Coldwell Banker Vision Realty Changes Hands, Builds Future From Strong Past

Ray Cavin, the new Broker-Owner of Coldwell Banker Vision Realty would prefer that this story start with something about Rick Cowling, who is the previous owner of the Coldwell Banker Vision Realty brokerage.

For his part, Rick Cowling would prefer that the story begin with something about Ray Cavin.

How to get around this impasse of politeness and get to the big announcement?

We’ll pass the mic to Rick’s wife, Shauna, for just a second.

“Those two get in this cycle of ‘Thank you, no, thank you, thank you very much for the opportunity, no, thank you for running the business and looking after it while I was on vacation, no, thank you for this, no, thank you for that,’” Shauna Cowling laughed.

“I feel like saying, why don’t you both say you’re welcome and then we can move on, right?!”

Unusual in today’s world

That little window into the genial and respectful professional relationship of “those two” starts to explain how Cowling and Cavin were able to pull off a smooth and uneventful business succession—including the sale of a new 6,000 square foot commercial building—ensuring a new chapter of growth for Coldwell Banker Vision Realty in Olds, AB.

Cavin described the secret of the working partnership.

“When both sides believe that you are taking out more than you are putting in, that relationship is always going to work,” he said. “I think that marriages, business relationships, friendships and partnerships die when we believe that we’re putting in more than we’re receiving.”

Cowling didn’t disagree about the taking-out-more-than-you-put-in equation: “Yeah, we laugh about that little saying all the time,” he said. “Ray started with me 10 years ago. We had our tenth anniversary here a couple of weeks ago. It’s really unusual in today’s world to find someone with such a similar character and beliefs and work ethic. It grabs you, actually.”

Cowling was formed by a life outdoors in the foothills of the Rocky Mountains.

Cowboy to Coldwell Banker

Now semi-retired, Rick Cowling is 66 years into a very Alberta life.

He grew up in the foothills of the Rocky Mountains on a farm near the village of Longview, AB. That’s where he studied economics.

“Growing up on a farm meant working with your hands, feeding the chickens and the pigs and the cattle, growing the grain, seeing how every dollar came in,” he said. “Just working side by side with my dad—my mom and my dad.”

In the mid-1970s, Cowling worked as a cowboy at the famed Bar U Ranch, which is now preserved as a national historic site in southern Alberta.

The family farm was sold when he was a teenager (“It broke my heart, but my dad always said his selling the farm was the best decision for me.”) The family moved to High River. Rick and Shauna married young, moved to Calgary, welcomed three children and then moved to Edmonton to get university degrees.

“We did things the hard way—university after children,” Cowling laughed. “Did I mention that I grew up on a farm?”

Saddling up for a trail ride.

Fast forward through a move back to southern Alberta … work as a teacher … time spent running a flooring company (where Cavin first worked for him) … a stint operating a home-building firm … and up to Cowling’s decision to go into real estate.

“We researched all the brands and Coldwell Banker always floated to the top,” Cowling said.

Cowling was the brokerage owner. Cavin became Broker of Record. They settled on “Vision” as the name of the brokerage in part to convey that they could be trusted with clients’ pictures of their futures.

Said Cavin: “We are not moving units around. It is relational. It’s not just transactional. This isn’t a ‘sale’ as much as it is a story of someone upsizing because they had a baby. Or downsizing because the kids have moved out, and so on.”

Out of the chute, the vision for Coldwell Banker Vision Realty was to grow the business to eight agents and to construct a new building with highway exposure within five years. They have reached and exceeded those goals.

“Our goal now is to become the largest local brokerage in our area—and not by a little,” Cavin said. “Our goal is to have an overwhelming market share.”

Ray Cavin, Broker-Owner, Coldwell Banker Vision Realty

What Coldwell Banker Vision agents can expect

To help get the brokerage there, a special kind of real estate agent and a special kind of support for that agent are needed.

“We are very selective, and we don’t take every agent,” Cavin said.

“The agents who do join us experience a brokerage where their business goals and personal dreams are met with unwavering support. When they grow professionally and personally, they are able to provide exceptional support to their clients.”

Said Cowling: “Trust is the most important word in real estate. You have to surround yourself with people you trust. People who have that family feel. People who you can rely on.”

Come on, really?

Really, Cavin said, that is the culture of the place.

The commitment to maintaining that culture has informed a unique hiring practice. A prospective agent is interviewed by Cowling and Cavin and then there’s a bit of twist.

“Rick and I would discuss it and then if the person passed that first test, and we made this clear to them, our next step would be to take it to a general meeting and discuss it with the agents,” he said. “The decision isn’t made by popular vote but by genuine conversation, and we’ve had some real conversations.”

Guiding those conversations is the principle of people over profit.

“There might be times where we make the decision that the net profit to this agent coming on isn’t going to be worth the disruption to the system,” Cavin said.

Cowling with grandson Zac and Shetland pony Aurora in the acreage riding arena. (Great grandma is in the background.)

Coldwell Banker Vision Realty

Cavin said he’s ready to take the next step and guide that system.

“I’ve had such a great mentor, so I’ve had it pretty easy,” he said. “Rick always said run this like you own it.”

Now, officially, he does.

For Cowling, the passing of the torch means a chance to devote more time to family life on the acreage, even though he intends to keep doing real estate on the side. He’ll have more time for trail rides into the beloved Rocky Mountains. And time, too, to glance back on the path that has gotten him and Coldwell Banker Vision Realty to where it is.

“I am happy about what we’ve built,” Cowling said. “We have a group of really good realtors who work in a really good environment. We’ve got a brand-new building. We’re always pushing ourselves to be better.”

Go figure, Cavin said much the same thing.

“When you share a vision, you know where you are going,” he said. “You know when you get there. And you get there together.”

Cowling alongside mother, Irene, driving Norwegian fjord brothers.

Note: Blog cover image at top shows Rick Cowling, left, and Ray Cavin as they seal with a handshake the change of ownership of Coldwell Banker Vision Realty in Olds, AB.

2023 Christmas Tree Trends

Christmas tree decorating season is here. It can be a daunting time of year. You’re short of money. You’re short of time. You’re short of inspiration.

Search “Christmas tree decorations” and your task gets a little more intimidating. You are seemingly up against decorating pros with lots of space, lots of time and lots of budget. Not to mention an eye for lighting and Instagram framing.

Here’s the good news: Charlie Brown.

There is a scene in A Charlie Brown Christmas where Chuck and Linus are sent by Lucy to find a glitzy, glamorous, modern tree for the school play. What they come back with is a small, thin, sad sapling barely able to hold a single ornament. But they stay with it.

Moral of the story: listen to what others have to say, sure, but when it comes to making things more beautiful at this time of year, remember that beauty is in the eye of the tree-holder. That’s you.

Going from your own version of “not so beautiful” to “a little beautiful” or from “a little beautiful” to “a little more beautiful” is more important than arriving at someone else’s pre-packaged definition of a beautiful tree.

With Charlie Brown Rules in effect, here are some Christmas tree trends that we’re seeing out there this year.

Source: Tidbits & Company

1. Go Natural

In a season of runaway advertising and pressure to consume, a sparse tree stands as a reminder to make room for the important things of life, including moderation. The attractiveness of a deliberately underdone tree is enhanced by the hands-on method of decorating it. Head outside to gather pinecones. Use dehydrated apples, cranberries and oranges. String together a good old-fashioned popcorn garland.

Source: The Merrythought

2. Choose Simple & Minimal

By its very presence, a minimal tree decorated in tasteful tones delivers the quiet joy and calm we search for at this time of year. Warm string lights, a wood bead garland and white clay ornaments work harmoniously to deliver tranquility. Baking your own clay ornaments printed with unique designs (constellations are a favourite) is a fun tradition to start with the little ones.

Source: Good Housekeeping

3. Or go Barbie!

Barbie, it’s been quite a year! Single (plastic) handedly, the 11½-inch-tall pop cultural icon, brought to life on the big screen by Margot Robbie, has infused our lives with pink. This year, it is not going out on a limb to think pink—pink ornaments, pink baubles, pink glitter and pink feathers, bows and ribbons. Red and green will still be there next year.

Source: @chelseazeferina

4. See Friendships Come Sailing In!

Make the friendship bracelets/ Take the moment and taste it, sang Taylor Swift in “You’re On Your Own, Kid.” Swifties obliged, making friendship bracelets a thing in socials and at Eras concerts this year. Some glue, lettering, foam pucks, and string are all you need to bring Taylor home for the holiday.

Source: Good Housekeeping

5. Mood Change

Home interiors are trending darker and moodier in palette. So are Christmas trees. Burgundies, burnt oranges, dark greens (olive, hunter, and Castleton), and even blacks are taking the place of classic reds and greens. This might be the right tone for the season.

Source: Handmade Farmhouse

6. Gold and Silver

Ever since the Irish poet W. B. Yeats decorated and painted eternity with “the silver apples of the moon and the golden apples of the sun,” people have found it mesmerizing to combine the sophisticated colours for special occasions. Gold and silver combine to form a kind of shimmering and icy purity.

Source: Domestically Blissful

7. Snow

One of the many cool things about a spruce tree is how it’s built to live with snow. Its needles offer less surface area for snow and ice to hang onto. Its cone shape means the weight of the snow is spread out near the base and not, like a deciduous tree, in the canopy. Also, snow collected on lower branches has a shorter journey to water the roots in spring. All of this makes a case for using fake snow to celebrate the real cleverness of the spruce tree at this time of year—indoors!

Source: Liz Marie Blog

8. Paper Tree

Short of floorspace? Got a length of rope and some loose pages from an old book? Then you’re all set. Why not fashion a wall tree that also pays tribute to the trees from which our books come to life? It’s also a reminder that the gift of a book for Christmas is all your favourite bookworm ever needs.

