Sustainable Living: An Easy Guide

Sustainable living has been a hot topic in recent years, and for good reason! As news of climate change and its impact becomes more prevalent, more and more people are trying to reduce their carbon footprint and live more eco-consciously. We have created an easy guide to help you understand what sustainable living is and how you can easily implement it in your life!

What is a Sustainable Home?

A sustainable home is designed to reduce environmental impact and operational costs. It uses low-impact, high-performance materials, and energy-efficient systems. Energy efficiency and quality materials are central to sustainability, reducing waste and improving longevity.

Tips & Features:

- Passive Solar Design:

Passive solar design involves strategic architectural planning to maximize the sun’s energy to heat and cool a building naturally. This design principle includes orienting the home so that the most sun-exposed areas are the ones that need warmth, such as living spaces. Large, south-facing windows can capture sunlight during the winter, while overhangs or shades block excessive heat during the summer. Materials like concrete or tile with thermal mass can absorb and slowly release heat, maintaining a more stable indoor temperature. This reduces the need for mechanical heating and cooling systems, leading to energy savings and a lower environmental impact. - High-Performance Windows:

High-performance windows are designed to significantly reduce energy loss, enhancing a home’s overall efficiency. These windows typically feature double or triple glazing, where multiple panes of glass are separated by air or gas-filled spaces to improve insulation. Low-emissivity (Low-E) coatings can further minimize heat transfer, reflecting infrared light while allowing visible light to pass through. Additionally, framing materials made from nonconductive materials, like vinyl, wood, or fiberglass, prevent thermal bridging, where heat escapes or enters through the window frame, improving the energy efficiency of the entire window unit. - Energy-Efficient Appliances:

Energy-efficient appliances are designed to perform their intended function using less energy than their conventional counterparts, often resulting in lower electricity bills and reduced environmental impact. Appliances with the ENERGY STAR® label meet strict energy efficiency guidelines set by regulatory agencies. These appliances, including refrigerators, washing machines, dishwashers, and more, often use advanced technologies like variable-speed motors and energy-saving modes to optimize performance while minimizing power consumption. - Drip Irrigation:

Drip irrigation is an efficient watering system that delivers water directly to the roots of plants, minimizing evaporation and runoff. This method uses a network of tubes, pipes, and emitters to apply water slowly and precisely to the plant’s base. Drip irrigation can be gravity-fed, using the natural force of gravity to move water through the system, or connected to a low-pressure pump. By delivering water directly to where it’s needed, drip irrigation reduces overall water usage, conserves electricity (especially in systems without pumps), and promotes healthier plant growth. - Eco-Paints:

Eco-paints are environmentally friendly paints that have low or zero volatile organic compounds (VOCs), which are harmful chemicals that can off-gas into the air, leading to indoor air pollution and health issues. These paints are made from natural or sustainably sourced materials, and they often have low odour during application and drying. By choosing eco-paints, you can create a healthier indoor environment, reduce the carbon footprint of your home improvement projects, and contribute to overall sustainability efforts. - Cool Roof:

A cool roof is designed to reflect more sunlight and absorb less heat than a standard roof. Cool roofs are typically made with reflective materials or coatings that have high solar reflectance and thermal emittance. By reducing the amount of heat transferred into the building, cool roofs can lower cooling costs, improve indoor comfort during hot weather, and extend the lifespan of the roof. Additionally, cool roofs can help mitigate the urban heat island effect, where densely built areas become significantly warmer than their rural surroundings. - Solar Panels:

Solar panels, or photovoltaic (PV) systems, convert sunlight into electricity, providing a renewable and sustainable source of energy for your home. By generating clean energy, solar panels reduce dependence on fossil fuels, lower greenhouse gas emissions, and can significantly decrease electricity bills. Depending on the size of the system and local energy costs, homeowners may see a return on investment over time through reduced utility bills, government incentives, and even selling excess energy back to the grid in some cases. - Smart Power Strips:

Smart power strips are designed to reduce energy waste by automatically cutting power to devices that are in standby mode or not in use. Unlike traditional power strips, smart power strips can detect when a device is not actively being used and shut off power to prevent “phantom” or “vampire” energy loss, which occurs when electronics consume electricity even when turned off. These power strips can be controlled manually, via a timer, or through remote sensors, making them a convenient and effective way to reduce overall energy consumption in a home. - Insulation Upgrades:

Upgrading insulation is one of the most effective ways to improve a home’s energy efficiency. Proper insulation in walls, floors, ceilings, and attics helps maintain a consistent indoor temperature, reducing the need for heating and cooling systems to work as hard. High-quality insulation materials, such as spray foam, fiberglass, or cellulose, prevent heat loss in the winter and keep cool air inside during the summer. Insulation upgrades can lead to significant energy savings, increased comfort, and a reduced carbon footprint by lowering overall energy consumption.

Types of Sustainable Homes:

- Shipping Container Homes:

Repurposing steel shipping containers into homes is a sustainable choice that reduces construction waste. These homes are durable, energy-efficient, and can withstand extreme weather conditions, making them ideal for various climates in Canada. With proper insulation and design, they offer a modern, eco-friendly living solution. - Zero-Carbon Homes:

Zero-carbon homes are designed to produce no net carbon emissions. They achieve this through high levels of insulation, airtight windows, and the use of renewable energy sources like solar panels. These homes are a key component in reducing Canada’s carbon footprint and promoting long-term environmental sustainability. - Tiny Homes:

Tiny homes are compact living spaces, usually under 400 square feet, that emphasize efficiency and minimalism. By reducing space, they inherently lower energy consumption and promote the use of sustainable materials. This makes them an excellent option for those looking to simplify their lives while minimizing their environmental impact. - Prefabricated Homes:

Prefabricated homes, or prefab homes, are built offsite in a controlled environment and then assembled on location. This method reduces construction waste and is typically more cost-effective than traditional building methods. Many prefab homes are now designed with sustainability in mind, including energy-efficient features and the use of eco-friendly materials. - Earthship Homes:

Earthship homes are designed for off-grid living, utilizing natural and recycled materials like earth-filled tires and bottles. These homes are self-sustaining, with systems for water collection, solar power, and temperature regulation through passive solar design. They are ideal for those seeking a lifestyle that is closely connected to the environment.

