rising prices by way of building value in your home, rather than chasing a market that could soon be out of reach.

Considering a move?

Contact Chris Perkins for expert guidance in navigating the complexities of the current real estate landscape. He will be with you every step of the way, ensuring you successfully achieve your real estate goals.

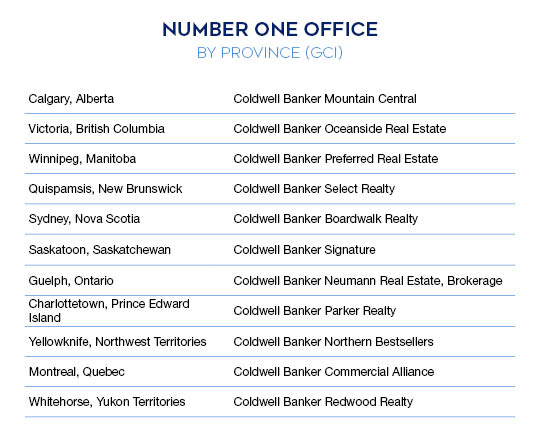

Coldwell Banker Canada Announces 2023 Winners in Annual Year-End Real Estate Awards

The most productive, the most inspiring and the most helpful people in the Coldwell Banker Canada real estate network are being celebrated as real estate awards season wraps up after another productive, inspiring and helpful year.

“In our full-service brokerages across the country, we share one goal, which is to guide clients to the homes of their dreams,” said Karim Kennedy, CEO of Coldwell Banker Canada.

“Our brokerages are where agents use their passion and experience—along with top-level training, support and technology—to make those dreams happen. We are proud of their work and the example of excellence they set. Congratulations to all!”

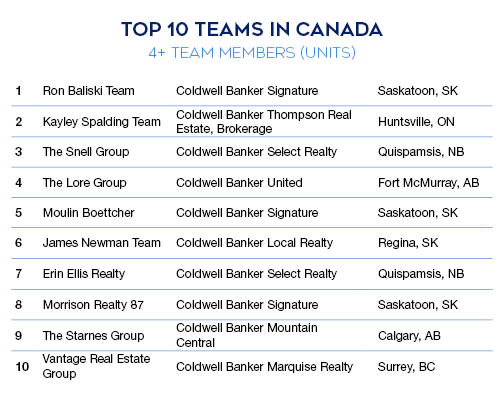

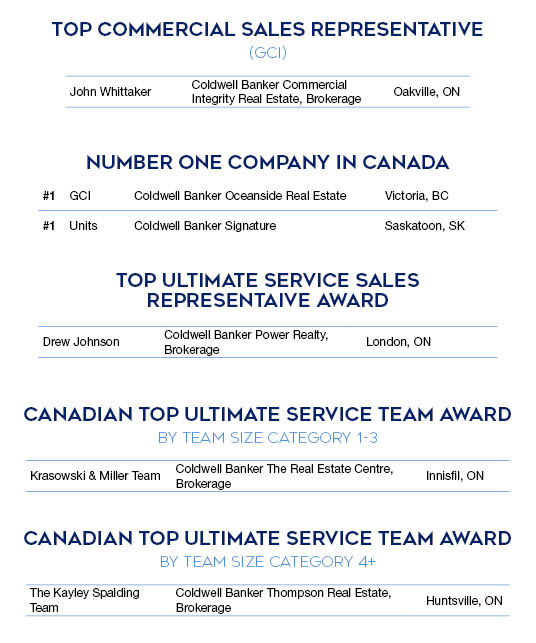

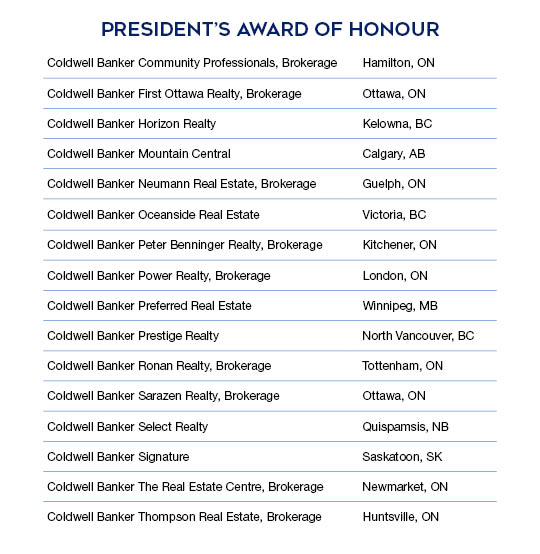

Here’s a selection of the big winners:

Rookie Of The Year Award

The Rookie Of The Year, for both GCI and Units Sold, was Sarah Vidalin of Coldwell Banker Oceanside Real Estate.