Source: Amazon.ca

9. Peanuts

The final word goes to Linus Van Pelt in A Charlie Brown Christmas:

“I never thought it was such a such a bad little tree,” said Linus. “It’s not bad at all, really. Maybe it just needs a little love.”

In the spirit of the season, happy decorating to all!

Sources

https://www.goodhousekeeping.com/holidays/christmas-ideas/

https://abeautifulmess.com/make-your-own-clay-ornaments/

https://treecanada.ca/article/how-trees-survive-in-winter/

https://www.lizmarieblog.com/2014/12/25-amazing-christmas-trees-one-everyones-style/

https://www.amazon.ca/ProductWorks-Peanuts-Charlie-Christmas-Blanket/dp/B01E7AIN2A?th=1

Coldwell Banker Complete Real Estate Joins Forces with Coldwell Banker Mountain Central in Calgary

Combined operation of industry leaders adds 11 real estate professionals and years of client satisfaction in Calgary market.

Calgary, AB – December 7, 2023 – Coldwell Banker Mountain Central and Coldwell Banker Complete Real Estate have today announced the finalization of a strategic merger born of a shared commitment to service, innovation and excellence in the Calgary real estate market.

The move means Coldwell Banker Mountain Central, led by Broker-Owner Rob Vanovermeire, adds 11 new associates from Coldwell Banker Complete Real Estate, including Broker-Owner Susanita de Diego, who is also a Director and Chair-Elect of the Calgary Real Estate Board.

“We share a deep knowledge of the unique Calgary market, a deep passion for the Coldwell Banker brand and a true commitment to being the ideal choice for real estate professionals looking for the support of a full-service brokerage,” said Vanovermeire and de Diego in a shared statement.

The decision to close her successful brokerage, de Diego said, and unite with Coldwell Banker Mountain Central was the best way forward to serve clients and colleagues, and to balance her work, volunteer and family life.

“Our vision from the very beginning back in 2006 was clear,” de Diego said.

“It was to create a nurturing and empowering home for high-performing REALTORS® who shared the common goal of providing unparalleled professional services to their valued clients. That commitment led us to excel in various real estate specialties, including luxury properties, country residential, condominiums, international real estate and specialized services for seniors.”

Over the years, Coldwell Banker Complete Real Estate not only met but exceeded its goals, continually raising the bar for real estate services. The brokerage and its teams earned numerous awards, including Canadian Top 10 Team Awards, highlighting their consistent, outstanding performance in the real estate industry.

In 2022 Coldwell Banker Complete Real Estate proudly claimed the title of number one real estate company in Canada in their size category.

“That recognition was a testament to our unwavering commitment to excellence and dedication to serving clients at the highest level,” said de Diego.

“That is the same commitment to excellence that everyone can expect as we now work collaboratively with a specialized group of real estate advisors under the Coldwell Banker Mountain Central banner,” she said. She added a “heartfelt thanks” from the team at Coldwell Banker Complete Real Estate for the support of clients, partners and the community over the years.

“We look forward to many more years of success and growth, serving clients with the same passion and dedication that have been our hallmark since day one,” said de Diego.

About Susanita de Diego and Rob Vanovermeire:

Susanita de Diego is a highly accomplished REALTOR® with a career spanning more than three decades. She began her real estate journey in Vancouver, BC, in 1987, and has consistently maintained her status as a top-producing professional.

Her dedication to her clients and her significant contributions to the Calgary Real Estate Board have solidified her reputation as a leader in the industry. She is excited to embark on the next phase of her career as part of the Coldwell Banker Mountain Central team.

Rob Vanovermeire, a significant figure in the Calgary real estate industry since 1999, established his real estate brokerage in 2008 and began implementing the marketing techniques he was teaching in his courses with the Alberta Real Estate Association, Mount Royal University and the Calgary Real Estate Board. In 2014 he joined the Coldwell Banker network and has expanded the brokerage to more than 70 full–time agents and to include a property management division.

To contact or set up interviews on the current Calgary real estate market:

Susanita de Diego, Coldwell Banker Mountain Central, 403-630-3390

Rob Vanovermeire, Coldwell Banker Mountain Central, 403-870-8704

Each office is independently owned and operated.

Coldwell Banker Dawnflight’s Greg Dodds Wins Community Entrepreneur of the Year

Coldwell Banker Dawnflight Broker-Owner Greg Dodds was named the Entrepreneur of the Year at the South Huron Business and Community Excellence Awards.

In his thank yous, Dodds quickly made the individual award a team accomplishment. And he proudly named names.

“We have great agents in Pat, Steve, Megan, and Kate who are not only amazing at their jobs but incredible people, too,” said Dodds. “Our operations and transactions manager James and marketing consultant Bree are also integral pieces of the puzzle who do so much on the back end of the business for us.”

Left to right: Steve Sararas (Sales Representative), James Lloyd (Operations & Transaction Manager), Dodds, Pat O’Rourke (Sales Representative), Kate Wuytenburg (Sales Representative). Missing, but presences noted: Megan Proper (Sales Representative) and Bree Glasier (Marketing Consultant).

New brokerage for natural leader

In January 2023, Dodds opened the doors to his brokerage in Exeter, a community in the municipality of South Huron, located approximately 40 km north of London in southern Ontario.

Dodds is devoted to the professional growth of brokerage recruits and to high-level sales production.

“We have tried to build a culture of good people to make coming to work every day enjoyable,” he said.

Paul Abbott, a Coldwell Banker Canada Vice-President, Franchise Development, said the award has gone to a natural leader whose skills have been allowed to shine as a broker-owner.

“Congratulations to Greg and the whole team at Coldwell Banker Dawnflight,” said Abbott. “This award recognizes the good things that happen for a business when everyone knows the direction they are going, and everyone is committed to the work needed to get there. That’s what leadership does.”

Dodds, left, and O’Rourke, who was also recognized at the Gala Awards.

Growth ahead

Coldwell Banker Dawnflight is getting set to get bigger.

“We are grateful to be where we are, but we are focusing on growing even larger in 2024,” said Dodds. “We will be moving into our new office which will be over double the size of our current one and we are all looking forward to expanding and growing our business.”

Remembrance Day 2023: Coldwell Banker Canada thanks all military veterans for their life of service

Countless wreaths will be laid at cenotaphs big and small across Canada on Remembrance Day. This is the story of one of the veterans performing that solemn task, Mark Goldade, CD, a 14-year veteran of the Canadian Forces. Goldade is only one of Canada’s veterans who work for Coldwell Banker. Their record of service merits attention and gratitude throughout the year, but especially on Remembrance Day. We thank each of them for their service. They each have compelling stories. Goldade’s, presented here, is one. Lest we forget.

Unexpectedly, Mark Goldade found himself quite alive in the middle of a canola field in southern Alberta one afternoon. His black and green jumpsuit was smeared oily yellow. His pulse rate was coming down. Right there, he decided to enlist with the Canadian Forces, and to serve his country.

Goldade, then a parachute rigger working on contract with a company that trained British Army skydivers, had just survived what’s called a line-over parachute malfunction.

Mark Goldade, 10,000 feet above ground level.

“I was the guy with a camera on my head filming a tandem jump,” Goldade said. “At 5,000 feet, I get the signal that the guy is going to open his parachute, so I fly away and get out of his way.”

At 3,000 feet, Goldade had tried to deploy his own parachute.

Nothing happened.

With no main parachute, he was free-falling at one thousand feet every five seconds. At 2,000 feet, it was no longer an option to try to get the main chute to deploy. He cut it away. At 1,200 feet, he opened his reserve parachute. It sounded like thunder.

Safe on Earth in southern Alberta

“My heart was in my throat,” he said.

Goldade came down in the canola field, nowhere near the landing target. He could see the plane above doing circles, trying to find him, getting his location to a rescue crew. The next chapter of his life came into focus.

“I’m on a contract. I don’t have healthcare. I don’t have life insurance. I’m living, eating and working out with these guys at the base. I admire what they’re doing. I’m going to join them. I went to the recruiting centre and signed the papers.”

That was 2007.

With that signature, Mark Goldade would see much of the earth in the service of his country. This Remembrance Day, his last in uniform as a serving member, Goldade, wearing his General Service Medal- Expeditionary (GSM-EXP) and his Canadian Decoration (CD) medal, will stand in Bruce Park in Winnipeg, MB. As the president of the Manitoba chapter for United Nations NATO veterans, he will lay a wreath to honour those veterans.

“It is an opportunity to remember those who have served and fought to provide us with the country that we have now,” he said.

Goldade, right, in Temiscaming, QC, on Remembrance Day 2014

Service highlights

Goldade’s decision to serve meant a life on the go. He did basic training at CFB Borden in Ontario. Occupational trades training happened at the Nav Canada facility in Cornwall, ON. His was then posted to North Bay, ON. From there, he took part in exercises at Hickham Air Force Base in Hawaii and at CFB Cold Lake, AB. He then served as a tactical data link operator (TDL-Op) in Air Task Force Iraq from 2015 to 2016.

“Basically, that means I created, using cryptography, a Wi-Fi in the sky that allowed aircraft to talk to the ground and to naval assets so we could pass tactical information back and forth securely,” he said.

After Air Task Force Iraq, it was back to Cold Lake as an IC (Supervisor) of security for Operation Maple Flag, the annual air combat exercises for allied pilots around the world. Newly promoted Master Cpl. Mark Goldade was then posted to Clear Space Force Station in Alaska for work on ground-based space radar and then onto the Combined Space Operations Center at Vandenberg Space Force Base in California.

“I got to be involved in a Delta IV rocket launch and a couple Falcon 9 launches, some pretty interesting stuff,” he said.

Goldade among fellow Canadians serving in Air Task Force Iraq, 2016.

Photo by: OP IMPACT, DND

KW03-2016-0066-001

Meaning of service

For Goldade, as for all veterans, the word “service” is a singular word. Yes, it’s a common word used in many aspects of life—business (including real estate), bureaucracy, dining and even sports (think tennis). For those who have put on a uniform, though, the word service carries a profound meaning, as well.