Simple Habits for Sustainable Living:

- Compost Kitchen Scraps:

Turn food waste into nutrient-rich compost instead of sending it to the landfill. Composting helps reduce methane emissions from landfills and provides valuable organic matter for your garden, enriching the soil and promoting plant growth. - Create an Energy-Efficient Garden:

Choose native or drought-tolerant plants that require less water and use mulch to conserve soil moisture. This reduces water usage and supports local biodiversity, creating a more sustainable garden that thrives with minimal maintenance. - Cold Water Laundry:

Washing clothes in cold water can significantly reduce your energy consumption, as heating water accounts for a large portion of energy use in laundry. This practice not only saves energy but also extends the life of your fabrics by being gentler on them. - Use Natural Cleaning Products:

Opt for eco-friendly cleaning products made from natural ingredients to reduce the presence of toxins in your home and minimize environmental pollution. Natural cleaning products are derived from ingredients like vinegar, baking soda, and essential oils, which are effective and safe alternatives to chemical-based cleaners. For example, vinegar can be used to clean glass and countertops, baking soda works well as a deodorizer and mild abrasive, and essential oils like lemon or lavender can add a pleasant scent while boosting cleaning power. Homemade cleaners can be easily mixed in spray bottles and used for various cleaning tasks, offering a healthier and more sustainable option for maintaining your home. - Houseplants:

Incorporating houseplants into your living space is a great way to enhance indoor air quality and bring a touch of nature into your home, especially if you don’t have a yard. Plants like spider plants, snake plants, and pothos are ideal for indoor environments as they are low-maintenance and can thrive in various light conditions. Houseplants help to filter pollutants from the air, increase humidity, and provide a calming aesthetic. They are also beneficial for mental health, offering a sense of tranquility and connection to nature. To care for houseplants, ensure they receive the appropriate amount of light, water them according to their needs, and use eco-friendly potting mixes to promote healthy growth. - Line-Dry Clothes:

Air-drying your clothes instead of using a dryer saves energy and reduces your carbon footprint. On rainy days, using dryer balls in the dryer can help reduce drying time and improve efficiency, further conserving energy.

Committing to sustainable living in Canada is about more than just reducing your environmental impact; it’s about making conscious choices that benefit both the planet and your quality of life. By adopting sustainable building practices and choosing eco-friendly homes, you are actively participating in the preservation of our natural resources and the reduction of harmful emissions. This commitment not only helps protect the environment but also ensures that you enjoy the long-term benefits of a healthier, more efficient living space. Sustainable living is a proactive choice that contributes to the well-being of the planet and fosters a legacy of environmental stewardship for future generations.

Information Referenced From:

https://blog.constellation.com/2020/01/07/ways-to-make-your-house-more-sustainable/

https://earth.org/sustainable-housing/

https://sustainabledesign.com/2602-2-2

https://thegoodhuman.com/container-home-vs-tiny-home/

https://natureloo.ca/our-blog/the-rise-of-off-grid-living-with-composting-toilets

https://theecohub.com/5-canadian-natural-cleaning-products-for-the-eco-conscious-home/

Late Summer Sales: How to Grab Buyers’ Attention in August

This article was reposted from Blue Matter by Jennifer McGuire, Article Here

Listing your home in the late summer might sound daunting. But selling a home in August can be a good strategy, as the market is typically active with buyers motivated to move for the new school year or to settle in before the holidays. Make your property stand out with these easy-to-implement strategies.

Leverage the Longer Summer Days

Longer days mean you have more daylight hours to show your home. Daytime showings allow sunlight to flood your rooms to better highlight architectural details, finishes and flooring. In general, natural light makes spaces appear larger, warmer, and more inviting.

Keep Up the Curb Appeal

First impressions are crucial. You’ll need to be at the top of your outdoor maintenance game. That means grass is always cut, weeds are pulled, and shrubs are trimmed. Other essential tasks include power washing the exterior, cleaning windows, and touching up paint where needed. Work with your real estate agent to understand the best way to bump up your curb appeal within your budget.

Show Off Your Outdoor Spaces

Maybe you have a spacious deck or a thriving garden. It’s worth spending a little time staging these areas to highlight them as extensions of your living space. Be sure these spaces are clean, inviting and free of weeds or debris. Consider adding some outdoor lighting to create ambiance and emphasize features like walkways, trees or sitting areas.

Add Seasonal Touches

Turn up the summertime charm with a few easy touches both outdoors and indoors. Add late-summer blooming plants like asters and mums near your front door. Place fresh, seasonal flowers around your home to add colour and fragrance. Incorporate pillows and throws in late summer colours like deep yellows and oranges. Another appreciated touch: Add a tray of lemonade and glasses to your counter or island for open houses or showings. Lastly, August can get hot and muggy! Keep your air conditioning running at a comfortable temperature so your guests have a distraction-free touring experience.

With a few extra steps, you can capture the magic of summer season and help potential buyers picture themselves relaxing on your deck with a cool drink. Remember these buyers are highly motivated, so make your property the one that shines!