Vidalin credited her well-known land developer father for her work ethic, realtor Eric Smith for his encouragement and brokerage colleagues for their friendship and support.

“Coldwell Banker was the only place where everyone was welcoming,” Vidalin said.

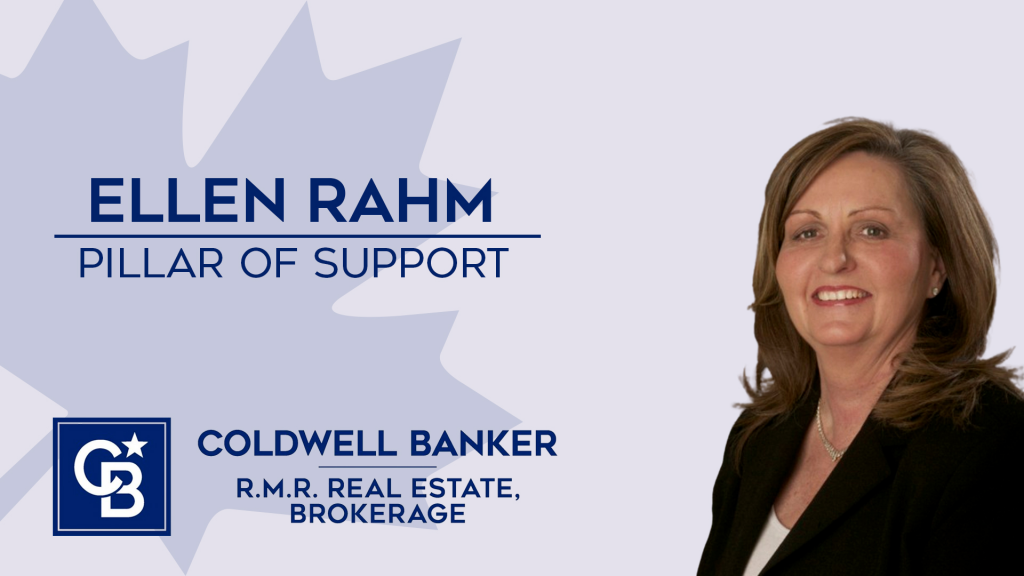

Canadian Pillar of Support Award

New this year was the Canadian Pillar of Support Award, recognizing an individual who demonstrated exceptional proficiency, dedication and effectiveness in administrative support.

Typical of the small mountain of nomination testimonials in support of Ellen Rahm of R.M.R. Real Estate, Brokerage, in Whitby, ON, was this tribute from a colleague:

“Ellen does everything for our office! Everything is an understatement. She makes the world go round at Coldwell Banker R.M.R. She supports all our agents in a way that I have never experienced working at other brokerages. She is always available to help. She always answers her phone when we call, and she does everything to her best ability to make our agents’ lives as easy and stress-free as possible. Ellen is truly one of a kind and we are so lucky to have her.”

Canadian Ambassador Award

Bianca Myddleton, Broker-Owner of Coldwell Banker Marquise Realty in Surrey, BC, won the coveted Canadian Ambassador Award, which is given to the talented and dedicated person in the network who proactively seeks to represent the best attributes of Coldwell Banker global brand.

Said CEO Kennedy: “She was celebrated for the professionalism in her office and her staff as well as for advocating for professionalism in the industry in the Fraser Valley. Bianca has also been a leading charitable force behind the annual Coldwell Banker Marquise Diaper Drive, which helps young families in need.”

Myddleton (middle) at the annual Coldwell Banker Marquise Diaper Drive.

Coldwell Banker Mountain Central Realty’s full-service brokerage comes home to Edmonton

To the list of things you might have heard about Edmonton—Gretzky played there back then, McDavid does now, it’s got a big mall, it’s cold in the winter, it’s got a lot of festivals, it gets a lot of sunlight, like, a lot—Rob Vanovermeire adds one more thing: real estate.

“People are recognizing that out of all the major cities in Canada, Edmonton is the best deal, it’s the best value,” says Vanovermeire, Broker-Owner of Coldwell Banker Mountain Central Realty.

“There’s no city in Canada better for value in real estate than Edmonton right now,” he says. “That will become increasingly apparent this year. I think we’re going to see more and more people looking to Edmonton to invest.”

Growing

The Edmonton-born, -raised, -schooled (and now Calgary-based) Vanovermeire walks the walk. He has just completed a successful merger with Coldwell Banker Venture Realty in Edmonton.