“For a Canadian Forces member, to serve means that we are willing, with no questions asked, to give up to and including our life to protect our country,” he said. “Nobody else in this country does that.”

It is in his blood. Goldade’s maternal great uncle Bob died in the Second World War Battle of Ravenna in Italy. His grandfather saw action at Monte Cassino. Two other great uncles also served in the Italian campaign.

Soldier in arm

Goldade wears his heart on his sleeve.

He has inscribed his own bodily commitment to his country—and made a record of adventures and friendships experienced along the way—in a unique fashion. His left arm is sleeved with tattoos that tell the story of his service.

Take a look:

Coldwell Banker mentor

Back in Winnipeg in 2021 and facing the prospect of a medical discharge, Goldade set his sights on the next chapter of his story.

“It was, quite literally, what can I do? Where can I go?” he remembered.

Goldade: “To serve means that we are willing, with no questions asked, to give up to and including out life to protect our country.”

Unexpectedly, he found himself one day in the middle of a conversation with a military legend—Honorary Colonel Brigadier-General Eldren Thuen. Thuen had retired from the military and was working as a realtor with Coldwell Banker Preferred Real Estate in Winnipeg.

“He said, ‘You know what? Let’s have a coffee and we’ll talk, and I’ll introduce you to [Sales Manager] Greta Torlen,’” said Goldade. “I was not ready for her. What a powerhouse!

The trio sat down and talked shop. They explained the compensation structure and the industry. Thuen offered to mentor Goldade.

“I did my due diligence, I reached out to other real estate brokerages, but none of them were willing to actually put in the time to coach and mentor,” he said. “But Eldren made that commitment. That’s why I came to Coldwell Banker.”

He got his real estate license in December 2022.

Military relocation in action.

Military relocations

Goldade is now among the Coldwell Banker network of realtors who, having served in the military or not, specialize in meeting the specialized needs of military relocation clients.

“When you get promoted, you get posted,” he explained. “The military doesn’t leave you in the same location when you’re promoted. You’re moved out of your comfort zone.”

Military members uprooted and set down in a new community benefit from dealing with a realtor who knows the drill, and who appreciates the time crunch faced by the member and family.

“You’ve been in a house for, say, three and half years and now you have to list it, sell it, and, during that process, fly to your new location, find a realtor who’s ready to go when you hit the ground, someone who knows that you want to look at 12-15 homes on average a day, not to mention the time need to find a school or schools for the kids and to check in with your new unit,” he said.

“Maybe, you’ve got seven days in the end for all of that to happen.”

Goldade and Harley-Davidson Street Glide at Tail of the Dragon, NC, August 2023.

PTSD

Service also informs Goldade’s work with The Rolling Barrage, a coast-to-coast motorcycle ride that raises money to combat post-traumatic stress disorder in veterans and first responders across the country. The ride just finished its seventh year.

“It started with three guys going coast to coast after they lost a buddy to PTSD, someone who took their life,” said Goldade, who is chief operating officer of the foundation. “Now, an average day is 100 to 150 bikes.”

The next ride is scheduled to leave St. John’s, NL, on June 28, 2024.

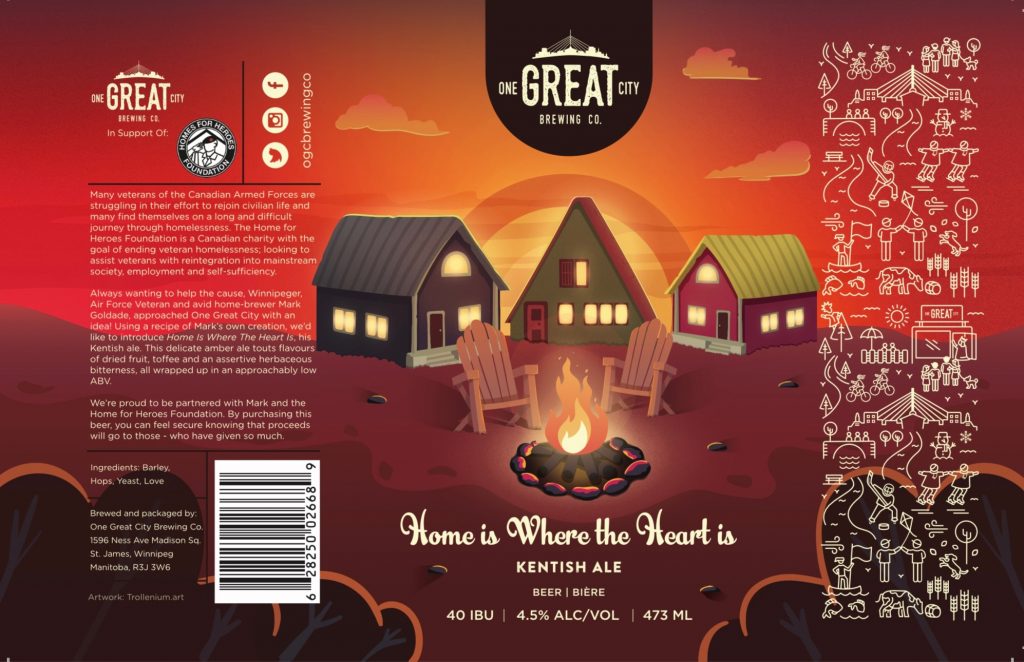

Sales of the beer based on Goldade’s recipe benefit homeless veterans.

Mark Goldade, 15, of the Royal Canadian Air Cadets – #9 Sqn Neepawa, on a trip to Minot Air Force Base, ND, 1987. “I bought my first beret at the kit shop there on the trip.”

Now serving: Mark’s home brew

There is one final, less serious aspect to the service that has inspired and still inspires Mark Goldade: his beer recipe.

Goldade is a home brewer whose Kentish ale recipe (the proportions of barley, hops, yeast and love remain proprietary) has been adopted by One Great City Brewing Co. in Winnipeg and bottled under the “Home is Where the Heart is” label. A portion of the proceeds supports Homes for Heroes Foundation, which combats homelessness experienced by veterans.

The label reads:

“By purchasing this beer, you can feel secure knowing that proceeds will go to those who have given so much.”

Goldade said he’s lately been dropping into legions around Winnipeg, drumming up orders.

“It will be ready on the shelves and on the taps in Winnipeg for Remembrance Day,” he said.

“Remembrance Day is about thanking those who have gone before us, and who sacrificed for us to be where we are.”

Lest we forget.

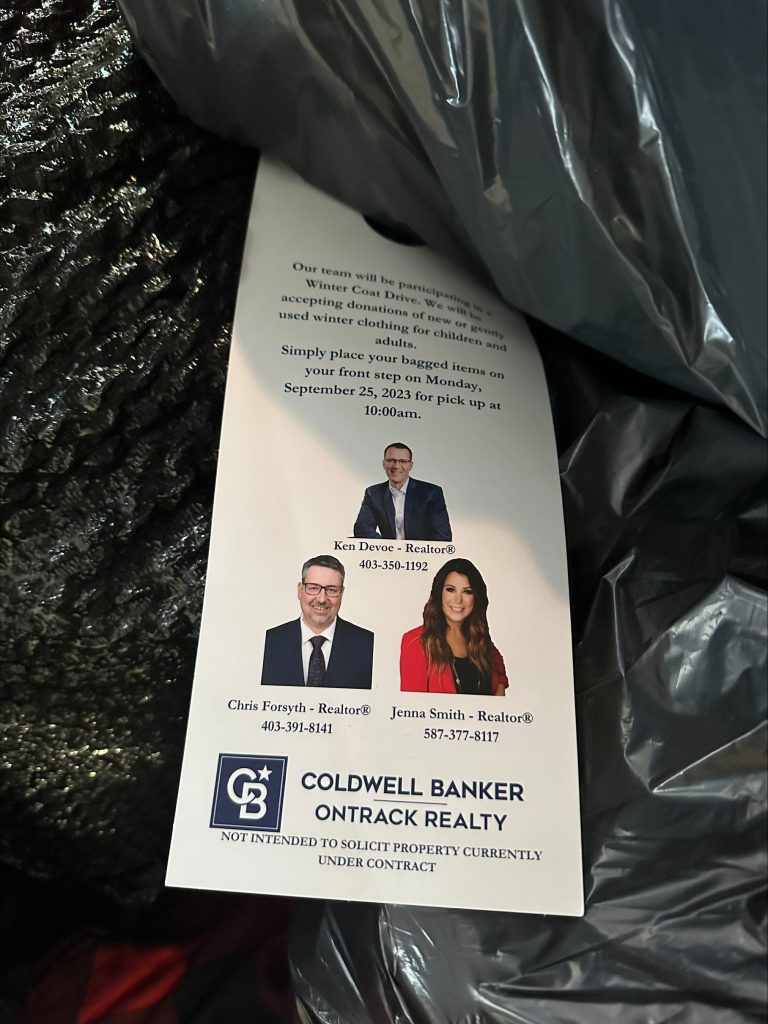

Coldwell Banker OnTrack Realty comes together for Coats for Kids in Red Deer

A recent Coats for Kids winter clothing drive imagined and pulled off by three real estate agents at Coldwell Banker OnTrack Realty in Red Deer, AB, was a big success. It’s also a bit of a how-to guide for others looking to give back to and connect with their communities. Spoiler alert: it’s teamwork.

Here are the big, impressive numbers from Coldwell Banker OnTrack Realty’s recent Coats for Kids clothing drive in Red Deer, AB:

215: coats

102: toques

41: pairs of gloves

33: snow pants

25: scarves

Here’s a small, equally impressive number:

3: the number of real estate agents who made it all happen

By name, those three Coldwell Banker OnTrack agents are Jenna Smith, Ken Devoe, and Chris Forsyth. They’re united in crediting their cohesion as a small but mighty group, along with the generosity of Red Deer residents, as the reasons for the success of the campaign.