Things to Do in Sarnia, Ontario

Whether you are looking for arts and culture, fine dining, farmers markets or a beach vacation, Sarnia is the place you want to be. Located where the natural azure waters of Lake Huron and the St. Clair River meet, Sarnia has one of the finest waterfronts in Canada, if not the world.

THINGS TO DO/VISIT IN SARNIA:

Pinery Provincial Park:

Pinery Provincial Park in Ontario comes with a beautiful beach, kilometres of rare forests and rolling dunes. It also has one of the highest-ranked sunsets in the world and is a truly breathtaking and unique place.

The park is located along Lake Huron near Grand Bend. Although there are countless scenic spots along Lake Huron, the Pinery has to be one of the most beautiful.

Canatara Beach:

The sandy beach located within Sarnia’s Canatara Park stretches nearly a kilometer along the shore of Lake Huron near the mouth of the St. Clair River. This urban beach has plenty of kid-friendly activities and is close to any urban comforts you might require.

Just how great is this beach? Canatara Beach is one of only 22 in Canada to have earned official Blue Flag status for its commitment to strict water quality and safety criteria.

Rock Glen Conservation Area:

Wind your way through Rock Glen Conservation Area, travelling over wide gravel trails, through Carolinian Forest, over bridges and down long staircases to explore the falls and experience the wonders of this hidden gem!

Imperial Theatre:

Built in 1919, the original Imperial Theatre in Sarnia operated until 1953, when a tornado devastated downtown Sarnia and leveled the theatre’s stage. While the rest of the theatre only suffered minor damage, the damage was too severe to allow the building to remain as a theatre, so the building was converted to office and retail space. The ‘Imperial’ theatre name returned to downtown Sarnia when the Capitol Theatre was renamed the Imperial Oil Centre for the Performing Arts. The Imperial Theatre receives many live concerts every month!

Waterfront Dining In Sarnia Bay:

At Sarnia Bay is where exceptional cuisine, stunning views, and warm hospitality come together for an unforgettable dining experience.

Lake Huron:

With its stunning natural beauty and abundance of recreational opportunities, Lake Huron in Sarnia, Ontario, is a paradise for boating, fishing, and watersports.

Refined Fool Brewing Company:

From humble beginnings using DIY converted maple syrup drums this successful brewery with 3 locations in Sarnia has an very diverse and tasteful beers menu.

Information Referenced From:

https://www.ontariossouthwest.com/on-the-water/beaches/canatara-park/

https://www.blogto.com/travel/2023/07/pinery-provincial-park-ontario/

Coldwell Banker Around the World: Nelson, BC

This article was reposted from Blue Matter by Sam Shalom, Article Here

Picturesque Nelson, BC, is set roughly halfway between Vancouver on Canada’s west coast and Calgary in the Canadian Rockies. Nestled in the Selkirk Mountains and set on the west arm of Kootenay Lake, the city of 11,000 residents is home (and vacation home) to people who love life outdoors in all four seasons. Nelson’s stunning natural architecture is bejewelled by the town itself—its waterfront, some 350 heritage buildings, a restored streetcar, a thriving arts and artisan scene and a rich offering of restaurants and live music.

“It’s a small town, but it’s got a big town feel,” says Kevin Arcuri, co-owner of Coldwell Banker Rosling Real Estate in Nelson. “People are continually amazed with what Nelson, for its size, offers.”

We caught up to Kevin after a showing and got him to talk a little more about Nelson, British Columbia, and what makes it so attractive to the anglers, hikers, single-track bike riders, photographers, skiers, snowshoers, paddle boarders, kayakers, beachcombers, gardeners, wildlife lovers, mountain climbers, artists, artisans, foodies and mountain types who either call it home, or who are counting the days until they can get back.

What’s the feel of the place?

There is a definite lifestyle here. Everybody has to work and has to make a living, but there’s something here called Kootenay Time. If we get 15 centimetres [half a foot, or so] of snow, you’ll experience Kootenay Time. Some businesses will put a sign in their window saying Back at Noon, and they’re away to enjoy the skiing while it’s there to be enjoyed. Everyone understands it. It’s a little quieter here in Nelson. It’s a little more challenging to get to because we’re not on the Trans-Canada Highway, but that’s also what keeps it quaint and feeling the way it does.

What’s a perfect weekend day for you?

Well, of course, I am a realtor, so…. but a perfect day these days would be getting up early and going cross country skiing with my wife or taking a drive along the lake. In the summer, I love to fish, as well. There’s a popular trail out of Nelson called Pulpit Rock that is good in spring, summer, winter and fall. There’s a good growing season here, too, so a perfect day would include some time in my garden. I start my garden in early April and we’re still getting food out of it in October. The garlic will be up in the spring. Tomatoes, onions, peppers, potatoes, carrots, artichokes. You name it, we can pretty much grow it here.

So, sitting at home and watching TV, not so big in Nelson?

Not ideally, not unless there’s a reason for that!

What are the main industries?

Originally, Nelson was a mining town. It has evolved. It has had to re-invent itself from being just an industrial-type town. What they ended up doing was undertaking a heritage revitalization program. They stripped the facades from the original buildings and now Nelson is full of original heritage buildings. We’re not designated as a resort community, but tourism has become a main draw. I hear it from clients from out of town all the time. They’re just amazed at how a small town can have so many high-quality restaurants. I was with some people from California, and they could not say enough about the restaurants and the quality of the food. They were blown away.

What are the major modes of transportation?

Car, definitely. We have great city transit. We have a streetcar that runs along the waterfront. But it’s an active town, too. E-bikes have become huge in Nelson.

What’s a little known but cool fact about Nelson?

I’m not sure if you remember it but there was a movie back in the 1980s called Roxanne, starring Steve Martin and…

Daryl Hannah, yes!