“We are growing,” says Vanovermeire. “As we grow, we get more resources to do bigger and better things with technology and marketing, which will give the agents the support, the training and the systems they need for their businesses to grow in this growing market.”

The merger more than doubles the size Coldwell Banker Mountain Central agents in the Alberta capital. The bricks-and-mortar site for the combined operation will be its Edmonton headquarters on 156 St. near Stony Plain Rd.

Vanovermeire: “People are recognizing that out of all the major cities in Canada, Edmonton is the best deal.”

Edmonton by the numbers

Vanovermeire’s bullish take on Edmonton has some statistical backing.

According to a recent forecast from the Canadian Real Estate Association (CREA), Alberta is the only province in Western Canada where expected gains in the average home price (6.3%) will exceed the national rate of 2.3%. Alberta (11%), Ontario (13.9%) and Nova Scotia (13.2%) are the only provinces where the forecast change in residential sales in 2024 will top the national average (10.4%).

According to CREA’s updated 2024 forecast, “the bigger sales gains in 2024 are expected to come from provinces where housing demand is strong, Alberta in particular, along with provinces that are expected to see a rebound from historically low sales volumes—British Columbia, Ontario, Nova Scotia.”

Here are some Edmonton-specific statistics from CREA:

$380,400 – Edmonton’s MLS® Home Price Index Benchmark Price, seasonally adjusted, December 2023

$568,000 – Calgary’s

$1,094,000 – Greater Toronto’s

$528,700 – Halifax-Dartmouth’s

6.2% – month-over-month rise in home sales activity in Edmonton between November and December 2023

3.7% – month-over-month increase in new residential listings in Edmonton between November and December 2023

5 – number out of 26 primary MLS® zones with a positive monthly change in number of new listings between November and December 2023

The lead, the realtor

Vanovermeire is clear when it comes to what he’s looking for in an agent to work in the Edmonton market.

“I am looking for agents either experienced or new to the industry who are committed to representing clients and our company the right way,” he says. “We especially look for people who have the desire to learn and embrace the technology that we have available to us.”

Vanovermeire views himself as a link in a tradition of realtors who have built successful careers and who share their learnings.

“I had a few fantastic mentors and coaches and one of the most powerful things I learned was how to convert real estate inquiries into an actual client,” he says.

“A lot of realtors generate leads but struggle with converting them to clients. We live in the information age. People want information before moving forward, but, at some point, they need our expertise, which requires meeting in person. Many agents have challenges moving from offering information to getting hired with a signed contract. We teach realtors how to turn inquiries into signed agreements with clients.”

Vanovermeire: “I am looking for agents either experienced or not as experienced, but who have the desire to do it right, the desire to learn, people who are reachable and who will really embracee verything that we have available to us.”

Hometown advantage

Vanovermeire adds one more item to his list of the good things about Coldwell Banker Mountain Central’s growing presence in Edmonton: the hometown advantage.

“In addition to the systems and the training that Edmonton agents benefit from, there’s the fact that I’m from Edmonton. It’s my hometown. It’s near and dear to me. I’m from here. I can relate.”

Editor’s note: the photo at the top of the post shows Rob Vanovermeire (back row, third from left) next to Karim Kennedy, CEO, Coldwell Banker Canada, at the former Coldwell Banker Venture Realty, now Coldwell Banker Mountain Central, office in Edmonton. Reach out here. BTW, Edmonton gets up to 17 hours of sunlight a day in summer!

Coldwell Banker Maritime celebrates big deal that brings Halifax real estate veteran on board

Collaboration between pillars of Coldwell Banker’s Nova Scotia brokerage scene builds for future success of agents and clients

Halifax, NS – January 9, 2024 – It is official, and it is big news: After 27 years at the helm of Coldwell Banker Supercity Realty, Broker-Owner Mariana Cowan has joined forces with Coldwell Banker Maritime Realty.

“To start the New Year, this is wonderful news for our company, for our agents and for the home buyers and sellers in this market,” said Chris Perkins, Broker-Owner of Coldwell Banker Maritime Realty. “Mariana Cowan has decades of experience that is relevant to the people in the market right now,” he said. “Simply put, she’s a powerhouse.”

The move, which was finalized on Dec 28, 2023, means 11 agents and a number of new recruits now join Coldwell Banker Maritime Realty, which opened its doors in June 2023.

Cowan, who will continue to work as a realtor, called the new arrangement “a perfect coming together of two ways of looking at the important work that a full-service brokerage does.”

Said Cowan: “This is so exciting because it’s so complementary. They have systems and a support structure that can easily be utilized with what we do. Chris is so savvy and is such a good listener. He really respects the experience and the knowledge of people I have built up over the years.”