“We work closely together in this brokerage, we help each other, we’re always bouncing business ideas off each other, and we’re always there for each other,” said Smith, who is Associate Broker and office manager.

Forsyth agreed: “We’ve always gotten together and chatted about work things and life stuff, and we try to help each other out in our businesses. It’s grown into a real team atmosphere.”

Said Devoe: “There’s no way I could have done this by myself. Absolutely no way. We just work well together. We’re all individual agents in our office, but we all work well together. And we have the same sense of humour, which is sometimes good!”

Coats for Kids delivery day at Coldwell Banker Ontrack Realty in Red Deer

Giving back

The campaign started with a question.

“We were talking about how me might give back,” Smith recalled. “How can we give back to the community, the three of us? It’s been a good year, and we wanted to find a way to give back.”

Smith came across Coats for Kids, which is run by the Red Deer Christmas Bureau, in an internet search. The idea of helping local children layer up for the winter struck a chord.

“Our winters are long,” said Devoe, himself a mountain-climbing, all-seasons fan of the outdoors. “Having clothes to be outside just a little more, even 15 minutes more a day, is good for everyone.”

But good winter clothing is not cheap. Not everyone has the means.

“And it can be hard to ask for help,” said Smith. “It can be hard on your pride.”

The plan took shape quickly. A call to action went out to clients and followers via Facebook and other social media.

A seasonal call to action went out on social on OnTrack Realty’s social media platforms.

They had 1,500 door hangers printed and dropped them off in a few Red Deer subdivisions in mid-September.

“It took us a few hours over three days, walking the neighbourhoods, putting them on the doors,” said Smith.

“It was nice weather. People were outside. So, we had a chance to talk to them and explain what we were doing and why we were there.”

The prep work was done. Social media posts were posted, door hangers hung, phone calls and texts made, people pitched—all that was left to do was wait until pickup day, September 25, to see if the community was as committed to the campaign as the organizers.

Pickup day nerves

In Smith’s SUV, the trio cruised the neighbourhoods looking for bags of clothing left on the front steps of houses they had canvassed. At first, they didn’t see as many bags as they hoped for.

“The first little bit was slow, so, you’re, like, oh, no, are we going to get more?” Smith said. “We were a bit nervous doing something new. You don’t know if it’s going to take off or what’s going to happen.”

Things started to take off, especially when the trio rolled into the Deer Park subdivision. Once the SUV was loaded with donations— “At one point we thought we were going to bury Chris in the back seat,” Smith joked—back it went to Devoe’s newly cleaned garage. And again. And then again.

“We did one subdivision, then went to another and we were probably a fifth of the way through that subdivision when we all just looked at each other and said, wow, this is getting bigger,” said Devoe.

“That was pretty cool.”

Forsyth said he was “taken aback by how many people actually reached out and kept reaching out even after we did our pickup.”

The community haul of (l-r) Devoe, Smith, Forsyth

Red Deer Christmas Bureau

The haul was then taken to the new location of the Red Deer Christmas Bureau, a 15,000-square foot bay operated by volunteers that features a library to enhance the literacy of its patrons, and a toy room taking shape for children at Christmas holiday time.

“The parents can come in, they get so many points, and they can pick gifts for their children,” said Smith. “I think we’re going to try to work with the Christmas Bureau again on their next book drive.”

Drop-off day at the Red Deer Christmas Bureau.

Handwritten thank you notes, a nice touch.

Thank yous

After the drop-off, the team was faced with a final question: how best to say thank you to the generous Red Deer residents who donated the winter wear?

They went old school—handwritten thank you notes. Each residence that donated clothing items got a thank you note in old-fashioned ink from Jenna, Ken and Chris.

“I was worried that people might throw the envelope away because we didn’t know their names, we just addressed it to the homeowner,” Smith said. “So, I got little Coats for Kids stickers made and put them on the front so they would hopefully see that and connect it all.”

A handwritten thank you note in return!

Next steps, lessons learned

The plan is to reprise and enlarge Coldwell Banker OnTrack Realty’s Coats for Kids effort next year. There is certainly room to grow. This year’s drive covered only a fraction of Red Deer’s neighbourhoods.

“I hope next year other realtors in our office pick a neighbourhood as well, too, and go out and do that same thing,” said Forsyth.

For others who are considering moving an idea out of the “wouldn‘t–it–be–nice–if”column into the “look-at-what-we-did“ column, the OnTrack Realty trio shared some advice.

It’s the expected refrain of teamwork.

Smith: “Find a partner. Find somebody you get along with and just partner up with them. A lot of people think real estate is cutthroat, but it doesn’t have to be like that. Our office isn‘t like that. Find each other and work together.”

Forsyth: “Jump in together. Don’t overthink it. Put a plan together and do it.”

Devoe: “I think we started something. We didn’t expect it to be this big. I’m really proud of what we did.”

By some of the signs left on the doorsteps for the Coldwell Banker OnTrack Realty trio to see, Red Deer is proud of what they did, too.

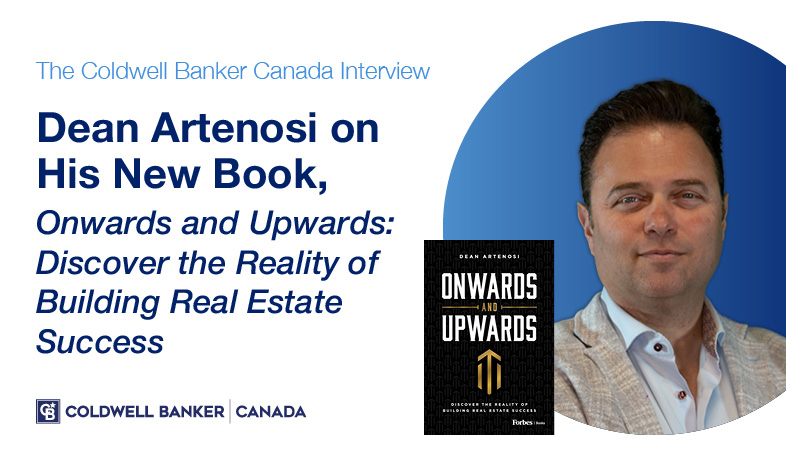

The Coldwell Banker Canada Interview—Dean Artenosi on his new book, “Onwards and Upwards: Discover the Reality of Building Real Estate Success”

Dean Artenosi, Broker/Owner of Coldwell Banker The Real Estate Centre, has a new book out.

Onwards and Upwards: Discover the Reality of Building Real Estate Success is published by Forbes. The book is intended as a course correction for those who view a career in real estate as an easy path to quick money, fame, or both. It offers substantial advice on generating lasting wealth for clients and agents alike, as well as lessons on risk and relationship building. It illustrates that an entrepreneurial mindset is key to envisioning and achieving success as an agent or developer. Artenosi’s goal in the book is to re-kindle a love of all the aspects of real estate work, to breathe life back into what he believes is a noble calling and a great adventure. We sat down with Artenosi to get a bit of a sense of the book and of the author himself. The conversation has been edited slightly for length.

Coldwell Banker Canada: One of the stories in the book that most readers will relate to is the story about the day as a school student you realized that you could—and really liked to—sell fundraising chocolates door to door. Not all door-to-door chocolate sellers have such warm memories!

Dean Artenosi, The Real Estate Centre: That was at St. Robert in Thornhill, Ontario. I learned how competitive I was! There was a $500 prize for most chocolates sold. That was my goal. I talked to my father about it. He got right behind it. He was in real estate and back in those days you went door to door to find your prospects. There was no internet. He appreciated the chance to coach me. One of the first things I did was to network with family members and ask them if they could take a couple of boxes and sell them to some of their friends.

CB: What was your door-to-door pitch? How did you do it?

DA: Basically, my pitch was, “hello, I’m representing St. Robert and we’re trying to raise money for the school. I have a goal, as well. I’m trying to win a prize of $500 that I will apply to my schoolbooks next year.”

CB: You made it emotional?