…it was a re-creation of the story of Cyrano de Bergerac, and it was filmed in Nelson around the time of the whole heritage building transition. It’s great to be able to pick out the sites from the movie here at home.

Is Nelson affordable?

When I started in the business 16 years ago, the average sale price was, probably, you could find a house for $250,000 (CAD). That’s your average three- or four-bedroom, 2,000 to 3,000-square foot house on a 6,000 square-foot lot. Now, we’re taking $600,000-plus. So, things have changed. But we still are more affordable than many of the mountain towns that Nelson gets compared to, including Fernie, Revelstoke, Squamish or Whistler. Nelson has very little vacancy as far as rentals go. We’re always below one percent there and it’s been that way for years.

What do you want people to know about Nelson?

It is worth checking out, for sure. I can’t tell you how many times I’ve heard from real estate clients that there is just something about this place. Everybody is friendly. The food is great. It’s got a low-pressure vibe. I’ll go back to what I’ve said before: it’s the lifestyle.

Territory summary

Nelson is in the Selkirk Mountains on the west arm of Kootenay Lake in the Southern Interior of British Columbia. Along with Castlegar and Trail, Nelson forms the population and commercial core of the West Kootenay region.

Key Facts

- Population (2016): 10,664 (area 25,000)

- Population change 2011-2016: + 3.1%

- Total private dwellings: 5,106

- Age cohort percentage: 0-14 (15.1%), 25-54 (41.2%), 65+ (18.7%)

- Major language spoken: English

- Currency: CAD

Industry Facts

- Median list price of homes in Nelson, January 2024 ($604,308). Source: Houseful

Follow Coldwell Banker Rosling Real Estate on social media!

Coldwell Banker Brand Announces Q1 Achievements

Coldwell Banker Real Estate Continues to Expand Horizons Globally and Maintains Strong Partnerships Domestically

This article was reposted from Blue Matter by Sam Shalom, Article Here

In the dynamic world of real estate, the Coldwell Banker® brand has been making waves across borders. The first quarter of 2024 witnessed remarkable achievements, both internationally and domestically. Let’s dive into the details:

Domestic Triumphs

$61 Million in GCI Retained: At home, the Coldwell Banker brand retained an impressive $61 million USD in Gross Commission Income (GCI) across 16 companies. This achievement underscores the brand’s commitment to excellence and strong partnerships in key markets.

Global Markets Flourish

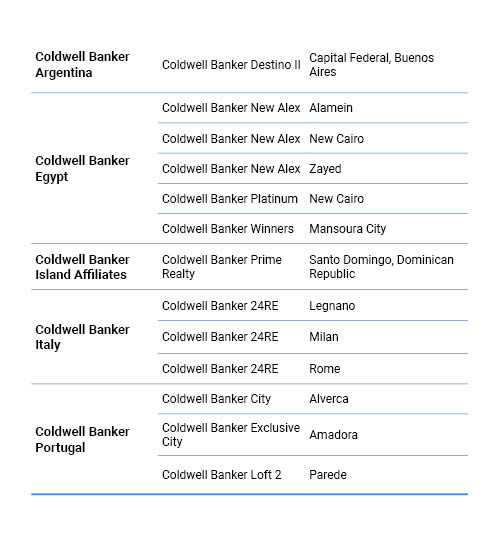

35 New Offices Worldwide: the Coldwell Banker brand’s global footprint expanded significantly with the opening of 35 new offices across 10 countries. From bustling city centers to serene coastal towns, our brand is making its mark in diverse locations. Some of the highlights include:

- Coldwell Banker Egypt leading expansion efforts by adding eight new locations, across New Cairo, Mansoura City, and Zayed among other locations.

- Coldwell Banker Turkey affiliated seven new companies to maintain their number one position as the largest network outside of the United States.

- Coldwell Banker France & Monaco opened its first office in Marseille, the oldest city in France with second largest population, after Paris.

- Coldwell Banker Spain & Andorra opened an office on the prestigious Golden Mile in Marbella, a luxury enclave for Europe’s elite. Additionally, Coldwell Banker Unique opened in the Barrio Salamanca neighborhood in Madrid, the capital of Spain and key real estate market.

- Coldwell Banker Italy and Coldwell Banker Mexico opened four new locations each, while Coldwell Banker Portugal and Coldwell Banker Argentina added three apiece.

COLDWELL BANKER INTERNATIONAL WELCOMED THE FOLLOWING NEW COMPANIES IN Q1 2024:

Additionally, the brand welcomed the following 14 offices to existing international companies:

COLDWELL BANKER INTERNATIONAL

About Coldwell Banker Canada: Founded in 1906, the Coldwell Banker brand is the most established residential real estate franchise system in North America. Fast forward over 100 years and the Coldwell Banker network is one of the most trusted in the world, with a global presence across over 40 countries and territories worldwide. The Coldwell Banker brand made its way to Canada in 1989 and has since gained a legacy of serving the real estate needs of Canadians from coast to coast for over 30 years. Since being acquired in 2021 by Canadian entrepreneurs Steve Houle and Karim Kennedy, the company strives to grow the brand’s presence on a national level. Coldwell Banker Canada is ready to make their mark in the Canadian Real Estate Market and transform the industry along the way.

Real Estate Spring 2024 – Buckle Up

This article is a Guest Post by Chris Perkins, Broker/Owner, Coldwell Banker Maritime Realty in Halifax, NS.

Our office had the senior economic analyst from the Canadian Real Estate Association speak to us this week, and his message was clear: “Buckle up.” In a captivating and somewhat terrifying 45-minute presentation on the Canadian real estate market, he predicted a surge in activity as people, previously held back by high interest rates, get ready to jump on opportunities when Spring listings hit the market. While we haven’t seen the expected influx of listings yet, things are delicately poised, with homeowners gearing up for the busiest time of the year.