Cowan said the move now frees up time to do even more to help aspiring agents attracted to Coldwell Banker for its commitment to learning, training and support. “I’ll now have the time to coach and mentor and that’s important because I truly believe that we have to get back to basics and really show the importance of relationship building,” she said. “Technology is wonderful, but there is a lot to be learned and re-learned about doing things in person.”

Perkins said the coming-together is perfectly timed for an expected rebound in the local real estate market in 2024. “The goal here is to bring our talented agents together and equip them with what they need to know about the marketplace in the months ahead,” said Perkins. “That’s the equation of Coldwell Banker Maritime Realty: deliver the tools and training and information to our agents so they can help deliver dreams for our clients.”

About Mariana Cowan and Chris Perkins:

On the strength of almost 40 years in the business, multiple professional accreditations, a deep commitment to community and an abiding interest in furthering the cause of women leaders in real estate, Mariana Cowan has been described as The First Lady of Halifax Real Estate. She is an award-winning realtor, educator and public speaker. “What do agents need now to get them to their true potential? That’s what motivates me.”

Chris Perkins is pictured here with wife and business partner Joelle along with their dachshund, Dwayne. The couple have lived in the Nova Scotia capital since 2018, two years after getting married on a trip to Halifax. Chris has been working in the real estate industry since 2007 and ranked internationally in the top 1% of agents for Coldwell Banker. He was recognized by Coldwell Banker International as a recipient of the Top 30 Under 30 award – a result of his commitment to service and to the best interests of his clients. Chris serves his clients with an informative, easy-to-read and provocative blog. Here’s his take on the performance the Halifax-area real estate market in 2023 and what’s ahead in 2024.

To contact or set up interviews on the current Halifax real estate market:

Mariana Cowan, Coldwell Banker Maritime Realty, 902-452-1639

Chris Perkins, Coldwell Banker Maritime Realty, 902-210-1223

Each office is independently owned and operated.

Coldwell Banker Electric Realty, Brokerage Switches on in Peterborough

One hundred and forty years and two blocks away from the newly renovated offices of Coldwell Banker Electric Realty, Brokerage in Peterborough, Ontario, the first electric streetlights in Canada were lit.

Brilliantly, Ian Marshall has channeled that piece of history into the name of his new real estate brokerage: Coldwell Banker Electric Realty.

“Peterborough is commonly referred to as Electric City and I wanted to make sure that the brokerage from day one was deeply rooted in the local feel of our city,” said Marshall.

“We knew immediately that the real estate brokerage that will serve this community was going to be called Electric.”

Ian Marshall, President & Broker of Record, Coldwell Banker Electric, Peterborough, ON.

Location, location, vocation

Marshall recalled the day 12 years ago when a switch went off and his future in real estate came into view. He was selling his house nearby and was in the market for a new one. The process—the details, the dreams—grabbed his attention.

“It was so intriguing to watch the agent I was working with at the time do his job —all the stuff behind the scenes, the paperwork, the conversations, the staging of the house,” Marshall said.

“I already enjoyed watching real estate shows on HGTV,” he said. “So, when I got to experience it myself on the client side, I said to myself, I can definitely do this!”

Inner voice

That inner voice that said “I can do this” has been a faithful navigator in Marshall’s life. It has reassured him that dropping out of high school was a beginning and not just an ending.

“High school was difficult for me, and I knew to survive I needed to blaze my own trail,” he said. “Leaving high school early is certainly not a path for everybody because you have to work incredibly hard to overcome the difficulties that come without that diploma, but I’ve been able to make it. Life has been my teacher.”

That inner voice has expected things of him.

“Leaving school at age 15, means a person grows up overnight,” Marshall said. “You instantly have to become an adult, get to work and figure out how life works.”

That voice has told him to keep going.

“I worked overnights in fast food straight out of high school,” he said. “I’ve done sales, telemarketing, network marketing, sold door-to-door. I’ve done over-the-phone tech support, worked in search engine optimization, supported executives, managed commercial properties and started a commercial and residential cleaning company.”

That voice has taught him to see people in everything he did.

Marshall’s maxim: “Every dollar our agents pay us, we want our agents to feel that dollar reciprocated.”

“In my opinion, the backbone to any sales relationship is understanding people and understanding what they really need and what they really want,” Marshall said.

“That means understanding, especially in our line of work, that purchases made today have the potential to impact the course of one’s life in a great way. To be a small part of that journey is amazing.”

And that voice has reminded him to trust himself.

“I never say good luck. I don’t believe in luck. I believe in hard work. I believe that everybody has the same opportunities. We all get the same 24 hours in a day, it’s what we do with that time that makes us ‘lucky.’”