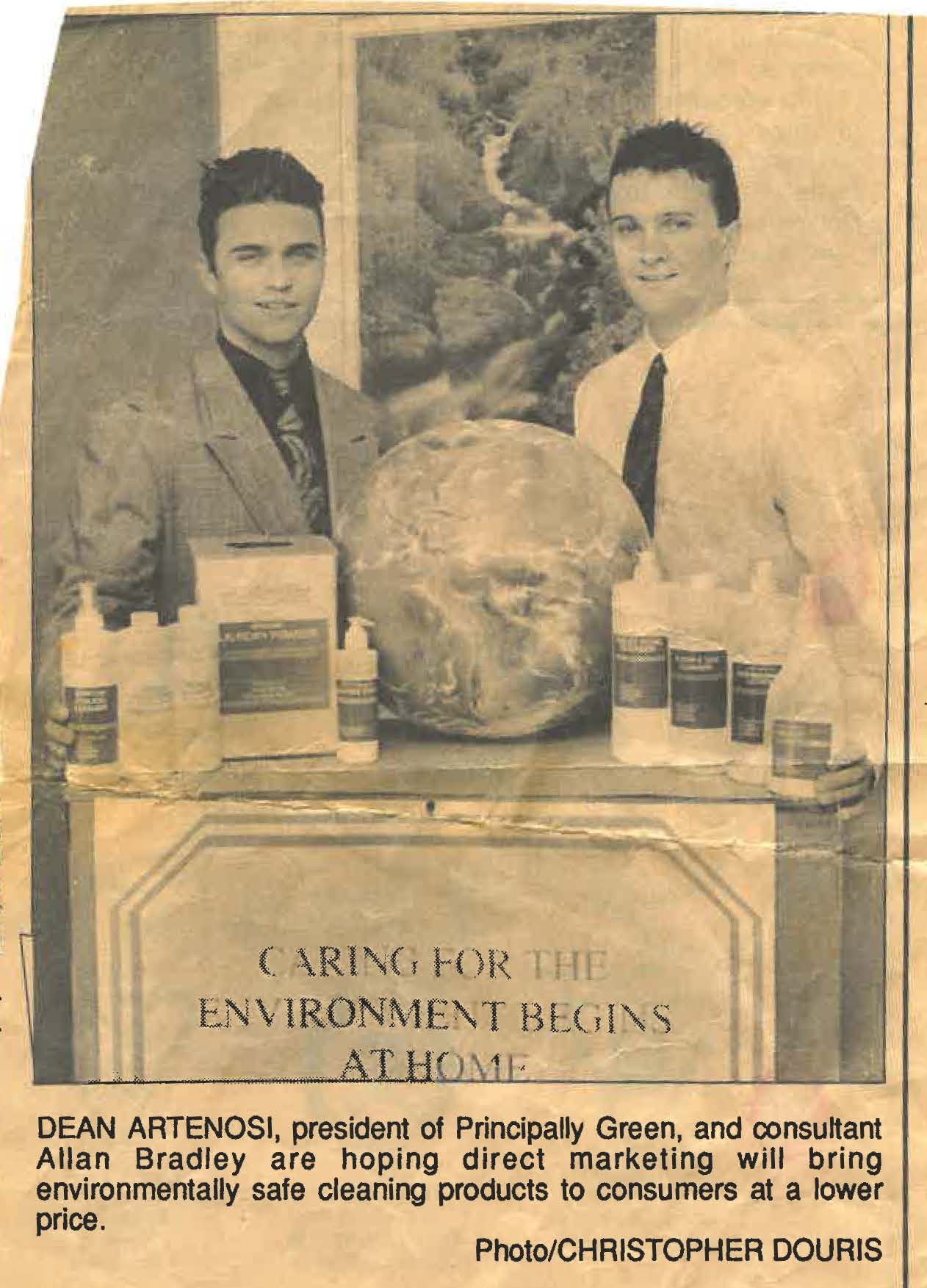

DA: People buy on emotion and justify with logic, for sure! I wasn’t the top student in my class, but I was the No. 1 chocolate bar salesperson. In a way, I just kept going door to door. In my early 20’s, I started a company with a line of environmentally safe cleaning products that we sold door to door.

A young Dean Artenosi, left, in a local newspaper clipping as he launched Principally Green environmental products.

CB: Are any of those door-to-door skills still relevant in today’s technological world, or have they become obsolete and we can now afford to live without them?

DA: I think we’ve moved away from those skills. Yes, they are still valuable. As I say in the book, real estate, for all its talk about location, location, location, is and will always be about people. Social media gives you exposure. It creates awareness. Realtors can have online campaigns, but why is it that some realtors close more deals than others? It’s because they have sales techniques and can deal with people. Nothing beats interpersonal skills. Some of it might be inherited or natural, but you can learn it. Like I say in the book, you must train to get and keep those skills.

CB: Honest question—why does the world need another book on success in real estate?

DA: There is money to be made and wealth to be created—for your clients and for yourself—by having the right mindset. That mindset is about providing ultimate service to your clients and building a successful sales practice from the things you learn from the ground up. My book is about seeing the difference between the real wealth in real estate versus the versions that catch people up in all the rah-rah and the downlines and the multi-level marketing schemes. All those aesthetics just don’t matter.

Artenosi and wife Tania celebrate the grand opening of the TREC’s Gravenhurst, ON, office with (l-r) Tim Hudak, Sandy Cairns, Penny Varney, and Randy Jorgensen.

CB: Okay, was going to ask this later, but let’s do it now, because you just mentioned that your book is about seeing the difference between real wealth and other kinds. References to seeing and vision are everywhere in your book. A real estate expert must see what isn’t there yet, you say, either in terms of neighbourhood that will have a better day or a piece of property whose use can be changed. You tell us the story of what your father was able to see in a plot of undeveloped land on unheralded Georgian Bay. How do you get the superpower to see the invisible?

DA: I have found that the biggest gains in real estate are to be realized when you change the use of real estate. I give a lot of examples in the book of how to see those changes. But it comes down to doing the work to get additional perspectives. What you see in front of you is not all there is. What can a rundown home in a transitional neighbourhood become? How about a piece of real estate near a future public transit line? Do you know what your municipality’s official plans are? Do you see the potential in corner lots? Do you enlarge your field of vision in these ways, and then do you see it through?

CB: See it through—another reference to vision.

DA: Yes. Staying true to your vision is essential.

CB: What’s the attraction of corner lots?

DA: The corner lot is always the kingpin. You have access on both sides of the road. It lets you imagine more uses for the land.

Try turning the people and places that snooty real estate agents write off as the “nothings” into “somethings” of real value. – from Onwards and Upwards: Discover the Reality of Building Real Estate Success

CB: Speaking of visionaries, let’s switch to fiction for a second. In your book, you testify to the enormous impact that Mordecai Richler’s The Apprenticeship of Duddy Kravitz had on you. That namechecking doesn’t happen in too many books on real estate, does it?

DA: I read that book in Grade 12. Mrs. Heslip’s class. I think she could see how much I related to that book, how much I was mesmerized by it—the story, the entrepreneurism, my being from an immigrant family, too. It really got in me. I wanted to be a developer from Grade 12 on.

CB: At the end of the story, Duddy is land-rich, but you could say, he had too much of his cash flow tied up in his equity. That’s a recurrent lesson in your book.

DA: I remember a bank manager telling me that you can’t spend dirt. That stuck with me. Yes, cash flow is important. But the really valuable lesson is that you must always have an eye on diversifying your holdings.

A dinner hosted by the Artenosis to celebrate Coldwell Banker International Award Winners from the various TREC offices.

CB: What’s a good mistake that you’ve made?

DA: There are times I haven’t been diversified enough, but I don’t think that’s what you’re asking. I talk about this in more detail in the book, but I remember losing my first OMB [Ontario Municipal Board] planning hearing. I had tried to shoe-horn in a development proposal. If I had listened more and compromised more and taken a more conciliatory approach, I likely wouldn’t have lost that hearing. It was an expensive lesson. But, in the long run, it helped me create a skillset that is the skillset of a team player with a purpose. The purpose is to help people, to solve problems and do what is right for the customer. Never worry about what the next person is making in a deal or you will never make anything yourself. Better to get a small piece of something than a big piece of nothing.

A selection of communities Artenosi has developed through the Arten Group.

CB: Right now, in the Canadian housing market, the issue of affordability is very complex and seemingly intractable. What can be done, including, what can the real estate industry do, to make more homes more affordable for more people?

DA: I think there are policy changes coming. There’s a bill [in Ontario] that will allow you to have two or three apartments on your property. Now, some people don’t like that. Years ago, they didn’t like that because they didn’t want to have a so-called rental property in the neighbourhood. The reality is many people are living like that. There are two or three families. When I built my home here, I had the basement apartment rented, I had the in-law nanny suite rented. I rented out everything I could to generate revenue. I do think real estate agents need to look at creating supplementary income for property owners.

CB: Is that one of the reasons your book underlines the importance for real estate agents of working with buyers, and not taking the easier seller’s route?

DA: It’s harder to work on the buyer’s side. If you have that vision for what a property could be, and if you can help your client execute that plan, then you learn how to really create some wealth for your client. If you can do it for them, you can do it for yourself. The book has more than a few of those real-life stories.

CB: Your book is full of advice and full of stories. Readers meet Mrs. Heslip and the neighbour who opposed your development who later came around. They meet Ruth and see how you helped her. (That’s a story that’s hard to forget.) They meet your aunt, who helped provide the title of the book, they meet your parents and your uncles. You take us to Italy to see the shack your grandfather lived in.

DA: You must never forget where you come from.

CB: Italy is a big character in your story.

Artenosi and family on a memorable trip to Ortona, Italy, in 2013. He came back with a Canada tattoo.

DA: Yes, so is Canada. I remember a family vacation we took in 2013. We took the kids and went to see more of my wife Tania’s side of the family. Her parents’ village is close to Ortona. There’s a graveyard there, a Canadian graveyard for all the soldiers from Canada who fought there in the Second World War. It was incredible. It was so emotional. I don’t have the words to explain it. I left so inspired to be a Canadian. I actually ended up getting a Canadian flag tattooed on my ankle. Anyways, that whole history resonates with me. It has inspired the Canadian Dream in me, it really has. I want to make a difference for good in people’s lives. That’s also the reason for the book.

CB: Who has the most to gain by ordering and reading your book?

DA: Real estate agents and real estate investors, new agents and experienced agents, agents that have been led in the wrong direction away from ultimate service and toward multi-level marketing schemes and so-called profit-sharing concepts. It’s never too late to learn all the components of real estate from start to finish.

CB: If the book is made into a movie, who plays you?

DA (laughing): DiCaprio? I also love De Niro and Pacino!

Artenosi in Times Square in Manhattan in 2023 for debut of billboard ad for “Onwards and Upwards”.

Editor’s note: Onwards and Upwards: Discover the Reality of Building Real Estate Success is published by Forbes. Order it here.

Coldwell Banker Tailored Realty Builds Community in Windsor-Essex

Chuck Roy brings an impressive business resume, a deep sense of a community and a vibrant collection of contacts to Coldwell Banker Tailored Realty in Windsor, ON, one of the newest brokerages in the growing Coldwell Banker Canada network. He also brings a keen sense of the importance of a team mentality in real estate. And he can hit a golf ball!

Chuck Roy’s golf game has always been about scoring the bigger number.

Roy, the Broker-Owner of the new Coldwell Banker Tailored Realty office in Windsor, ON, remembered being on the links at a tournament in 2007 that raised money for the St. Vincent de Paul Society. The tournament brought in about $6,000.

“I told the president at the time, I said, ‘Don, we could make a lot more money for this worthy cause if we did things just a little different,’” Roy said. “I mean, we could put a four-by-eight-foot piece of plywood at a hole and put 12 sponsor signs on it if we wanted to!”