HRM Snapshot: Over the past 24 months, Spring has consistently seen home sale prices that were 10-15% higher than in Winter.

Where are prices going?

For those hoping for a drop in real estate prices, the outlook is not promising. Rising interest rates created intense pressure in the rental market. With a vacancy rate of less than 1%, the expensive rental rates are prompting people to consider buying again. Those entering the real estate market are likely to encounter far more competition than in recent times.

Why is there a housing supply shortage?

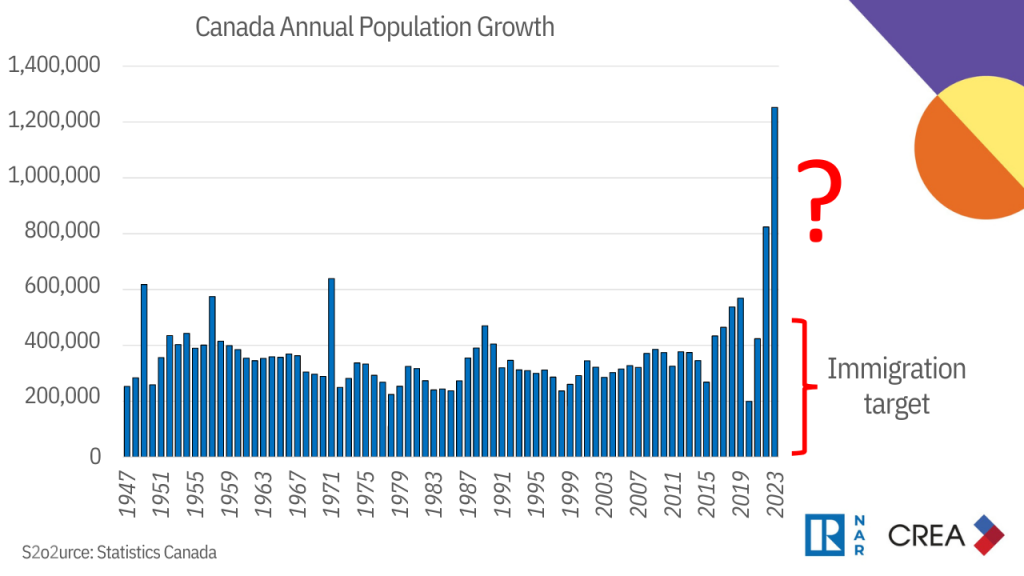

In 2023, Canada’s population grew by a staggering 1.2 million, surpassing the government’s target by 800,000. The pressing question: Where will these people live?

To meet rising demand, the government sees the need to construct 3.5 million homes, equivalent to 830,000 annually by 2030. Currently, we are only building 250,000 units so it seems completely impossible to meet that goal. On top of that, construction cranes dominating our skylines are not addressing the right housing needs – apartments vs single family. I own a wiener dog who I love dearly, but he barks at everything. The last place I want to be is in an elevator with him.

What about locally?

Looking at the local market in HRM (Halifax Regional Municipality), there’s a similar story to the rest of Canada. The influx of individuals from other countries and inter-provincial migration is creating significant pressure on housing in Halifax. As of now, the average price of a home is $575,000, marking an 8% increase from the last year. With just two months of housing supply (A Seller’s Market), there are only 750 homes on the market in an area with a population approaching half a million.

So, how do I navigate this?

For those thinking about their next steps, selling a home in this competitive environment allows you to leverage the demand to maximize property value. If upgrading is in your plans, the greater competition in lower price brackets allows you to sell at a premium while retaining negotiating power in higher brackets. However, first-time homebuyers have a tough task. I would recommend getting on the ladder, even if that means making concessions on your needs/wants list. What seems expensive now is likely to be even more so in the years to come. Once you own, you’ll benefit from rising prices by way of building value in your home, rather than chasing a market that could soon be out of reach.

Considering a move?

Contact Chris Perkins for expert guidance in navigating the complexities of the current real estate landscape. He will be with you every step of the way, ensuring you successfully achieve your real estate goals.

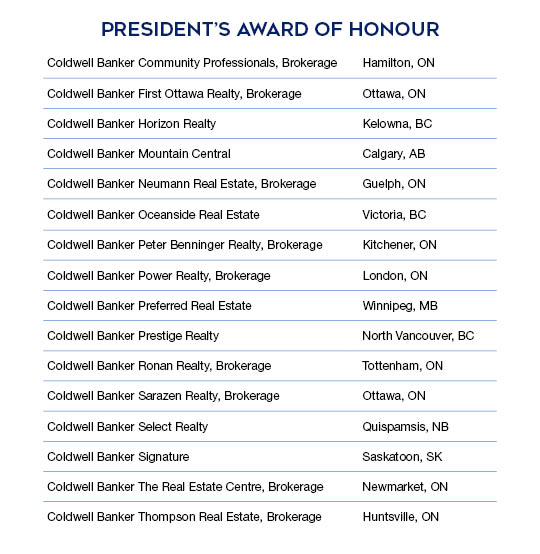

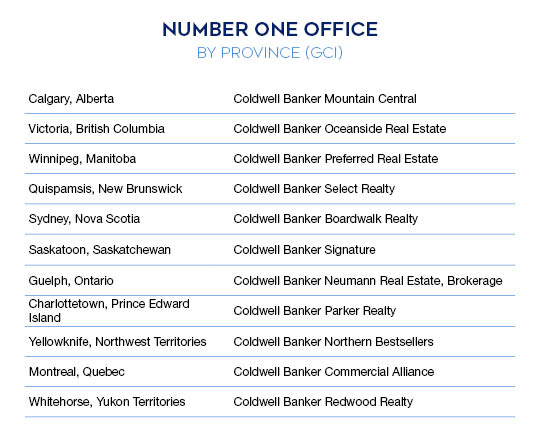

Coldwell Banker Canada Announces 2023 Winners in Annual Year-End Real Estate Awards

The most productive, the most inspiring and the most helpful people in the Coldwell Banker Canada real estate network are being celebrated as real estate awards season wraps up after another productive, inspiring and helpful year.