“I’ve done a lot of things,” says Marshall, here in front of a first listing in Pickering, ON, in 2016, “but my passion has always been real estate.”

The road home to Coldwell Banker

In 2014, it was time for real estate for Ian Marshall.

Marshall studied for and got his license and then joined a boutique brokerage. He quickly realized he needed the training and support offered by a brand.

He joined a family-owned RE/MAX brokerage, found a mentor, thrived and loved it there until it was swallowed up by a “conglomerate-type brokerage.”

The feeling of the place changed almost overnight, he said. It was a good time for a change. He spent a few years trying to find a brokerage that felt like home.

He was convinced he could build a brokerage where agents received real value for the real contributions they made.

Reciprocal value at Coldwell Banker

“There are definitely some brokerages that do an amazing job providing value to their people, but there are many brokerages where agents get to the point that they’re seeing expenses off their commissions cheques and they find themselves asking, ‘What is this brokerage providing me that equates to this expense? What’s the value for both of us?’” he said.

Those questions led Marshall to investigate franchising options. At first, Coldwell Banker Canada wasn’t on his radar. Then, he said, he saw all the good things happening with the company, including the master franchise being acquired and its connection to Coldwell Banker’s global branding. Marshall went for lunch with Paul Abbott.

He shared his vision. It was, he quickly learned, a shared vision.

“He was just a fantastic guy to deal with and extremely generous,” said Marshall of Abbott, Coldwell Banker Canada’s Vice President, Franchise Development, in Ontario.

“He talked about the great things Coldwell Banker Canada is doing to provide value to their both their agents and their Broker-Owners, shared key parts of the franchise agreement that clicked perfectly and showed us the amazing branding and marketing materials Coldwell Banker offers. We left that meeting realizing just how much sense it made to partner with Coldwell Banker.”

Paul Abbott, fourth from right, and Ian Marshall, second from right, joined Coldwell Banker Canada CEO Karim Kennedy, centre, and Coldwell Banker Broker-Owner colleagues, Oakville, ON, December 2023.

Value for agents

Marshall came away convinced that his dream of a brokerage built on reciprocal value could be made real at Coldwell Banker.

“That is going to be part of Coldwell Banker Electric,” Marshall said.

“Every dollar our agents pay us, we want our agents to feel that dollar reciprocated. We want our agents to feel that this is a place where they are getting what they pay for and to never question whether their relationship with us is valuable or not—because it always will be.”

For Abbott, the stage is now set for Marshall’s innate leadership skills to do what innate leadership skills do: attract talented agents.

“With Ian Marshall at the wheel, Coldwell Banker has added to our team another sharp, experienced, passionate leader who understands real estate and understands people,” said Abbott. “The future is bright for Coldwell Banker Electric.”

Recruits

Coldwell Banker Electric will open the doors to its newly renovated 6,000 square-foot headquarters on historic George Street in late January 2024.

“It’s a great location,” Marshall said.

“There’s tons of foot traffic and a lot of history with our building. For many years, the building was known for being the home to Copperfields Restaurant & Bar and then to The Protectors Group. Before that it wore several hats but was originally built as a Loblaws in the early 1950s, it then burned down, and was rebuilt. Like me, it’s done a lot of work.”

Marshall said he’s ready for the good work ahead.

“We are going to hit the ground running with our recruiting efforts to attract the best of best agents here in Peterborough,” he said.

Who has the makings of a Coldwell Banker Electric agent?

“We want our culture to be that of productive agents,” Marshall said. “We’re looking for people who aren’t afraid of hard work and are eager to learn and grow. Maybe they haven’t had a ton of success where they are. Maybe they are new, maybe they’re in a slump. Maybe they are just looking for a change. But the makings of our agents will be that they’re hungry and humble and good people who realize everybody has their own story to tell.”

Marshall, fiancé Jeff and daughter Charlotte, Christmas 2023

Strong market

Marshall said the real estate market in Peterborough has always been strong and that the prospect of relief on interest rates suggests good things ahead in 2024.

“I am so excited to bring Coldwell Banker Electric to Peterborough and start sharing our vision and our passion with the agents, the great agents of Peterborough, and show them why Coldwell Banker Electric is the brokerage to partner with here in town.”

Coldwell Banker Vision Realty Changes Hands, Builds Future From Strong Past

Ray Cavin, the new Broker-Owner of Coldwell Banker Vision Realty would prefer that this story start with something about Rick Cowling, who is the previous owner of the Coldwell Banker Vision Realty brokerage.