Chuck Roy’s “just a little different” meant a more liberal definition of a hole sponsor. It meant more levels of corporate sponsorship. And Roy’s “just a little different” meant leaning into his radio connections for on-air advertising.

“Just a little different” turned into a significant difference when the tournament happened the following year.

“We got a lot of different folks involved and we were able to clear $32,000,” said Roy. “The whole idea is to raise a good amount of money, right?”

Chuck Roy foursome at 2023’s Society of St. Vincent de Paul Charity Golf Classic, Windsor, ON, included Roy, left, and Paul Abbott, V.P. Franchise Development (Ontario), right.

Windsor-Essex: very charitable

Roy has answered that question the same way every year since. This year, with Roy again at the fundraising helm, the Society of St. Vincent de Paul Charity Golf Event netted $28,000 for its food bank programs. Since 2008, the tournament has raised $450,000 for the charity.

Roy said the easiest thing to do is to ask someone for their money.

“The worst thing they are going to do is say no, so, if that happens, you say thank you and move on to the next person,” Roy said.

“When you are in a sales job, you get ‘no’ a lot. I feel every now and then that I am bothering people, but I’m really not. Besides, Windsor-Essex is very, very charitable, it’s unbelievable.”

Subway years

Doing business and supporting his community have been twin impulses for Chuck Roy since the very beginning. As a 20-year-old in 1987, he opened his first Subway shop. At the time, it was only the third or fourth franchise in the entire country. The shop at 300 Oullette Avenue in downtown Windsor was “10 or eleven feet wide and a hundred and some feet deep.”

The tiny restaurant gave Roy a closeup view of the challenge of homelessness.

He got involved with the Downtown Business Association and helped support outreach programs with food from his Subway franchise.

“I feel that I have been fortunate,” he said.

“I’ve always worked my butt off, but I’ve always been fortunate, too, and I appreciate the life I was able to build for myself and my family. I have tried to always give back to the people in the areas I lived and worked in.”

Roy was able to do increasingly more for charities as his Subway career took off. And take off, it did. By the time he wrapped up his time with Subway in 2012, he had owned 18 restaurants—as many as 12 at one time.

“When I started expanding, I was the first guy to go into all the little towns,” he said. “People thought it was the wrong move. But those stores ended up being the highest volume stores. There was no competition.”

“Remember to be generous”

Over the better part of two decades, Roy also served as global chair of the Subway Franchise Advertising Trust Fund, the first non-U.S. born official to achieve the top post that came with a healthy marketing budget. Along the way, he sat on or led Subway’s local, regional and national advertising boards.

“As other franchisees got on board in the market, and as we got bigger and more funding was available, I tried to remind us all to be generous,” he said.

“Contribute and give and do what you can. If you do good things, good things come back.”

Yes, Roy still supports the company that supported him and his charity initiatives over the years. Yes, he still eats at Subway.

“Once or twice a month,” he said. “My wife doesn’t like me eating the cold cuts, but I like the BMT and they’ve got this new Italian one, I forget its name, it’s the No. 13.”

Windor, ON, waterfront.

Amazing waterfront in Windsor

Chuck Roy was born in Campbelltown, NB. When he was five years of age, his father moved the family to Windsor after getting a job at Champion Spark Plugs. Chuck met his future wife, Marla, in Windsor, where they worked at a Burger King restaurant together.

“She worked the specialty board,” Roy said, “where they make the different non-hamburger sandwiches, the chicken sandwiches.”

The fast-food romance stuck. They’ve been married for 36 years and have two grown children.

Windsor is home for the Roys. The land and the people are beautiful, he said.

“We are surrounded by water and the waterfront is amazing,” he said. “Not everyone knows about all the wineries on the South Shore. It’s a lovely drive. Very peaceful.”

Windsor-Essex, population 342,000, is just across the river from Detroit, population 4.3 million, a metro region that offers all the entertainment, shopping, sporting and dining draws that come with being the 14th largest city in the United States.

The enduring attraction of the region, though, is its people. And their generosity.

“People always reach into their pockets here,” Roy said. “The money that comes out of the auto workers’ pockets every month is impressive. The charity in the people here is what you get to know when you live here.”

The next chapter: real estate

“What do you want me to do with these briefcases that you haven’t opened yet?” Marla Roy asked her retired husband one day a few years ago.

The couple were downsizing and moving to a new home. What to take, what to keep were the big questions. The fate of five briefcases was up for negotiation. Each briefcase was identical. Each contained real estate licence course material. There were five briefcases because, for five straight years, Roy had ordered the course material, and for five straight years he had let the briefcases sit without opening them or cracking a book.

“I bought the first course five times,” he laughed. “Back then it was the old system where you had to get your first course done within the first year. If you didn’t, they’d call you up after a year and ask, same last four digits on your Visa, sir? and send you the material again.”

Eventually, Roy stopped ordering the course material, actually opened a briefcase, dug in, enrolled in a class in London, ON, and, after a year of study, got his real estate licence and his broker’s licence.

“Real estate was always interesting to me—all the different types of real estate,” he said. “I was close to the commercial side of things over the years. I did a lot of the legwork myself, getting appraisals done and stuff like that.”

Roy started as an independent realtor in 2015. He made a splashy entrance. He wrapped his SUV with an image of his face, he bought billboards.

“You name it, I did it,” Roy said. “There weren’t many people in Windsor who didn’t know I was in the business.”

Coldwell Banker enters picture

Over time, he realized that the realtors in his brokerage needed more support.

“I wanted to find a global brand because I just didn’t have the ability to give the realtors the resources they need—website, training, social media, that kind of important stuff.”

Chuck Roy, right, with William Nelson, Broker-Owner, Coldwell Banker WIN Realty, at Coldwell Banker Gen Blue conference, Vancouver, June 2023.

In brand shopping mode, Roy ran into a Coldwell Banker franchisee at a networking event. From there, he filled out the fields of information in the online Coldwell Banker Canada franchise inquiry form. Then, Vice-President, Franchise Development, Paul Abbott “got in the car and drove up here,” said Roy. They had dinner. Abbott suggested that Roy attend the Gen Blue Canada conference in Vancouver to get a feel for the people of brand.

“I was tremendously impressed with everything I saw there and got back and made the decision to move forward with Coldwell Banker,” Roy said. “It’s a big benefit to align yourself with a global brand.

Chuck Roy’s brand shopping took him to Coldwell Banker Canada’s online franchise information page. Illustration.

Coldwell Banker Tailored Realty

Roy’s Tailored Realty has joined Coldwell Banker Essential Realty (Owen Crampsie, Broker-Owner) and Urban Realty (Joane and Frank Urbanski, Broker-Owners) in serving clients in the Windsor-Essex region.

Abbott said the addition of Tailored Realty to the Coldwell Banker landscape in Windsor-Essex is a great development for the brand and for buyers and sellers.

“Coldwell Banker Canada continues to attract high-quality leaders with experience and vision, and that is what is available, both for agents and consumers, in Windsor-Essex,” said Abbott.

Growth

“I wanted to find a global brand because I just didn’t have the ability to give the realtors the resources they need—website, training, social media, that kind of important stuff,” Roy says.

Roy said he wants to grow the brokerage to 15 agents or so.

“What I love about Coldwell Banker is they’re more concerned with quality, not quantity,” he said.

Coldwell Banker Tailored Realty takes its name from the sense of concierge or boutique service it offers its clients, a kind of attention and care that has long animated Chuck Roy.

“We work like a team,” he said. “We help. We don’t let anybody fall down. We keep people picked up.”

Here’s the Fun Tale of Coldwell Banker Beaver Realty — Seriously.

September 6, 2023

Business partners Johnny Hewerdine and Tristan Squire-Smith were looking to acquire a real estate franchise. They went to the Coldwell Banker Canada franchise webpage, filled in a few lines, and hit return. That’s how the tale of Beaver Realty began.

Coldwell Banker Beaver Realty is flipping the script for its real estate brokerage grand opening in London, Ont. Don’t be surprised if they throw in a figure-four armlock and a cross-face chickenwing or two, too.

“We’ve got some live wrestling ready to rock,” says Johnny Hewerdine, Beaver Realty Broker of Record. “The last match is scripted very much like Hulk Hogan, like Hulkamania. We call it Beavermania. It’s going to be for all the Beavermaniacs out there—an event of music and magic and wrestling.”

As if to pile-drive home his point, Johnny adds: “This is just our own thing. We’re doing our own thing.”

Business partner Tristan Squire-Smith takes the tag: “This is our sense of humour anyway. It’s not like we’re trying to make something and create an image. This is who we are.”

Making a splash in London, Ont., real estate

We get the job done, says Beaver Realty’s Johnny Hewerdine

Johnny and Tristan believe that bona fide real-estate credentials wrapped in fully bloomed personalities served with heaping helpings of entertainment is the recipe to attract the clients they want to attract, and who want them. Transaction, in this way of thinking about the business, gives way to experience.

“You can be professional and highly competent and still bring a sense of levity to the serious situation of real estate,” Tristan says.

“The real estate world can be wound very, very tight,” Johnny says.

“We get the job done. We know what we’re doing, don’t get us wrong. But we’d just as soon be the real guys we are and create an experience that our customers absolutely love. It’s a big investment and a big sale, and there are some tough moments with negotiations, but it doesn’t have to be as scary as everyone says.”

Beaver Realty swims in pop culture

To start to enjoy the Beaver Realty experience, look no further than their typical listing videos on Facebook. (Spoiler: there’s nothing typical about the videos.) One features a mascot beaver that has infiltrated the house, staying one step ahead of the videographer. Another is takeoff on a Sopranos episode.

Cartoon characters appear. An unexplained gasoline fireball transition recurs. When a door opens, it sounds like it. Johnny and Tristan routinely make appearances. They actually do the filming and editing.

“We do the videos ourselves with our own technology,” Johnny says. “We add some comedy just to keep people engaged and to get more eyes on the listing. Our clients are, like, we can’t wait for you to do this for us, and we get full permission to make the video entertaining.”