“In our full-service brokerages across the country, we share one goal, which is to guide clients to the homes of their dreams,” said Karim Kennedy, CEO of Coldwell Banker Canada.

“Our brokerages are where agents use their passion and experience—along with top-level training, support and technology—to make those dreams happen. We are proud of their work and the example of excellence they set. Congratulations to all!”

Here’s a selection of the big winners:

Rookie Of The Year Award

The Rookie Of The Year, for both GCI and Units Sold, was Sarah Vidalin of Coldwell Banker Oceanside Real Estate.

Vidalin credited her well-known land developer father for her work ethic, realtor Eric Smith for his encouragement and brokerage colleagues for their friendship and support.

“Coldwell Banker was the only place where everyone was welcoming,” Vidalin said.

Canadian Pillar of Support Award

New this year was the Canadian Pillar of Support Award, recognizing an individual who demonstrated exceptional proficiency, dedication and effectiveness in administrative support.

Typical of the small mountain of nomination testimonials in support of Ellen Rahm of R.M.R. Real Estate, Brokerage, in Whitby, ON, was this tribute from a colleague:

“Ellen does everything for our office! Everything is an understatement. She makes the world go round at Coldwell Banker R.M.R. She supports all our agents in a way that I have never experienced working at other brokerages. She is always available to help. She always answers her phone when we call, and she does everything to her best ability to make our agents’ lives as easy and stress-free as possible. Ellen is truly one of a kind and we are so lucky to have her.”

Canadian Ambassador Award

Bianca Myddleton, Broker-Owner of Coldwell Banker Marquise Realty in Surrey, BC, won the coveted Canadian Ambassador Award, which is given to the talented and dedicated person in the network who proactively seeks to represent the best attributes of Coldwell Banker global brand.

Said CEO Kennedy: “She was celebrated for the professionalism in her office and her staff as well as for advocating for professionalism in the industry in the Fraser Valley. Bianca has also been a leading charitable force behind the annual Coldwell Banker Marquise Diaper Drive, which helps young families in need.”

Myddleton (middle) at the annual Coldwell Banker Marquise Diaper Drive.

Coldwell Banker Mountain Central Realty’s full-service brokerage comes home to Edmonton

To the list of things you might have heard about Edmonton—Gretzky played there back then, McDavid does now, it’s got a big mall, it’s cold in the winter, it’s got a lot of festivals, it gets a lot of sunlight, like, a lot—Rob Vanovermeire adds one more thing: real estate.

“People are recognizing that out of all the major cities in Canada, Edmonton is the best deal, it’s the best value,” says Vanovermeire, Broker-Owner of Coldwell Banker Mountain Central Realty.

“There’s no city in Canada better for value in real estate than Edmonton right now,” he says. “That will become increasingly apparent this year. I think we’re going to see more and more people looking to Edmonton to invest.”

Growing

The Edmonton-born, -raised, -schooled (and now Calgary-based) Vanovermeire walks the walk. He has just completed a successful merger with Coldwell Banker Venture Realty in Edmonton.

“We are growing,” says Vanovermeire. “As we grow, we get more resources to do bigger and better things with technology and marketing, which will give the agents the support, the training and the systems they need for their businesses to grow in this growing market.”

The merger more than doubles the size Coldwell Banker Mountain Central agents in the Alberta capital. The bricks-and-mortar site for the combined operation will be its Edmonton headquarters on 156 St. near Stony Plain Rd.

Vanovermeire: “People are recognizing that out of all the major cities in Canada, Edmonton is the best deal.”

Edmonton by the numbers

Vanovermeire’s bullish take on Edmonton has some statistical backing.

According to a recent forecast from the Canadian Real Estate Association (CREA), Alberta is the only province in Western Canada where expected gains in the average home price (6.3%) will exceed the national rate of 2.3%. Alberta (11%), Ontario (13.9%) and Nova Scotia (13.2%) are the only provinces where the forecast change in residential sales in 2024 will top the national average (10.4%).

According to CREA’s updated 2024 forecast, “the bigger sales gains in 2024 are expected to come from provinces where housing demand is strong, Alberta in particular, along with provinces that are expected to see a rebound from historically low sales volumes—British Columbia, Ontario, Nova Scotia.”

Here are some Edmonton-specific statistics from CREA:

$380,400 – Edmonton’s MLS® Home Price Index Benchmark Price, seasonally adjusted, December 2023

$568,000 – Calgary’s

$1,094,000 – Greater Toronto’s

$528,700 – Halifax-Dartmouth’s

6.2% – month-over-month rise in home sales activity in Edmonton between November and December 2023

3.7% – month-over-month increase in new residential listings in Edmonton between November and December 2023

5 – number out of 26 primary MLS® zones with a positive monthly change in number of new listings between November and December 2023

The lead, the realtor

Vanovermeire is clear when it comes to what he’s looking for in an agent to work in the Edmonton market.

“I am looking for agents either experienced or new to the industry who are committed to representing clients and our company the right way,” he says. “We especially look for people who have the desire to learn and embrace the technology that we have available to us.”

Vanovermeire views himself as a link in a tradition of realtors who have built successful careers and who share their learnings.