For his part, Rick Cowling would prefer that the story begin with something about Ray Cavin.

How to get around this impasse of politeness and get to the big announcement?

We’ll pass the mic to Rick’s wife, Shauna, for just a second.

“Those two get in this cycle of ‘Thank you, no, thank you, thank you very much for the opportunity, no, thank you for running the business and looking after it while I was on vacation, no, thank you for this, no, thank you for that,’” Shauna Cowling laughed.

“I feel like saying, why don’t you both say you’re welcome and then we can move on, right?!”

Unusual in today’s world

That little window into the genial and respectful professional relationship of “those two” starts to explain how Cowling and Cavin were able to pull off a smooth and uneventful business succession—including the sale of a new 6,000 square foot commercial building—ensuring a new chapter of growth for Coldwell Banker Vision Realty in Olds, AB.

Cavin described the secret of the working partnership.

“When both sides believe that you are taking out more than you are putting in, that relationship is always going to work,” he said. “I think that marriages, business relationships, friendships and partnerships die when we believe that we’re putting in more than we’re receiving.”

Cowling didn’t disagree about the taking-out-more-than-you-put-in equation: “Yeah, we laugh about that little saying all the time,” he said. “Ray started with me 10 years ago. We had our tenth anniversary here a couple of weeks ago. It’s really unusual in today’s world to find someone with such a similar character and beliefs and work ethic. It grabs you, actually.”

Cowling was formed by a life outdoors in the foothills of the Rocky Mountains.

Cowboy to Coldwell Banker

Now semi-retired, Rick Cowling is 66 years into a very Alberta life.

He grew up in the foothills of the Rocky Mountains on a farm near the village of Longview, AB. That’s where he studied economics.

“Growing up on a farm meant working with your hands, feeding the chickens and the pigs and the cattle, growing the grain, seeing how every dollar came in,” he said. “Just working side by side with my dad—my mom and my dad.”

In the mid-1970s, Cowling worked as a cowboy at the famed Bar U Ranch, which is now preserved as a national historic site in southern Alberta.

The family farm was sold when he was a teenager (“It broke my heart, but my dad always said his selling the farm was the best decision for me.”) The family moved to High River. Rick and Shauna married young, moved to Calgary, welcomed three children and then moved to Edmonton to get university degrees.

“We did things the hard way—university after children,” Cowling laughed. “Did I mention that I grew up on a farm?”

Saddling up for a trail ride.

Fast forward through a move back to southern Alberta … work as a teacher … time spent running a flooring company (where Cavin first worked for him) … a stint operating a home-building firm … and up to Cowling’s decision to go into real estate.

“We researched all the brands and Coldwell Banker always floated to the top,” Cowling said.

Cowling was the brokerage owner. Cavin became Broker of Record. They settled on “Vision” as the name of the brokerage in part to convey that they could be trusted with clients’ pictures of their futures.

Said Cavin: “We are not moving units around. It is relational. It’s not just transactional. This isn’t a ‘sale’ as much as it is a story of someone upsizing because they had a baby. Or downsizing because the kids have moved out, and so on.”

Out of the chute, the vision for Coldwell Banker Vision Realty was to grow the business to eight agents and to construct a new building with highway exposure within five years. They have reached and exceeded those goals.

“Our goal now is to become the largest local brokerage in our area—and not by a little,” Cavin said. “Our goal is to have an overwhelming market share.”

Ray Cavin, Broker-Owner, Coldwell Banker Vision Realty

What Coldwell Banker Vision agents can expect

To help get the brokerage there, a special kind of real estate agent and a special kind of support for that agent are needed.

“We are very selective, and we don’t take every agent,” Cavin said.

“The agents who do join us experience a brokerage where their business goals and personal dreams are met with unwavering support. When they grow professionally and personally, they are able to provide exceptional support to their clients.”

Said Cowling: “Trust is the most important word in real estate. You have to surround yourself with people you trust. People who have that family feel. People who you can rely on.”

Come on, really?

Really, Cavin said, that is the culture of the place.

The commitment to maintaining that culture has informed a unique hiring practice. A prospective agent is interviewed by Cowling and Cavin and then there’s a bit of twist.

“Rick and I would discuss it and then if the person passed that first test, and we made this clear to them, our next step would be to take it to a general meeting and discuss it with the agents,” he said. “The decision isn’t made by popular vote but by genuine conversation, and we’ve had some real conversations.”

Guiding those conversations is the principle of people over profit.

“There might be times where we make the decision that the net profit to this agent coming on isn’t going to be worth the disruption to the system,” Cavin said.

Cowling with grandson Zac and Shetland pony Aurora in the acreage riding arena. (Great grandma is in the background.)