The singularity of Beaver Realty is right there in its moniker.

No other Coldwell Banker Canada brokerage carries the name of an industrious rodent that is:

- steeped in the folklore of the country

- transmitted on TV by the Hinterland Who’s Who public service announcements (“…if you’d like more information about the beaver…”)

- minted on the national currency, and

- referenced on Jeopardy.

The industrious rodent was featured recently on the iconic answer-and-question TV quiz show, Jeopardy.

The beaver is everywhere. Which helps when you’re trying to come up with a name that resonates for a real estate brokerage.

“If you’re in or around London, Ontario, you’ll see coats of arms at the university and at local schools and other areas, and they reference the beaver,” says Tristan. “The Canadiana thing becomes subconscious and gives us an endless supply of material. Plus, it’s an animal. People love animals, right?”

The Western men’s swim team, 2000-2001, was the beginning of the business partnership between local products Johnny Hewerdine and Tristan Squire-Smith, circled, front and middle rows.

The beginnings of Beaver Realty

The tale of Beaver Realty began two decades ago in the water at The University of Western Ontario in London. That’s where, as members of the university swim team, the friends met. Johnny studied languages (“I majored in partying”), then worked as an electrician, and went on to assemble and grow the successful and massive Middlesex Swimming organization. Johnny got his real estate licence in 2017 and worked with an independent broker as well as with another Coldwell Banker brokerage.

Tristan has degrees in chemistry, languages, nursing, and business. He continues to work as a registered nurse in a long-term care facility. He has a U.S. patent on a device to prevent ear infections. He’s the author of The Wrinkly Ranch: Unbelievably funny, shocking and poignant anecdotes of work and life in Long-Term Care. Tristan got his real estate licence in 2021.

Swimmers of note, L-R, in Beaver Realty’s latest billboard: Tristan Squire-Smith, beaver, Johnny Hewerdine

The two entrepreneurs still swim in masters competitions. They took the plunge into real estate by opening their co-owned brokerage in June 2023.

“We’re both entrepreneurial and both fascinated by real estate and property,” says Tristan. “Johnny has built a successful business and sold it. My healthcare background means I am a strong advocate for my patients and my clients. We’ve been responsible for budgets and HR and worked with boards of directors. Between us, Johnny and I have a great set of transferable skills not only for our clients but to support other brokers and realtors, as well.”

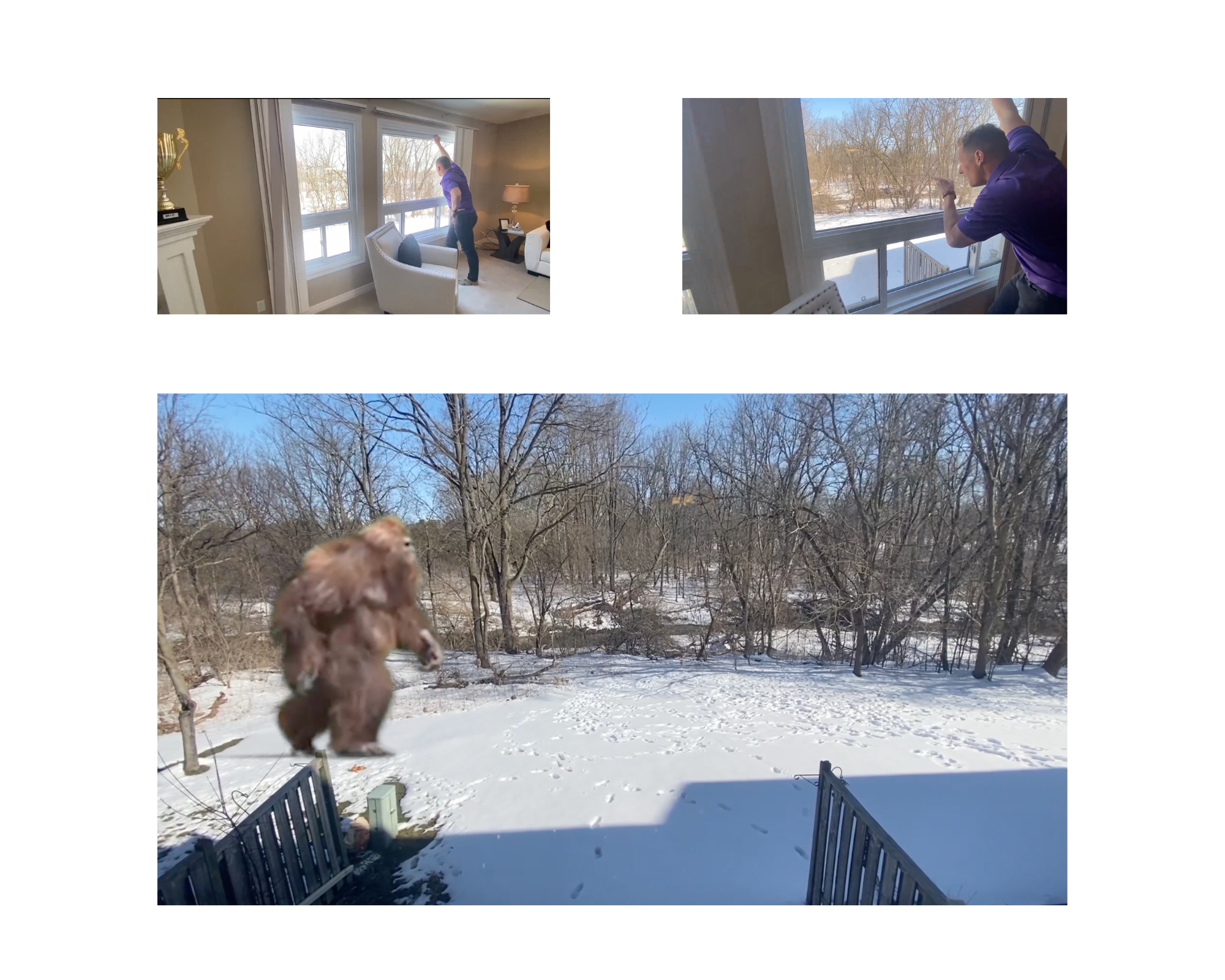

Beaver Realty’s Tristan Squire-Smith is cast opposite Sasquatch, below, in Beaver Realty listing video on Facebook.

Coldwell Banker franchise inquiry

The pair landed on their corporate home after reaching out on the Coldwell Banker Canada franchise webpage about acquiring a franchise. From there, they met with Paul Abbott, Vice-President, Franchise Development, Ontario. The duo interviewed different brokerages, narrowed the list down to two and, in March 2023 or so, chose the company with the north star in its logo.

“We feel more at home at Coldwell Banker,” Johnny said. “There’s a business mindset, and they’ve added a lot more stuff like CB Ignite.”

(CB Ignite is a custom broker and real estate solutions platform provided to brokerages at no cost.)

Coldwell Banker Beaver Realty joins Coldwell Banker Power Realty in serving clients in London, the surrounding area and southwest Ontario.

Business growth for Beaver Realty

Ambitious growth is on the agenda for both Johnny and Tristan.

“We’d love to have a brokerage with a young group of agents who are fully supported in their creativity and do a great job offering amazing service to consumers in London,” says Johnny.

Supporting that creativity by offering agents efficient systems, processes and technology is also a priority, says Tristan.

“We want to back up that public image with solid, real estate infrastructure,” he says.

That duality to Coldwell Banker Beaver Realty—personality on the outside, perspicacity behind the scenes—is the dynamic of the duo.

Offering amazing service to consumers in London is the goal, says Beaver Realty’s Johnny Hewerdine

“Sure, some people might not like what we do, and they can pretend that we’re just fooling around and we’re jokers,” says Johnny, “but, come on, you don’t get where we are by fooling around. Billboards going viral, being on TV, on radio, in newspapers and podcasts, and doing innovative and dependable work for our clients, doesn’t just happen.

“It takes some serious skill and some serious hard work, and here we go!”

Editor’s note: the pic at the top of the post shows a Beaver Realty ad featuring Tristan Squire-Smith, left, and Johnny Hewerdine, right. We couldn’t find a natural way to include in this post the musical fact that Johnny is a skilled Irish tenor banjo player. We apologize to Johnny for this failure. Beavermania happens Sept. 30, 2023, at 521 Burbrook Place in London. If you’d like more information about Beavermania, or reservations, text (519) 319-0224.

Coldwell Banker 30 Under 30 Winners from Canada Talk Real Estate, Leadership, Heroes, Dogs—and Selling Sunset

August 16, 2023

By Coldwell Banker Canada

Realtors Crystal Blezard, Tré Folkes and Josh Singh have joined the club of Coldwell Banker 30 Under 30 winners from Canada. That’s a big deal. Congrats to each of them! Congrats also to their families, their support teams and the brokerages where their talents in philanthropy, leadership and sales have a place to grow. 30 Under 30 winners are chosen from across 2,700 offices and 39 countries and territories in Coldwell Banker’s international network. In 1906, Colbert Coldwell and Arthur Banker were 24 and 28 years old, respectively, when they started the real estate company in San Francisco that still bears their name. Zoom wasn’t a thing back then, but it let us bring Crystal, Tré and Josh together recently to get their thoughts on the award and other things. Gotta say, lots of insight, lots of laughter, lots of hope.

Q: Okay, your honest first thoughts when you heard that you had won?

Crystal: I have a five-month-old daughter and I’m a realtor! My world is all babies and real estate right now. I didn’t check my email or go on social media, so the owner of Coldwell Banker The Real Estate Centre called me and said, oh, I hear congratulations are in order. I’m, like, for what?! I was shocked and surprised.

Josh: My heart sank, but in a good way. I was in front of the computer. I was dealing with a client’s situation. The email notification popped up. This isn’t legit, I thought. No way, no way, no way! I went to my broker and asked is this legit? Should I be happy right now?! A lot of emotions came at me at once. I almost cried.