“I had a few fantastic mentors and coaches and one of the most powerful things I learned was how to convert real estate inquiries into an actual client,” he says.

“A lot of realtors generate leads but struggle with converting them to clients. We live in the information age. People want information before moving forward, but, at some point, they need our expertise, which requires meeting in person. Many agents have challenges moving from offering information to getting hired with a signed contract. We teach realtors how to turn inquiries into signed agreements with clients.”

Vanovermeire: “I am looking for agents either experienced or not as experienced, but who have the desire to do it right, the desire to learn, people who are reachable and who will really embracee verything that we have available to us.”

Hometown advantage

Vanovermeire adds one more item to his list of the good things about Coldwell Banker Mountain Central’s growing presence in Edmonton: the hometown advantage.

“In addition to the systems and the training that Edmonton agents benefit from, there’s the fact that I’m from Edmonton. It’s my hometown. It’s near and dear to me. I’m from here. I can relate.”

Editor’s note: the photo at the top of the post shows Rob Vanovermeire (back row, third from left) next to Karim Kennedy, CEO, Coldwell Banker Canada, at the former Coldwell Banker Venture Realty, now Coldwell Banker Mountain Central, office in Edmonton. Reach out here. BTW, Edmonton gets up to 17 hours of sunlight a day in summer!

Coldwell Banker Maritime celebrates big deal that brings Halifax real estate veteran on board

Collaboration between pillars of Coldwell Banker’s Nova Scotia brokerage scene builds for future success of agents and clients

Halifax, NS – January 9, 2024 – It is official, and it is big news: After 27 years at the helm of Coldwell Banker Supercity Realty, Broker-Owner Mariana Cowan has joined forces with Coldwell Banker Maritime Realty.

“To start the New Year, this is wonderful news for our company, for our agents and for the home buyers and sellers in this market,” said Chris Perkins, Broker-Owner of Coldwell Banker Maritime Realty. “Mariana Cowan has decades of experience that is relevant to the people in the market right now,” he said. “Simply put, she’s a powerhouse.”

The move, which was finalized on Dec 28, 2023, means 11 agents and a number of new recruits now join Coldwell Banker Maritime Realty, which opened its doors in June 2023.

Cowan, who will continue to work as a realtor, called the new arrangement “a perfect coming together of two ways of looking at the important work that a full-service brokerage does.”

Said Cowan: “This is so exciting because it’s so complementary. They have systems and a support structure that can easily be utilized with what we do. Chris is so savvy and is such a good listener. He really respects the experience and the knowledge of people I have built up over the years.”

Cowan said the move now frees up time to do even more to help aspiring agents attracted to Coldwell Banker for its commitment to learning, training and support. “I’ll now have the time to coach and mentor and that’s important because I truly believe that we have to get back to basics and really show the importance of relationship building,” she said. “Technology is wonderful, but there is a lot to be learned and re-learned about doing things in person.”

Perkins said the coming-together is perfectly timed for an expected rebound in the local real estate market in 2024. “The goal here is to bring our talented agents together and equip them with what they need to know about the marketplace in the months ahead,” said Perkins. “That’s the equation of Coldwell Banker Maritime Realty: deliver the tools and training and information to our agents so they can help deliver dreams for our clients.”

About Mariana Cowan and Chris Perkins:

On the strength of almost 40 years in the business, multiple professional accreditations, a deep commitment to community and an abiding interest in furthering the cause of women leaders in real estate, Mariana Cowan has been described as The First Lady of Halifax Real Estate. She is an award-winning realtor, educator and public speaker. “What do agents need now to get them to their true potential? That’s what motivates me.”

Chris Perkins is pictured here with wife and business partner Joelle along with their dachshund, Dwayne. The couple have lived in the Nova Scotia capital since 2018, two years after getting married on a trip to Halifax. Chris has been working in the real estate industry since 2007 and ranked internationally in the top 1% of agents for Coldwell Banker. He was recognized by Coldwell Banker International as a recipient of the Top 30 Under 30 award – a result of his commitment to service and to the best interests of his clients. Chris serves his clients with an informative, easy-to-read and provocative blog. Here’s his take on the performance the Halifax-area real estate market in 2023 and what’s ahead in 2024.

To contact or set up interviews on the current Halifax real estate market:

Mariana Cowan, Coldwell Banker Maritime Realty, 902-452-1639

Chris Perkins, Coldwell Banker Maritime Realty, 902-210-1223

Each office is independently owned and operated.

Coldwell Banker Electric Realty, Brokerage Switches on in Peterborough

One hundred and forty years and two blocks away from the newly renovated offices of Coldwell Banker Electric Realty, Brokerage in Peterborough, Ontario, the first electric streetlights in Canada were lit.

Brilliantly, Ian Marshall has channeled that piece of history into the name of his new real estate brokerage: Coldwell Banker Electric Realty.

“Peterborough is commonly referred to as Electric City and I wanted to make sure that the brokerage from day one was deeply rooted in the local feel of our city,” said Marshall.

“We knew immediately that the real estate brokerage that will serve this community was going to be called Electric.”

Ian Marshall, President & Broker of Record, Coldwell Banker Electric, Peterborough, ON.

Location, location, vocation

Marshall recalled the day 12 years ago when a switch went off and his future in real estate came into view. He was selling his house nearby and was in the market for a new one. The process—the details, the dreams—grabbed his attention.

“It was so intriguing to watch the agent I was working with at the time do his job —all the stuff behind the scenes, the paperwork, the conversations, the staging of the house,” Marshall said.

“I already enjoyed watching real estate shows on HGTV,” he said. “So, when I got to experience it myself on the client side, I said to myself, I can definitely do this!”