Coldwell Banker Vision Realty

Cavin said he’s ready to take the next step and guide that system.

“I’ve had such a great mentor, so I’ve had it pretty easy,” he said. “Rick always said run this like you own it.”

Now, officially, he does.

For Cowling, the passing of the torch means a chance to devote more time to family life on the acreage, even though he intends to keep doing real estate on the side. He’ll have more time for trail rides into the beloved Rocky Mountains. And time, too, to glance back on the path that has gotten him and Coldwell Banker Vision Realty to where it is.

“I am happy about what we’ve built,” Cowling said. “We have a group of really good realtors who work in a really good environment. We’ve got a brand-new building. We’re always pushing ourselves to be better.”

Go figure, Cavin said much the same thing.

“When you share a vision, you know where you are going,” he said. “You know when you get there. And you get there together.”

Cowling alongside mother, Irene, driving Norwegian fjord brothers.

Note: Blog cover image at top shows Rick Cowling, left, and Ray Cavin as they seal with a handshake the change of ownership of Coldwell Banker Vision Realty in Olds, AB.

2023 Christmas Tree Trends

Christmas tree decorating season is here. It can be a daunting time of year. You’re short of money. You’re short of time. You’re short of inspiration.

Search “Christmas tree decorations” and your task gets a little more intimidating. You are seemingly up against decorating pros with lots of space, lots of time and lots of budget. Not to mention an eye for lighting and Instagram framing.

Here’s the good news: Charlie Brown.

There is a scene in A Charlie Brown Christmas where Chuck and Linus are sent by Lucy to find a glitzy, glamorous, modern tree for the school play. What they come back with is a small, thin, sad sapling barely able to hold a single ornament. But they stay with it.

Moral of the story: listen to what others have to say, sure, but when it comes to making things more beautiful at this time of year, remember that beauty is in the eye of the tree-holder. That’s you.

Going from your own version of “not so beautiful” to “a little beautiful” or from “a little beautiful” to “a little more beautiful” is more important than arriving at someone else’s pre-packaged definition of a beautiful tree.

With Charlie Brown Rules in effect, here are some Christmas tree trends that we’re seeing out there this year.

Source: Tidbits & Company

1. Go Natural

In a season of runaway advertising and pressure to consume, a sparse tree stands as a reminder to make room for the important things of life, including moderation. The attractiveness of a deliberately underdone tree is enhanced by the hands-on method of decorating it. Head outside to gather pinecones. Use dehydrated apples, cranberries and oranges. String together a good old-fashioned popcorn garland.

Source: The Merrythought

2. Choose Simple & Minimal

By its very presence, a minimal tree decorated in tasteful tones delivers the quiet joy and calm we search for at this time of year. Warm string lights, a wood bead garland and white clay ornaments work harmoniously to deliver tranquility. Baking your own clay ornaments printed with unique designs (constellations are a favourite) is a fun tradition to start with the little ones.

Source: Good Housekeeping

3. Or go Barbie!

Barbie, it’s been quite a year! Single (plastic) handedly, the 11½-inch-tall pop cultural icon, brought to life on the big screen by Margot Robbie, has infused our lives with pink. This year, it is not going out on a limb to think pink—pink ornaments, pink baubles, pink glitter and pink feathers, bows and ribbons. Red and green will still be there next year.

Source: @chelseazeferina

4. See Friendships Come Sailing In!

Make the friendship bracelets/ Take the moment and taste it, sang Taylor Swift in “You’re On Your Own, Kid.” Swifties obliged, making friendship bracelets a thing in socials and at Eras concerts this year. Some glue, lettering, foam pucks, and string are all you need to bring Taylor home for the holiday.

Source: Good Housekeeping

5. Mood Change

Home interiors are trending darker and moodier in palette. So are Christmas trees. Burgundies, burnt oranges, dark greens (olive, hunter, and Castleton), and even blacks are taking the place of classic reds and greens. This might be the right tone for the season.

Source: Handmade Farmhouse

6. Gold and Silver

Ever since the Irish poet W. B. Yeats decorated and painted eternity with “the silver apples of the moon and the golden apples of the sun,” people have found it mesmerizing to combine the sophisticated colours for special occasions. Gold and silver combine to form a kind of shimmering and icy purity.

Source: Domestically Blissful

7. Snow

One of the many cool things about a spruce tree is how it’s built to live with snow. Its needles offer less surface area for snow and ice to hang onto. Its cone shape means the weight of the snow is spread out near the base and not, like a deciduous tree, in the canopy. Also, snow collected on lower branches has a shorter journey to water the roots in spring. All of this makes a case for using fake snow to celebrate the real cleverness of the spruce tree at this time of year—indoors!