Tré: I wasn’t on social media that morning. I had gotten my workout in and was heading for the office when our Broker of Record gave me a shout. I was super shocked and humbled. This was a silent goal that I had. I knew people from other real estate companies, and I always wondered, whaddya gotta do to get on that list?!

Q: Okay, Tré, whaddya gotta do to get on this list?

Tré: Try to be a good person. Be kind. Have empathy. Good people will then gravitate towards you and those are the people you really want to work with.

Q: Oppenheimer or Barbie?

Crystal: Between real estate and the five-month-old, I am planning to see Barbie, but it’ll be when it’s out of theatres!

Q: In what ways do you belong to your generation, and in what ways not?

Josh (Gen Z): I do use social media a lot because it’s what you have to do in today’s world to get your name and your branding out there. I can reach people around the world. But I’m very old school, too. I would rather meet you in person. Let’s go for a coffee, let’s go for lunch, let’s go for nine or 18 holes of golf. Talking business and playing golf is a perfect day.

Tré (Millennial): I love using social media. Being a digital native is millennial of me. But there are ways I’m not a millennial, too. I love my routine. Some people call me a grandpa. I go to bed early. I wake up early. I’m into self-care. That makes me appear older to my peers sometimes.

Crystal (Millennial): I think that part of being a millennial is being progressive, and I do consider myself progressive. I think I’m not so much of a millennial because I had to look up on Google what a millennial is supposed to be.

<laughter>

Q: Why real estate?

Josh: My father is a big influence in my life, and he’s my business partner, too. He’s also a civil engineer. He’s a Broker with Coldwell Banker. Growing up, I was always around blueprints and construction sites and real estate portfolios. He’s the reason I chose real estate.

Tré: My father is also a Broker with Coldwell Banker. We’re an athletic family. My brother Liam just finished up playing hockey in the American Hockey League, my dad ran at the Olympics and my mother was a long-distance marathon runner, so, sports taught us a lot about working hard and aiming for a goal. Real estate lets me help others achieve their goals, too.

Crystal: I have a different story. Real estate picked me. Real estate was never really on my mind. In my family, no one ever owned homes. Real estate was unobtainable. Self-employment was unobtainable. I was one of the first people in my family other than my mom to go to university. I got my degree. I was going to be a social worker. I had it all planned out. Then I saw a job posting for a real estate admin. I got the job and I’ve been in the business ever since.

Q: What is the most important quality for a realtor? How do you acquire it? How do you maintain it?

Josh: The most important quality is to not work for yourself. Don’t work for your own benefits, don’t work for your commission. Work for the people. Listen to people. Understand their situations. Every person is in a different situation. They confide in you. They tell you their whole world. If you are really going to help them with buying or selling their home, you have to listen.

I believe money is a byproduct of success. If you do good for people, good will happen for you. Have purity in your heart.

Q: Nice poetic turn there. Tré?

Tré: Empathy and kindness. First and foremost, you need to be a good person. With those qualities, you can build relationships and keep relationships. How do you build empathy? Go out and connect with people in a different setting than you’re familiar with. Hear people’s stories. The more people you talk to, the more you will see that not everyone comes from a privileged background. That puts things into perspective.  That’s where you can learn to build empathy. You shouldn’t lose it if it’s engrained in you. The successful realtors and brokers I have come across are all kind people.

That’s where you can learn to build empathy. You shouldn’t lose it if it’s engrained in you. The successful realtors and brokers I have come across are all kind people.

Crystal: What’s brought me to where I am in my career is being authentic. I am authentic to a fault. I am myself and I bring my full self into every situation I’m in. In real estate, you need to be authentic. Don’t try to be the same, don’t be a cookie cutter. We’re in a people business. It’s easy to get caught up and want to change to be other things. I’m Crystal Blezard. I’m a realtor, I’m a mom, I’m a human being.

Tré: I really like that.

Q: If someone had to describe what you do in a sentence, but not use your job title or any corporate jargon, what would they say?

Tré: Helping people believe in themselves and spreading positivity to get people to build a healthy and happy life with their families or partners.

Josh: Oooh, I like that.

Crystal: I’ll take this in a funny direction. I go through people’s homes when they’re not there! I’m a matchmaker.

<laughter>

Josh: Same! I’m available 24/7!

“I’m just doing my job to the best of my ability and doing everything I can for my clients,” says Crystal Blezard.

Q: What does home mean to each of you? Home, that four-letter word that we all chase, frame, market, write songs about, dream about, lose, cry over, move away from, return to, celebrate. What does home mean to each of you?

Josh: Two words: safe space. I can put my worries and stresses at the door. It’s where my loved ones are. I can sit there and relax and stay forever.

Josh Singh at the annual Dog Festival presented by the Coldwell Banker Homes for Dogs Project in Sarnia, Ont.

Tré: Somewhere where you’re happy and comfortable and, hopefully, stress-free at the end of the day.

Crystal: Home for me doesn’t necessarily mean a place. It’s security. Home is my family. Home is people, and my people are in my house, so house and home and people are all interconnected for me. Home is a place, yes, but it’s also people. It’s an environment you create. As realtors, we’re helping people create a new home, a place where you have your people through all of life’s changes.

Home is about my dogs, too. Chewie and Mookie. Chihuahua yorkies. They’re so needy. They sleep in bed with me. But I love them.

Tré: My parents said no dogs when we were growing up, but then my brother and I moved away from home at 18 to play hockey and they were, like, okay, now we’ve got to get a dog! I think they were a little bored when we were gone.

Crystal: You got replaced by the dog!

Tré: Ouch!

<laughter>

Josh: I still live with my parents. My mom, my brother, my sister-in-law we all want a dog, but my dad is, like, no chance! When I move out, I can get a dog. He’s, like, I’ve already raised you two, I’m not looking to raise another.

<laughter>

Q: Hero?

Crystal: Tough question, I’ve had so many. I’d say my mom. She was a single mom. She went to university, worked really hard, got herself into an amazing position later in life. I strive to work hard and do good for my kids.

Tré: My grandparents. I have one left on either side. They’re made it to 80 on one side and 92 on the other. Just to be happy and positive every single day right now means they’ve done something right. I want to be like them.

Josh: My father. My family moved to Canada in 2014 from India. He was one of the top engineers in the state and he went to work in warehouses just to support his family. I have seen him be happy with a smile on his face no matter what situation he might be in or what mood he might be in. That has inspired me.

Home is where my loved ones are, says Josh Singh. I can sit there and relax and stay forever.

Q: What is the biggest obstacle faced by young home shoppers? Do young people still want to be homeowners?

Crystal: The biggest struggle right now is interest rates and affordability. Everyone dreams of owning a home, but it somewhat feels unobtainable for young people, and that is super unfortunate. I like to try to educate people on options—co-signers, use those parents for good! It’s hard. Not everyone’s parents have a cheque waiting to help them buy a house. I think it is something that all young people want.

Tré: The biggest obstacle is affordability. If you don’t come from a fortunate family… I tell everybody in the market I serve, which is Toronto, which is expensive, you can look first at a condo and muster up some savings in a couple of years, invest with a partner. There are ways into the market, but affordability makes it hard for young people. Everybody I am around still has high hopes of owning property one day.

Josh: It’s lack of knowledge, too. A lot of first-time homebuyers need direction and proper guidance. Real estate is a deep world. It can be overwhelming. People are dealing with their life savings. That’s where we come in. Guiding them, listening to their wants and needs and making sure they’re more focused on the needs. I believe in long-term relationships and in nurturing that relationship over the years. Knowing what the right time is to refinance, based on the market.

It’s not just about the real estate you can buy in a month. It’s more a case of understanding this is what you should do for the next two or three months, this is how to get there, and then in six or seven months, we’ll start looking and get you to the perfect place you’re looking for.

Crystal: I think this is kind of what sets the three of us apart. We’re realizing that this is a long-term game. You don’t want to help just the one client get a house. You want to help all their family members to get a house, and to help them upgrade in two or three years as their life changes, as they’re having kids, when their kids are moving out. I think it’s just staying with them long-term.

Q: What’s the metaphor for what you do? Are you gardeners, in a way?

Crystal: Yeah, you plant a seed, and you help that plant grow throughout its stages.

Tré: Crystal hit it on the head with that one. You plant seeds, you water them, you see it through. You never want to see a plant that’s not healthy. You check up on it, making sure it’s in good shape. That’s a great way to explain it.

Q: Is there a question that you’re tired of being asked, or wish, for a change, that you were asked?

Josh: Let me go first. Will you cut your commission? is the question I am tired of being asked! That is probably the most commonly asked question in our industry, along with, how much of a discount can I get?

“Go out and connect with people in a different setting than you’re familiar with,” says Tré Folkes. “Hear people’s stories.”

Q: What do you say?

Josh: It depends on the situation, but, usually, I say no, but with an explanation. I try to point out that this is the value that I bring, these are the kinds of things that I will do for you. I like to compare it to law. We’re representing. We will represent you to the fullest and to the best of our abilities.

Tré: A question I wish I were asked more is: when would the right time for me to buy based on my specific situation? Someone who is interested in getting the full financial picture of their situation at their stage in life—that is the person with the question a lot more people should be asking.

Crystal: I just thought of a question while we were talking. It goes both ways. I want to be asked it and I don’t want to be asked it! The question is: what sets me apart?

Q: Okay, Crystal, what sets you apart?

Crystal: That’s an interesting question in this market because I’m not special, I’m not. I just work hard, and I care about people, and I want to make a difference in this business. I want to make a difference in an individual’s life. I’m not re-writing the wheel of real estate. I’m just doing my job to the best of my ability and doing everything I can for my clients.

Q: What is something you are watching or reading or listening to that you want to recommend to the rest of us?

Crystal: Mine is too predictable, I’ll let the guys go first.

Tré: What is it, Crystal?