Inner voice

That inner voice that said “I can do this” has been a faithful navigator in Marshall’s life. It has reassured him that dropping out of high school was a beginning and not just an ending.

“High school was difficult for me, and I knew to survive I needed to blaze my own trail,” he said. “Leaving high school early is certainly not a path for everybody because you have to work incredibly hard to overcome the difficulties that come without that diploma, but I’ve been able to make it. Life has been my teacher.”

That inner voice has expected things of him.

“Leaving school at age 15, means a person grows up overnight,” Marshall said. “You instantly have to become an adult, get to work and figure out how life works.”

That voice has told him to keep going.

“I worked overnights in fast food straight out of high school,” he said. “I’ve done sales, telemarketing, network marketing, sold door-to-door. I’ve done over-the-phone tech support, worked in search engine optimization, supported executives, managed commercial properties and started a commercial and residential cleaning company.”

That voice has taught him to see people in everything he did.

Marshall’s maxim: “Every dollar our agents pay us, we want our agents to feel that dollar reciprocated.”

“In my opinion, the backbone to any sales relationship is understanding people and understanding what they really need and what they really want,” Marshall said.

“That means understanding, especially in our line of work, that purchases made today have the potential to impact the course of one’s life in a great way. To be a small part of that journey is amazing.”

And that voice has reminded him to trust himself.

“I never say good luck. I don’t believe in luck. I believe in hard work. I believe that everybody has the same opportunities. We all get the same 24 hours in a day, it’s what we do with that time that makes us ‘lucky.’”

“I’ve done a lot of things,” says Marshall, here in front of a first listing in Pickering, ON, in 2016, “but my passion has always been real estate.”

The road home to Coldwell Banker

In 2014, it was time for real estate for Ian Marshall.

Marshall studied for and got his license and then joined a boutique brokerage. He quickly realized he needed the training and support offered by a brand.

He joined a family-owned RE/MAX brokerage, found a mentor, thrived and loved it there until it was swallowed up by a “conglomerate-type brokerage.”

The feeling of the place changed almost overnight, he said. It was a good time for a change. He spent a few years trying to find a brokerage that felt like home.

He was convinced he could build a brokerage where agents received real value for the real contributions they made.

Reciprocal value at Coldwell Banker

“There are definitely some brokerages that do an amazing job providing value to their people, but there are many brokerages where agents get to the point that they’re seeing expenses off their commissions cheques and they find themselves asking, ‘What is this brokerage providing me that equates to this expense? What’s the value for both of us?’” he said.

Those questions led Marshall to investigate franchising options. At first, Coldwell Banker Canada wasn’t on his radar. Then, he said, he saw all the good things happening with the company, including the master franchise being acquired and its connection to Coldwell Banker’s global branding. Marshall went for lunch with Paul Abbott.

He shared his vision. It was, he quickly learned, a shared vision.

“He was just a fantastic guy to deal with and extremely generous,” said Marshall of Abbott, Coldwell Banker Canada’s Vice President, Franchise Development, in Ontario.

“He talked about the great things Coldwell Banker Canada is doing to provide value to their both their agents and their Broker-Owners, shared key parts of the franchise agreement that clicked perfectly and showed us the amazing branding and marketing materials Coldwell Banker offers. We left that meeting realizing just how much sense it made to partner with Coldwell Banker.”

Paul Abbott, fourth from right, and Ian Marshall, second from right, joined Coldwell Banker Canada CEO Karim Kennedy, centre, and Coldwell Banker Broker-Owner colleagues, Oakville, ON, December 2023.

Value for agents

Marshall came away convinced that his dream of a brokerage built on reciprocal value could be made real at Coldwell Banker.

“That is going to be part of Coldwell Banker Electric,” Marshall said.

“Every dollar our agents pay us, we want our agents to feel that dollar reciprocated. We want our agents to feel that this is a place where they are getting what they pay for and to never question whether their relationship with us is valuable or not—because it always will be.”

For Abbott, the stage is now set for Marshall’s innate leadership skills to do what innate leadership skills do: attract talented agents.

“With Ian Marshall at the wheel, Coldwell Banker has added to our team another sharp, experienced, passionate leader who understands real estate and understands people,” said Abbott. “The future is bright for Coldwell Banker Electric.”

Recruits

Coldwell Banker Electric will open the doors to its newly renovated 6,000 square-foot headquarters on historic George Street in late January 2024.

“It’s a great location,” Marshall said.

“There’s tons of foot traffic and a lot of history with our building. For many years, the building was known for being the home to Copperfields Restaurant & Bar and then to The Protectors Group. Before that it wore several hats but was originally built as a Loblaws in the early 1950s, it then burned down, and was rebuilt. Like me, it’s done a lot of work.”

Marshall said he’s ready for the good work ahead.

“We are going to hit the ground running with our recruiting efforts to attract the best of best agents here in Peterborough,” he said.

Who has the makings of a Coldwell Banker Electric agent?

“We want our culture to be that of productive agents,” Marshall said. “We’re looking for people who aren’t afraid of hard work and are eager to learn and grow. Maybe they haven’t had a ton of success where they are. Maybe they are new, maybe they’re in a slump. Maybe they are just looking for a change. But the makings of our agents will be that they’re hungry and humble and good people who realize everybody has their own story to tell.”

Marshall, fiancé Jeff and daughter Charlotte, Christmas 2023

Strong market

Marshall said the real estate market in Peterborough has always been strong and that the prospect of relief on interest rates suggests good things ahead in 2024.

“I am so excited to bring Coldwell Banker Electric to Peterborough and start sharing our vision and our passion with the agents, the great agents of Peterborough, and show them why Coldwell Banker Electric is the brokerage to partner with here in town.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link