Source: Liz Marie Blog

8. Paper Tree

Short of floorspace? Got a length of rope and some loose pages from an old book? Then you’re all set. Why not fashion a wall tree that also pays tribute to the trees from which our books come to life? It’s also a reminder that the gift of a book for Christmas is all your favourite bookworm ever needs.

Source: Amazon.ca

9. Peanuts

The final word goes to Linus Van Pelt in A Charlie Brown Christmas:

“I never thought it was such a such a bad little tree,” said Linus. “It’s not bad at all, really. Maybe it just needs a little love.”

In the spirit of the season, happy decorating to all!

Sources

https://www.goodhousekeeping.com/holidays/christmas-ideas/

https://abeautifulmess.com/make-your-own-clay-ornaments/

https://treecanada.ca/article/how-trees-survive-in-winter/

https://www.lizmarieblog.com/2014/12/25-amazing-christmas-trees-one-everyones-style/

https://www.amazon.ca/ProductWorks-Peanuts-Charlie-Christmas-Blanket/dp/B01E7AIN2A?th=1

Coldwell Banker Complete Real Estate Joins Forces with Coldwell Banker Mountain Central in Calgary

Combined operation of industry leaders adds 11 real estate professionals and years of client satisfaction in Calgary market.

Calgary, AB – December 7, 2023 – Coldwell Banker Mountain Central and Coldwell Banker Complete Real Estate have today announced the finalization of a strategic merger born of a shared commitment to service, innovation and excellence in the Calgary real estate market.

The move means Coldwell Banker Mountain Central, led by Broker-Owner Rob Vanovermeire, adds 11 new associates from Coldwell Banker Complete Real Estate, including Broker-Owner Susanita de Diego, who is also a Director and Chair-Elect of the Calgary Real Estate Board.

“We share a deep knowledge of the unique Calgary market, a deep passion for the Coldwell Banker brand and a true commitment to being the ideal choice for real estate professionals looking for the support of a full-service brokerage,” said Vanovermeire and de Diego in a shared statement.

The decision to close her successful brokerage, de Diego said, and unite with Coldwell Banker Mountain Central was the best way forward to serve clients and colleagues, and to balance her work, volunteer and family life.

“Our vision from the very beginning back in 2006 was clear,” de Diego said.

“It was to create a nurturing and empowering home for high-performing REALTORS® who shared the common goal of providing unparalleled professional services to their valued clients. That commitment led us to excel in various real estate specialties, including luxury properties, country residential, condominiums, international real estate and specialized services for seniors.”

Over the years, Coldwell Banker Complete Real Estate not only met but exceeded its goals, continually raising the bar for real estate services. The brokerage and its teams earned numerous awards, including Canadian Top 10 Team Awards, highlighting their consistent, outstanding performance in the real estate industry.

In 2022 Coldwell Banker Complete Real Estate proudly claimed the title of number one real estate company in Canada in their size category.

“That recognition was a testament to our unwavering commitment to excellence and dedication to serving clients at the highest level,” said de Diego.

“That is the same commitment to excellence that everyone can expect as we now work collaboratively with a specialized group of real estate advisors under the Coldwell Banker Mountain Central banner,” she said. She added a “heartfelt thanks” from the team at Coldwell Banker Complete Real Estate for the support of clients, partners and the community over the years.

“We look forward to many more years of success and growth, serving clients with the same passion and dedication that have been our hallmark since day one,” said de Diego.

About Susanita de Diego and Rob Vanovermeire:

Susanita de Diego is a highly accomplished REALTOR® with a career spanning more than three decades. She began her real estate journey in Vancouver, BC, in 1987, and has consistently maintained her status as a top-producing professional.

Her dedication to her clients and her significant contributions to the Calgary Real Estate Board have solidified her reputation as a leader in the industry. She is excited to embark on the next phase of her career as part of the Coldwell Banker Mountain Central team.

Rob Vanovermeire, a significant figure in the Calgary real estate industry since 1999, established his real estate brokerage in 2008 and began implementing the marketing techniques he was teaching in his courses with the Alberta Real Estate Association, Mount Royal University and the Calgary Real Estate Board. In 2014 he joined the Coldwell Banker network and has expanded the brokerage to more than 70 full–time agents and to include a property management division.

To contact or set up interviews on the current Calgary real estate market:

Susanita de Diego, Coldwell Banker Mountain Central, 403-630-3390

Rob Vanovermeire, Coldwell Banker Mountain Central, 403-870-8704

Each office is independently owned and operated.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link